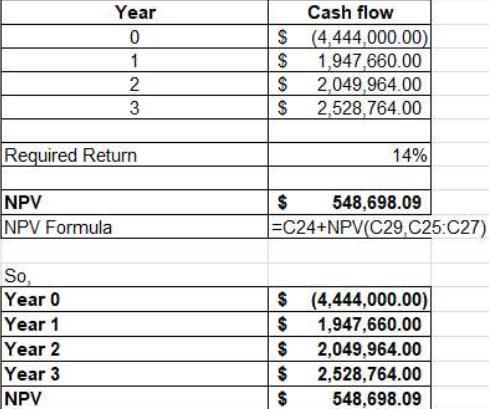

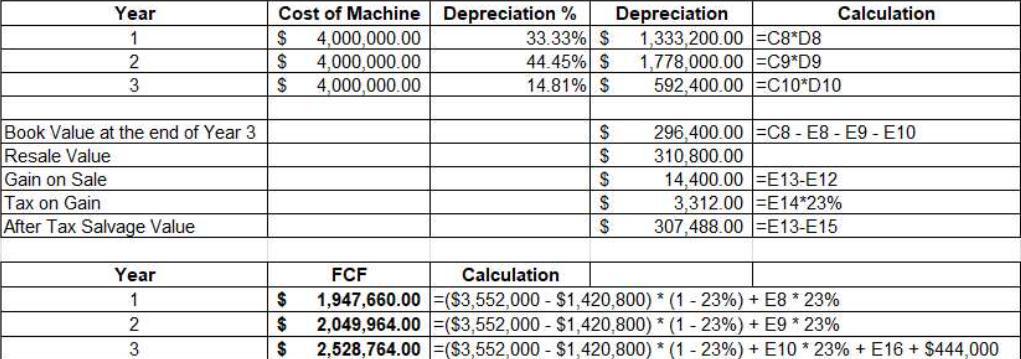

00 8 Skipped Quad Enterprises is considering a new 3-year expansion project that requires an initial fixed asset investment of $4.0 million. The fixed asset falls into the 3-year MACRS class (MACRS Table) and will have a market value of $310,800 after 3 years. The project requires an initial investment in net working capital of $444,000. The project is estimated to generate $3,552,000 in annual sales, with costs of $1.420,800. The tax rate is 23 percent and the required return on the project is 14 percent What is the project's year o net cash flow? Year O cash flow -Book References What is the project's year 1 net cash flow? Year 1 cash flow Ť What is the project's year 2 net cash flow? Year 2 cash flow What is the project's year 3 net cash flow? Year 3 cash flow ما What is the NPV? NPV Year Seven-Year 1 2 Property Class Three-Year Five-Year 33.33% 20.00% 44.45 32.00 14.81 19.20 7.41 11.52 11.52 5.76 3 4 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 5 6 7 8.

Answers

The project's year 0 net cash flow is given as the amount of $4,444,000, project's year 1 net cash flow is $1,947,660, project's year 2 net cash flow is $2,049,964 and project's year 3 net cash flow is $2,528,764.

After all debts have been settled, net cash flow can represent either a gain or a loss in money over a time period. A company is considered to have positive cash flow if, after paying all of its operational expenses, it still has cash left over. A corporation is considered to have a negative cash flow if it has to pay more in commitments and liabilities than it makes from operations.

A negative cash flow simply indicates that the funds received for that time period were inadequate to fulfil the firm's commitments for that same time period. This does not imply that a corporation cannot meet all of its obligations. if other savings accounts are emptied to pay the debt.

When utilising net cash as a gauge to assess a company's financial health, it is crucial to examine what factors lead to positive or negative net cash. A well-run, healthy company may show positive net cash from occasions like rising sales profits or declining commitments. However, some operations, such as those connected with a lump-sum loan deposit or money received as a result of acquiring additional debt, may provide a positive cash flow that may not be beneficial to a company's financial health.

Learn more about Net cash flow:

https://brainly.com/question/25716101

#SPJ4

Related Questions

As treasurer of Leisure Products, Inc., you are investigating the possible acquisition of Plastitoys. You have the following basic data: Plastitoys Forecast earnings per share Forecast dividend per share Number of shares Stock price Leisure Products $ 5 $ 3 600,000 $ 50 $ 3.20 $ 1.80 400,000 $ 26 You estimate that investors currently expect Plastitoys's earning and dividend to grow at a steady rate of 7% per year. You believe that Leisure Products could increase Plastitoys's growth rate to 10% per year, after 1 year, without any additional capital investment required.

d-1. Suppose immediately after the completion of the merger, everyone realizes that the expected growth rate will not be improved. Reassess the cost of the cash offer. d-2. Reassess the NPV of the cash offer. d-3. Reassess the cost of the share offer. d-4. Reassess the NPV of the share offer.

Answers

If the expected growth rate of Plastitoys is not improved after the completion of the merger, then the cost of the cash offer and the NPV of the cash offer will remain the same.

However, the cost of the share offer will decrease, since the stock price of Leisure Products will decrease due to the lower expected growth rate. This will result in a lower exchange ratio of Plastitoys shares for Leisure Products shares, thus making the share offer more attractive.

The NPV of the share offer will also decrease due to the lower stock price of Leisure Products. Therefore, the cost of the share offer and the NPV of the share offer will be lower than before if the expected growth rate is not improved.

Know more about growth rate here

https://brainly.com/question/12490064#

#SPJ11

marriott corporation: the cost of capital (abridged)how does marriott use its estimate of the cost of capital? does this make sense?

Answers

your question makes sense. Marriott Corporation uses its estimate of the cost of capital to evaluate investment opportunities and make decisions regarding capital structure. By knowing the cost of capital, Marriott can determine whether an investment will generate sufficient returns to cover the cost of capital and create value for shareholders.

Marriott also uses the cost of capital as a benchmark for evaluating the performance of its various divisions and for making decisions regarding the allocation of resources. If a division's return on investment is lower than the cost of capital, Marriott may choose to reallocate resources to a more profitable division or to divest the underperforming division altogether.

Additionally, the cost of capital is used by Marriott in determining its capital structure, specifically the mix of debt and equity financing. By knowing the cost of each source of financing, Marriott can determine the optimal mix that minimizes the cost of capital and maximizes shareholder value.

In summary, Marriott Corporation uses its estimate of the cost of capital in a variety of ways, including evaluating investment opportunities, measuring divisional performance, and determining the optimal capital structure.

To know more about Marriott refer home

https://brainly.com/question/3910024#

#SPJ11

5. Consider the following MBS pass through with principal $300 million. The original mortgage pool has a WAM = 360 months (30 years) and a WAC = 7.00%. The pass through security pays a coupon equal to 6.5%. The PAC has an upper collar of 300% PSA and a lower collar of 85% PSA. (a) What is the price of each tranche? Assume a constant PSA = 150%. (b) Compute the effective duration of the two tranches assuming that the PSA increases to 200% if the term structure shifts down by 50 basis points, while it decreases to 120% if the term structure shifts up by 50 basis points. Which tranche is more sensitive to interest rate movements? Which tranche is less sensitive?

Answers

(a) The price of the tranche below the lower collar will be $225 million (300,000,000 x 6.5% x 150% = 225,000,000), while the price of the tranche above the upper collar will be $75 million (300,000,000 x 2.5% x 150% = 75,000,000).

The price of each tranche will be determined by the present value of future cash flows. The tranche below the lower collar (85%) will have an expected coupon of 6.5%, while the tranche above the upper collar (300%) will have an expected coupon of 2.5%.

(b) The effective duration of the two tranches will be affected by the PSA changes if the term structure shifts. The tranche below the lower collar will have an effective duration of 8.19 years (8.19 x 12 months = 98.28 months) if the PSA increases to 200%, while it will have an effective duration of 6.75 years (6.75 x 12 months = 81 months) if the PSA decreases to 120%.

The tranche above the upper collar will have an effective duration of 4.41 years (4.41 x 12 months = 52.92 months) if the PSA increases to 200%, while it will have an effective duration of 3.55 years (3.55 x 12 months = 42.6 months) if the PSA decreases to 120%.

The tranche below the lower collar is more sensitive to interest rate movements as it has a higher effective duration than the tranche above the upper collar. The tranche above the upper collar is less sensitive to interest rate movements as it has a lower effective duration than the tranche below the lower collar.

Know more about tranche here

https://brainly.com/question/31514584#

#SPJ11

Suppose that Firefox Corp. has announced it is going to repurchase stock instead of paying out dividends. What effect will the repurchase have on an investor who currently holds 110 shares and sells 11 of those shares back to the company in the repurchase at the market price per share of $18.6 (1.0., Wh are the values of the investor's shares and cash)? Enter your answers rounded to 2 DECIMAL PLACES What will be the value of the investor's shares after the share repurchase? 1841.4 Correct response: 1,841.410.01

What will be the value of the investor's cash after the share repurchase? 204.6 correct response: 204.60.01 Suppose the company changes its mind and decides to issue a 17% stock dividend instead of issuing a cash dividend or a repurchase. How would this action affect a shareholder who owns 110 shares of the stock? Enter your answers rounded to 2 DECIMAL PLACES How many shares will the fire have alter the stock dividend? Number What will be the price per share after the stock dividend? Number

What will be the value of the investor's shares after the stock dividend? Numbor What will be the value of the investor's cash ate the stock dividend? Number

Answers

After selling 11 shares back to the company, the investor will be left with 99 shares (110-11=99). The total value of the shares before the repurchase is $18.6 x 110 = $2046.

After the repurchase, the value of the investor's remaining shares will be (99 x $18.6) = $1841.4, rounded to 2 decimal places. The value of the cash received from the repurchase will be (11 x $18.6) = $204.6, rounded to 2 decimal places.

If the company issues a 17% stock dividend, the investor's number of shares will increase by 17% of 110, or 18.7 shares (0.17 x 110 = 18.7), rounded to the nearest whole share. The investor will then own 110 + 18.7 = 128.7 shares, which can be rounded down to 128 shares.

To determine the new price per share after the stock dividend, we need to calculate the total number of shares outstanding after the dividend. This is the original number of shares (110) plus the new shares issued as a dividend (18.7), which equals 128.7. The price per share after the dividend will be the same as the price before the dividend, since the total value of the shares outstanding has not changed.

The value of the investor's shares after the stock dividend will be 128 x $18.6 = $2380.80, rounded to 2 decimal places.

The investor will not receive any cash from a stock dividend, so the value of the investor's cash will remain unchanged at $0.

to know more about investor refer here

https://brainly.com/question/30828591#

#SPJ11

who is responsible for decisions about security strategy? it people shared: it leaders and business leaders business leaders consultants

Answers

! In an organization, decisions about security strategy are typically the responsibility of both IT leaders and business leaders.

Understanding IT leaders and business leaders.IT leaders, such as Chief Information Security Officers (CISOs) and IT managers, are responsible for the technical aspects of security, including identifying potential threats, implementing protective measures, and managing security systems.

Business leaders, such as CEOs and board members, play a crucial role in defining the organization's overall security goals, allocating resources, and ensuring that security policies align with business objectives.

Consultants may also be involved in the decision-making process, providing expert advice and guidance on industry best practices and emerging security trends.

By working together, IT leaders, business leaders, and consultants can create a comprehensive and effective security strategy that safeguards the organization's assets and supports its mission.

Learn more about security strategy at

https://brainly.com/question/28317637

#SPJ11

with an adjustable-rate mortgage, the interest rate changes in response to the movement of ____ as a whole.

Answers

With an adjustable-rate mortgage, the interest rate changes in response to the movement of the market as a whole. Specifically, the interest rate of an adjustable-rate mortgage is tied to an index, such as the prime rate or the London Interbank Offered Rate (LIBOR). As the index moves up or down, so does the interest rate on the mortgage.

This means that the monthly mortgage payments can also change, potentially increasing or decreasing depending on the movement of the index. One advantage of an adjustable-rate mortgage is that it typically starts off with a lower interest rate than a fixed-rate mortgage. This can make the initial monthly payments more affordable, which is appealing to some borrowers. However, it's important to keep in mind that the interest rate and monthly payments can change over time, which can make budgeting more challenging.

Before deciding on an adjustable-rate mortgage, it's important to carefully consider your financial situation and your ability to handle potential interest rate increases. It's also a good idea to work closely with a trusted lender who can help you understand the risks and benefits of different types of mortgages.

To know more about LIBOR, visit https://brainly.com/question/30974049

#SPJ11

Assume that interest rates on 30-year Treasury and corporate bonds with different ratings, all of which are non-callable, are as follows:

Treasury bond: 7.72%

Corporate bond (AA rating): 8.72%

Corporate bond (A rating): 9.64%

Corporate bond (BBB rating): 10.18%

Answers

The interest rates on 30-year Treasury and corporate bonds with different ratings, the non-callable is: 30-year Treasury bond: 7.72%. The correct option is A.

In general, Treasury bonds are considered to be the safest investment because they are backed by the full faith and credit of the U.S. government. Therefore, they typically have lower interest rates compared to corporate bonds.

Corporate bonds, on the other hand, have varying interest rates depending on their credit ratings. Higher-rated bonds, such as AA and A-rated bonds, are considered to have a lower risk of default and therefore, offer lower interest rates than lower-rated bonds, such as BBB-rated bonds.

In this scenario, the interest rate on the 30-year Treasury bond is 7.72%. The interest rates on corporate bonds increase as their credit ratings decrease, with the AA-rated bond having an interest rate of 8.72%, the A-rated bond at 9.64%, and the BBB-rated bond at 10.18%.

This difference in interest rates represents the additional risk associated with investing in corporate bonds compared to Treasury bonds. Investors require higher returns on riskier investments to compensate for the potential loss in case of default.

To know more about Treasury bond, refer here:

https://brainly.com/question/30733447#

#SPJ11

Complete question:

Assume that interest rates on 30-year Treasury and corporate bonds with different ratings, all of which are non-callable, are as follows:

a. Treasury bond: 7.72%

b. Corporate bond (AA rating): 8.72%

c. Corporate bond (A rating): 9.64%

d. Corporate bond (BBB rating): 10.18%

the relative importance of each facet of operational information is directly related to the degree to which a supply chain is positioned to function on a(n)

Answers

Supply chain management is operation of the inflow of goods, related to a product or service, from the procurement to final product. It's responsive, anticipant.

The relative significance of each hand of functional information is directly related to the degree to which a force chain is deposited to serve on a responsive or anticipant base

supply chain management deals with a system of procurement, operations , logistics and marketing channels so that the raw accoutrements can be converted into a finished product and delivered to the end client.

force chain operation is vital to society, furnishing the medium for getting products into the hands of consumers, from essential masses similar as food and drug to luxury particulars.

To know more about the Supply Chain Management,

brainly.com/question/31406616

#SPJ4

the limitation on the deduction of business interest does not apply to businesses that qualify under the gross receipts test. true or false

Answers

False. The limitation on the deduction of business interest does apply to businesses that qualify under the gross receipts test.

However, businesses that have average annual gross receipts of $25 million or less for the three prior tax years are exempt from the limitation on the deduction of business interest expense under the small business exception. This exception allows small businesses to deduct business interest expense in full, subject to certain limitations and restrictions.

The gross receipts test is a threshold used to determine whether a business is exempt from the limitation on the deduction of business interest expense under the small business exception. To qualify for the exception, a business must have average annual gross receipts of $25 million or less for the three prior tax years. Gross receipts generally include all revenue from the sale of goods or services, including income from investments, royalties, and rental income, but exclude returns and allowances

To know more about gross receipts test. here

https://brainly.com/question/31306826

#SPJ4

True. The limitation on the deduction of business interest does not apply to businesses that qualify under the gross receipts test. This test applies to businesses with average annual gross receipts of $25 million or less for the three prior tax years.

True, the limitation on the deduction of business interest does not apply to businesses that qualify under the gross receipts test. This means that businesses with average annual gross receipts of $25 million or less (indexed for inflation) for the previous three tax years are exempt from the limitation.

For more such questions on business

https://brainly.com/question/24553900

#SPJ11

How does the Scrum Master help the Product Owner? Select the three most appropriate answers.

Understanding product planning in an empirical environment

Finding techniques for effective Product Backlog management

Facilitating Scrum events as requested or needed

Introducing cutting edge development practices

Answers

The three most appropriate answers to the question "How does the Scrum Master help the Product Owner" are first 3 options.

1. Understanding product planning in an empirical environment: The Scrum Master helps the Product Owner by providing guidance on how to plan and prioritize the product backlog items in an empirical environment. This includes understanding the needs of the stakeholders, incorporating feedback, and making informed decisions based on data.

2. Finding techniques for effective Product Backlog management: The Scrum Master helps the Product Owner by finding effective techniques for managing the product backlog. This includes refining the backlog items, breaking them down into smaller pieces, and ensuring that they are prioritized based on business value.

3. Facilitating Scrum events as requested or needed: The Scrum Master helps the Product Owner by facilitating Scrum events such as Sprint Planning, Sprint Review, and Sprint Retrospective. The Scrum Master ensures that these events are effective and efficient, and that the Product Owner has the support they need to make informed decisions based on the team's progress.

Learn more about Scrum Master- https://brainly.com/question/28919511

#SPJ11

Help Save Su Check my w 3A 4 percent decrease in the price of milk causes a 16 percent decrease in the quantity demanded of chocolate syrup. What is the cross-price elasticity of demand for chocolate syrup with respect to the price of milk? Instructions: Enter your response as a whole number. If you are entering a negative number, be sure to include a negative sign (-) Cross-price elasticity of demand equals .The two goods are complementa v because when the cross price elasticity of demand is a) negative, the two goods are complements b) negative, the two goods are substitutes, c) positive, the two goods are complements. d) positive, the two goods are substitutes

Answers

The cross-price elasticity of demand equals 4. The two goods are complements because when the cross price elasticity of demand is positive, the two goods are complements. Therefore, the correct option is C.

To calculate the cross-price elasticity of demand for chocolate syrup with respect to the price of milk, you can use the following formula:

Cross-price elasticity of demand = (% change in quantity demanded of chocolate syrup) / (% change in price of milk)

First, identify the given information:

% change in price of milk = -4% (decrease)

% change in quantity demanded of chocolate syrup = -16% (decrease)

Now, plug the values into the formula:

Cross-price elasticity of demand = (-16%) / (-4%)

Cross-price elasticity of demand = 4

Since the cross-price elasticity of demand is positive, the two goods are complements, which corresponds to option C in the given choices. When two goods are complements, they experience joint demand which means that the demand of one good is linked to the demand for another good.

So, the cross-price elasticity of demand for chocolate syrup with respect to the price of milk is 4, and the two goods are complement.

Learn more about Cross-price elasticity:

https://brainly.com/question/15308590

#SPJ11

celia has been married to daryl for 52 years. the couple has lived in their current home for the last 20 years. in october of year 0, daryl passed away. celia sold their home and moved into a condominium. what is the maximum exclusion celia is entitled to if she sells the home on december 15 of year 1?

Answers

Based on the information given, Celia owned and used the home as her primary residence for at least two out of the five years before the sale. Therefore, she may be eligible for a maximum exclusion of $250,000 from the sale of her home.

However, since Daryl passed away in October of year 0, Celia may be entitled to an increased exclusion amount. When a taxpayer sells a home after the death of their spouse, the maximum exclusion amount is increased to $500,000 if the sale occurs within two years of the spouse's death, and the taxpayer has not remarried since the spouse's death.

Since Celia sold the home on December 15 of year 1, which is within two years of Daryl's death in October of year 0, and she did not remarry after his death, she may be eligible for the increased exclusion amount of $500,000.

However, there may be other factors that could affect Celia's eligibility for the exclusion, such as whether she used the home for business or rental purposes, or whether she has already used the exclusion on a previous home sale. Therefore, it is recommended that Celia consults with a tax professional for more specific guidance based on her individual circumstances.

Click the below link, to learn more about Exclusion celia :

https://brainly.com/question/15872198

#SPJ11

each potential client may not know the competitors to _________ product.

Answers

Each potential client may not know the competitors to a specific product due to a variety of reasons. Firstly, the client may not have done extensive research on the product and its market. Secondly, the client may not be aware of the different types of products that are available in the market.

Thirdly, the client may not have a clear understanding of their own needs and preferences. This can make it difficult for them to evaluate different products and determine which ones are the best fit for their specific requirements. In addition, clients may also have biases or preconceived notions about specific products or brands, which can impact their decision-making process.

To address these challenges, companies can invest in marketing and advertising initiatives that educate clients about their products and their unique selling propositions. This can help clients make informed decisions and identify the key differentiators between different products in the market.

Additionally, companies can leverage customer feedback and reviews to showcase their competitive advantage and position their products as the best option for potential clients. Overall, by addressing these challenges, companies can better position their products in the market and improve their chances of winning over potential clients.

for more such questions on competitors

https://brainly.com/question/28902069

#SPJ11

which do you think would be more harmful to the economy? multiple choice an inflation rate that averages 5 percent a year and has a high standard deviation. an inflation rate of 7 percent that has a standard deviation close to zero.

Answers

Answer: Inflation rate that averages 5% a year with a high degree of standard deviation.

Explanation: Low Inflation rate with high degree of standard deviation is more likely to be harmful than the high inflation rate with low degree of standard deviation. The reasoning behind this is that a high standard deviation indicates a greater degree of variability in the inflation rate, which can lead to increased uncertainty for businesses and consumers. This uncertainty can negatively impact economic growth, as businesses may hesitate to invest or hire new employees, and consumers may delay spending.

On the other hand, an inflation rate of 7 percent with a low standard deviation means that the inflation rate is relatively stable and predictable, hence motivating businesses and consumers to make better planning and informed decisions regarding investments and spending.

While a 7 percent inflation rate may be higher than the 5 percent rate, the predictability and stability can be better for the economy, as businesses and consumers can make informed decisions with a clearer understanding of the economic environment.

Learn more about Inflation and standard deviation: https//brainly.com/question/31519047

#SPJ11

In financial analysis, it is important to select an appropriate discount rate. A project's discount rate must be high to compensate investors for the project's risk. The return that shareholders require from the company as a compensation for their investment risk is referred to as the cost of equity. Consider this case:Markung's Co. is a 100% equity-financed company (no debt or preferred stock); hence, its WACC equals its cost of common equity. Markung's Co.'s retained earnings will be sufficient to fund its capital budget in the foreseeable future. The company has a beta of 1.65, the risk-free rate is 5.5%, and the market return is 7.2%. What is Markung's Co.'s cost of equity?a) 29.13%b) 8.31% c) 10.01% d) 19.08%

Answers

Markung's Co.'s cost of equity is 8.31%. Therefore, the correct option is B.

In order to calculate Markung's Co.'s cost of equity, we can use the Capital Asset Pricing Model (CAPM). The CAPM formula is as follows:

Cost of Equity = Risk-free rate + (Beta * (Market return - Risk-free rate))

Given the information provided:

Beta = 1.65

Risk-free rate = 5.5%

Market return = 7.2%

Let's plug the values into the CAPM formula:

Cost of Equity = 5.5% + (1.65 * (7.2% - 5.5%))

Cost of Equity = 5.5% + (1.65 * 1.7%)

Cost of Equity = 5.5% + 2.805%

Cost of Equity = 8.31%

So, cost of equity is 8.31% which corresponds to option B.

Learn more about Cost of equity:

https://brainly.com/question/30761849

#SPJ11

doing whatever is necessary to transfer ownership from one party to another, including providing credit, delivery, installation, guarantees, and follow-up services.

possession utility place utility Form Utility

information utility

Answers

Possession utility is doing whatever is necessary to transfer ownership from one party to another, including providing credit, delivery, installation, guarantees, and follow-up services.

The amount of usefulness or perceived worth a consumer obtains from possessing and being able to utilise a particular product is known as possession utility. This utility's fundamental tenet is that customers need to be able to utilise a certain good or service as soon as they are able to buy it or receive it.

For instance, if the most recent iPhone is backordered by Apple and can't be produced and sent to the customer in a timely manner, the product won't be very useful to the buyer. So, it is crucial for businesses to make their products easier to own, as this raises the product's usefulness as a possession or perceived value.

Learn more about possession utility:

brainly.com/question/27848340

#SPJ4

Possession utility is necessary to transfer ownership from one party to another, including providing credit, delivery, installation, guarantees, and follow-up services.

The value that is produced for consumers by giving a buyer ownership of a good or service is referred to as possession utility. This comprises all actions required to complete the transfer, such as giving credit, making a delivery, setting up an installation, offering guarantees, and providing after-sale services. One of the four forms of utility that are frequently used to describe the value produced for clients through the marketing of goods and services is possession utility. Form utility, location utility, and time utility are the other three categories of utility. Businesses may guarantee that their consumers obtain the goods or services they require and are happy with their purchasing experience by offering possession utility.

learn more about Possession utility here:

https://brainly.com/question/14753862

#SPJ11

Question 10 (1 point) Suppose a firm produces two goods, A and B. If they produce the goods jointly, the total cost is TC = 100+ 50Q AQB - VAQB If they produce the goods separately, the total cost of

Answers

In this scenario, the firm's total cost (TC) of producing both goods A and B jointly is represented by the equation TC = 100 + 50Q_AQB - VAQB.

However, if the firm decides to produce goods A and B separately, then the total cost would change. Without specific information on the cost of producing each good individually, it is difficult to calculate the exact cost of producing the goods separately.

However, we can assume that the cost of producing both goods separately would likely be higher than the joint production cost as there would be additional fixed costs associated with producing each good separately.

Overall, it is important for firms to consider the costs and benefits of joint versus separate production when making production decisions.

To know more about total cost,refer to the link:

https://brainly.com/question/31115209#

#SPJ11

A project is expected to generate annual revenues of $120,900, with variable costs of $76,000, and fixed costs of $16.500. The annual depreciation is $4.050 and the tax rate is 40 percent What is the annual operating cash flow? Ο $18,660 Ο $46,520 Ο $32.450 Ο $28.400 S63,020

Answers

The annual operating cash flow for the given project is $18,660. Therefore, the correct option is option 1.

It is given that a project has an annual revenues of $120,900, variable costs of $76,000, fixed costs of $16,500, annual depreciation of $4,050, and a tax rate of 40 percent.

To calculate the annual operating cash flow follow these steps:1. Calculate the Earnings Before Interest and Taxes (EBIT):

EBIT = Revenues - Variable Costs - Fixed Costs

EBIT = $120,900 - $76,000 - $16,500

EBIT = $28,400

2. Calculate the Earnings Before Taxes (EBT):

EBT = EBIT - Depreciation

EBT = $28,400 - $4,050

EBT = $24,350

3. Calculate the Taxes:

Taxes = EBT * Tax Rate

Taxes = $24,350 * 0.4

Taxes = $9,740

4. Calculate the Net Income:

Net Income = EBT - Taxes

Net Income = $24,350 - $9,740

Net Income = $14,610

5. Calculate the annual Operating Cash Flow (OCF):

OCF = Net Income + Depreciation

OCF = $14,610 + $4,050

OCF = $18,660

So, the annual operating cash flow for this project is option 1: $18,660.

Learn more about Operating cash flow:

https://brainly.com/question/28185713

#SPJ11

You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.75 a share at the end of the year (D1 = $1.75) and has a beta of 0.9. The risk-free rate is 3.2%, and the market risk premium is 6.0%. Justus currently sells for $33.00 a share, and its dividend is expected to grow at some constant rate, g. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is P3 ?) Round your answer to two decimal places. Do not round your intermediate calculations.

Answers

The market believes that the stock price will be $40.34 at the end of three years.

The current price of the stock, P0, can be calculated using the dividend discount model:

P0 = D1 / (r - g)

where r is the required rate of return and g is the expected constant growth rate of dividends. We are given D1, and we can calculate r as follows:

r = rf + β (rm - rf)

= 0.032 + 0.9 * 0.06

= 0.086

So, P0 = 1.75 / (0.086 - g)

We are also given that P0 = $33.00, so we can solve for g:

33 = 1.75 / (0.086 - g)

g = 0.035

Therefore, the expected constant growth rate of dividends is 3.5%. We can use the constant growth version of the dividend discount model to find P3:

P3 = D4 / (r - g)

= D1 * (1 + g)^3 / (r - g)

= 1.75 * (1.035)^3 / (0.086 - 0.035)

= $40.34

For more such questions on market, click on:

https://brainly.com/question/25369230

#SPJ11

Ms. Anh maintains a savings deposit with VCB Ha Thanh branch. This past year Anh received 10.75 million VND in interest earnings from her savings account. Her savings deposit had the following average balance each month: (in million VND) January 40 July 351 February 25 August 42.51 March 30 September 55 April 15 October 601 May 22.5|November 62.5 June 30 December 30 What was the annual percentage yield (APY) earned on Anh's savings account?

Answers

The annual percentage yield (APY) earned on Anh's savings account is 5.17%.

To calculate the annual percentage yield (APY) earned on Anh's savings account, we need to use the following formula:

[tex]APY = (1 + r/n)^n - 1[/tex]

Where r is the annual interest rate, and n is the number of times interest is compounded in a year.

First, we need to calculate the total amount of interest earned by Anh during the year. We can do this by adding up the interest earnings from each month:

10.75 million VND = (40 x 0.5%) + (25 x 0.5%) + (30 x 0.5%) + (15 x 0.5%) + (22.5 x 0.5%) + (30 x 0.5%) + (351 x 0.6%) + (42.51 x 0.6%) + (55 x 0.6%) + (601 x 0.65%) + (62.5 x 0.65%) + (30 x 0.65%)

Next, we need to calculate the average monthly balance for the year. We can do this by adding up the balances for each month and dividing by 12:

Average monthly balance = [tex](40 + 25 + 30 + 15 + 22.5 + 30 + 351 + 42.51 + 55 + 601 + 62.5 + 30) / 12 = 104.38 million VND[/tex]

Now, we can use the formula to calculate the APY:

[tex]APY = (1 + r/n)^n - 1[/tex]

[tex]10.75 million VND = (104.38 million VND x r/12)^12 - 1r = 5.17%[/tex]

This means that for every 100 million VND in Anh's account, she earned 5.17 million VND in interest over the course of the year.

In conclusion, APY is an important factor to consider when choosing a savings account, as it reflects the actual return on your investment. By using the formula above, we can calculate the APY earned on Anh's savings account based on her average monthly balance and interest earnings.

To learn more about annual percentage yield here:

https://brainly.com/question/27997520#

#SPJ11

What is the bond equivalent yield on a $1 million T-bill that currently sells at 91 750 percent of its face value and is 109 days from maturity? (write your answer in and sound it to a dee mal phoon)

Answers

The bond equivalent yield on this $1 million T-bill that currently sells at 91.750 percent of its face value and is 109 days from maturity is 30.1%.

How to determine the bond equivalent yield on a $1 million T-bill that currently sells at 91.750 percent of its face value and is 109 days from maturity?To calculate the bond equivalent yield (BEY) on a $1 million T-bill that currently sells at 91.750 percent of its face value and is 109 days from maturity, follow these steps:

Calculate the purchase price: 91.750% x $1,000,000 = $917,500

Find the absolute return: $1,000,000 - $917,500 = $82,500

Calculate the daily return: $82,500 / 109 days = $756.88

Annualize the daily return: $756.88 x 365 days = $276,260.20

Divide the annualized return by the purchase price: $276,260.20 / $917,500 = 0.301

Convert to percentage: 0.301 x 100 = 30.1%

The bond equivalent yield on this $1 million T-bill that currently sells at 91.750 percent of its face value and is 109 days from maturity is 30.1%.

Learn more about bond equivalent yield

brainly.com/question/14644574

#SPJ11

In 150-250 words describe how bid- ask spreads are determined?

What are the components of the bid-ask spread?

Answers

The bid-ask spread is the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept.

This spread is determined by a variety of factors, including market conditions, the level of liquidity for the asset in question, and the competitiveness of the marketplace.The components of the bid-ask spread include the bid price, which is the highest price that a buyer is willing to pay, and the ask price, which is the lowest price that a seller is willing to accept. In addition to these two primary components, the spread may also be influenced by other factors, such as transaction costs, market volatility, and the overall level of demand for the asset.

In general, the bid-ask spread tends to be narrower for assets that are more liquid, such as stocks and bonds that are actively traded on major exchanges. For less liquid assets, such as real estate or certain types of commodities, the spread may be wider due to the higher level of risk and uncertainty associated with these types of investments. Ultimately, the bid-ask spread is determined by the interaction of buyers and sellers in the marketplace, with each party seeking to maximize their own interests while also accounting for the prevailing market conditions and the specific characteristics of the asset in question.

Learn more about components here:https://brainly.com/question/28630529

#SPJ11

Calculate the future value of $9,000 in a. Four years at an interest rate of 9% per year. b. Eight years at an interest rate of 9% per year. c. Four years at an interest rate of 18% per year. d. Why is the amount of interest earned in part (a) less than half the amount of interest earned in part (b)? a. Four years at an interest rate of 9% per year. The future value of $9,000 in 4 years at an interest rate of 9% per year is $_____. (Round to the nearest dollar.)

Answers

a. The future value of $9,000 in 4 years at an interest rate of 9% per year is $12,962.

b. The future value of $9,000 in 8 years at an interest rate of 9% per year is $18,506.

c. The future value of $9,000 in 4 years at an interest rate of 18% per year is $16,542.

d. The amount of interest earned in part (a) is less than half the amount of interest earned in part (b) because of the effect of compounding

a) To calculate the future value of $9,000 in 4 years at an interest rate of 9% per year, we can use the following formula:

FV = PV x (1 + r)^n

Where PV is the present value, r is the interest rate, and n is the number of years.

Plugging in the numbers, we get:

FV = 9,000 x (1 + 0.09)^4 = $12,744.39

Therefore, the future value of $9,000 in 4 years at an interest rate of 9% per year is $12,744.39.

b) To calculate the future value of $9,000 in 8 years at an interest rate of 9% per year, we can use the same formula:

FV = PV x (1 + r)^n

Plugging in the numbers, we get:

FV = 9,000 x (1 + 0.09)^8 = $19,402.08

Therefore, the future value of $9,000 in 8 years at an interest rate of 9% per year is $19,402.08.

c) To calculate the future value of $9,000 in 4 years at an interest rate of 18% per year, we can again use the same formula:

FV = PV x (1 + r)^n

Plugging in the numbers, we get:

FV = 9,000 x (1 + 0.18)^4 = $17,713.28

Therefore, the future value of $9,000 in 4 years at an interest rate of 18% per year is $17,713.28.

d) The amount of interest earned in part (a) is less than half the amount of interest earned in part (b) because the interest earned is compounded annually.

for more such questions on interest

https://brainly.com/question/14394479

#SPJ11

With a(n) ___________, the caller had a transaction with the receiver within the last 18 months; or the customer has made an inquiry with the caller’s firm in the last 3 months.

Answers

With a customer relationship management (CRM) system, the caller had a transaction with the receiver within the last 18 months or the customer has made an inquiry with the caller's firm in the last 3 months.

A CRM system is a technology tool that helps businesses manage interactions with customers and potential customers. It provides a way to collect and analyze customer data, including customer preferences, purchase history, and communication channels.

With a CRM system, businesses can segment customers based on various criteria, such as their buying behavior, location, or demographic data. This segmentation allows businesses to personalize their communication and marketing efforts, leading to a better customer experience and higher customer satisfaction.

The benefit of using a CRM system is that it helps businesses maintain a positive relationship with their customers, which can lead to repeat business and increased revenue. By keeping track of customer interactions, businesses can identify patterns and trends in customer behavior, enabling them to make data-driven decisions to improve their products and services.

for more such questions on transaction

https://brainly.com/question/1016861

#SPJ11

Aregistered bond is a bond registered with the trustee of the bondissue. True or FalseBonds are long-term liabilities of the issuer of the bonds.True or False

Answers

A registered bond is a bond that is registered with the trustee of the bond issue, which means that the owner's information is recorded with the trustee, and interest payments and principal repayment are made directly to the owner.

This is in contrast to bearer bonds, which do not have registered owners, and interest payments are made to whoever holds the physical bond certificate.

Bonds are long-term debt securities issued by corporations, municipalities, and government entities to raise capital. They are considered long-term liabilities of the issuer since they have a maturity date that extends beyond one year from the date of issuance.

Learn more about bonds https://brainly.com/question/29344176

#SPJ11

You are planning to start up a technology-based business in Malaysia. As technopreneur, what would be the business start-up model to be implemented to reduce the first 2 years Capital Expenditures (CapEx). With an aid of diagram, propose and discuss a suitable business start-up model.

Answers

One of the most suitable business start-up model to reduce the first 2 years Capital Expenditures (CapEx) is the pay as you go model.

This model works by allowing the business to pay for services or products only when they are used or consumed. This model is especially suitable for a technology-based business in Malaysia as it does not require a large capital investment upfront and instead allows for the business to invest in technology and services as needed, when needed.

The diagram below illustrates the ‘pay as you go’ model. In this model, the business owner only pays for the resources used, such as paying for the number of hours of IT service used, or the number of databases created. This helps to reduce the initial capital expenditure (CapEx) as the business does not need to invest in a large number of resources upfront.

The ‘pay as you go’ model is a great way to reduce the initial CapEx for technology-based businesses in Malaysia, as it allows the business to pay for services and products only when they are needed. This helps to reduce the amount of money spent in the first two years of the business.

Know more about Capital Expenditures here

https://brainly.com/question/31497984#

#SPJ11

A company using a narrow target market in its business strategy is a. following a cost leadership business strategy.

b. focusing on a broad array of geographic markets. c. limiting the group of customer segments served.

d. decreasing the number of activities on its value chain.

Answers

When a company uses a narrow target market in its business strategy, it is limiting the group of customer segments served. So, the correct answer is c. limiting the group of customer segments served.

This means that the company is focusing on a specific group of customers who have similar needs, preferences, and characteristics. By doing so, the company can tailor its products or services to meet the specific needs of this group, which can lead to increased customer loyalty and profitability.

This strategy is also known as a niche strategy, and it is often used by small or specialized businesses. It is different from a cost leadership strategy (a) which focuses on minimizing costs to offer lower prices to customers, and from a broad geographic strategy (b) which focuses on expanding into different regions or countries.

It is also different from decreasing the number of activities on its value chain (d) which is a strategy to streamline operations and reduce costs.

To know more about target market refer here:

https://brainly.com/question/6253592#

#SPJ11

masterson company's budgeted production calls for 67,000 units in april and 63,000 units in may of a key raw material that costs $1.65 per unit. each month's ending raw materials inventory should equal 20% of the following month's budgeted materials. the april 1 inventory for this material is 13,400 units. what is the budgeted materials purchases for april?

Answers

The budgeted materials purchases for April are $109,230

How to calculate the budgeted materials purchasesThe Masterson Company's budgeted production calls for 67,000 units in April and 63,000 units in May for a key raw material costing $1.65 per unit.

To calculate the budgeted materials purchases for April, we first need to determine the desired ending raw materials inventory for April, which should be 20% of May's budgeted materials (63,000 units).

April's desired ending inventory = 0.20 * 63,000 = 12,600 units

Now, we can calculate the total materials needed for April, considering both production and the desired ending inventory:

Total materials needed = Budgeted production + Desired ending inventory - Beginning inventory

Total materials needed = 67,000 + 12,600 - 13,400

Total materials needed = 66,200 units

Finally, to find the budgeted materials purchases for April, we multiply the total materials needed by the cost per unit:

Budgeted materials purchases = 66,200 * $1.65

Budgeted materials purchases = $109,230

Learn more about budgeting at

https://brainly.com/question/15683430

#SPJ11

who is the hub of the team management wheel and often acts in the main role of team leader, although all team members need to contribute to the activity?

Answers

The hub of the team management wheel and the main role of the team leader is the Project Manager. The Project Manager is the main point of contact for the team and acts as a facilitator, making sure that everyone is working together as efficiently as possible.

They are responsible for setting the team goals and objectives, planning, organizing and controlling the team's activities, and providing guidance and direction to the team. They also need to ensure that the team members have the skills, knowledge and resources they need to complete the project.

The Project Manager also needs to be able to motivate the team and foster a cooperative, productive working environment. Ultimately, the success of the project depends on the Project Manager's ability to lead the team, coordinate resources, and ensure that everyone is working together to achieve the desired results.

Know more about management here

https://brainly.com/question/29023210#

#SPJ11

John and Mary both enjoyed professional careers. They had their first child at the age of 28 John had life insurance coverage from work, but Mary did not. A) Does Mary need to have personal life insurance coverage? B) If Mary does decide to get life insurance, what are some of the things she should considered when determining what amount she should have?

Answers

A) Yes, Mary should have personal life insurance coverage as both she and John have dependents and unexpected events can happen at any time.

B) When determining the amount of life insurance coverage she needs, Mary should consider her family's financial needs, such as mortgage payments, childcare, and education expenses.

She should also factor in her income, debts, and any future financial obligations. Consulting with a financial advisor can help her determine the appropriate amount of coverage.

It's important to note that life insurance coverage should be regularly reviewed and adjusted as financial circumstances change over time.

To know more about life insurance click on below link:

https://brainly.com/question/1400638#

#SPJ11