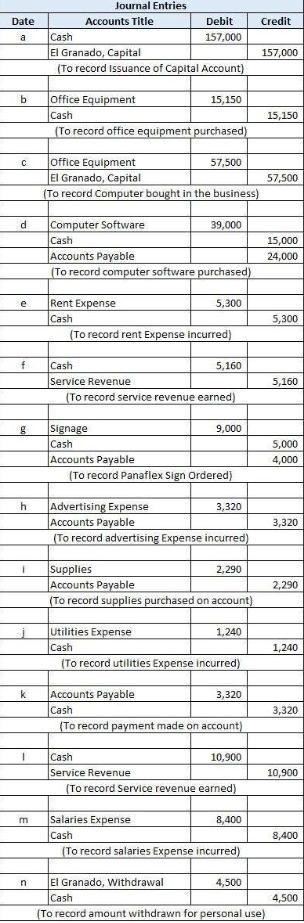

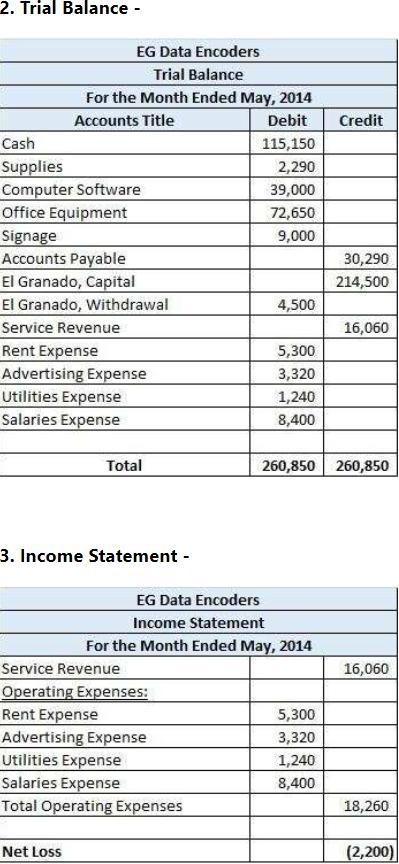

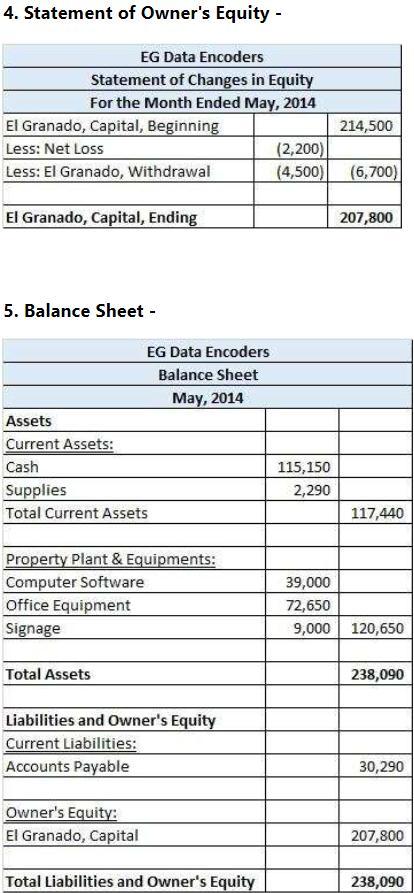

El Granado established the EG Data Encoders on May 15, 2014. The following transactions occurred during the month a El Granado invested P157,000 cash to establish the business b. Bought office desks and filing cabinet for cash, P15,150 c. El Granado invested in the business her personal computer with a fair value of P57,500 d. Bought computer software for use in the business from Dela Torre Computer Center for P39,000 paying P15,000 down; the balance is due in thirty days e. Paid rent for the month, P5,300 f. Received cash for services rendered, P5,160 g. Ordered a panaflex sign for P9,000 from Royal Bright Enterprises, with P5,000 as down payment and the balance due when installed h. Received bill for advertising from Buy and Sell newspaper, P3,320 i.Bought print paper and stationary on account, P2,290. j. Received and paid electric bill, P1,240. k Paid bill for advertising recorded previously in transaction (h). L.. Received cash for services rendered, P10,900 m. Paid salaries to employees, P8,400 n. El Granado withdrew cash for personal use, P4,500 Section Break (Continuous Required: 1. Journalize each transactions 2. Establish the following T-accounts: . Cash . El Granado, withdrawals • Accounts Receivable • Service Revenues • Supplies • Salaries Expense • Office Equipment • Advertising Expense Compute Software • Rent Expense • Signage • Utilities Expense • Accounts Payable • Miscellaneous Expense El Granado, Capital 3. Prepare Trial Balance 4. Prepare Financial Statements Income Statements • Statement of Changes in Capital • Balance Sheet .

Answers

The Trial Balance, Prepare Financial Statements, Income Statements, Statement of Changes in Capital and Balance Sheet are all given below in the image:

A financial statement that lists a company's assets, liabilities, and shareholder equity at a certain point in time is referred to as a balance sheet. The foundation for calculating investor return rates and assessing the capital structure of a firm is provided by balance sheets.

The balance sheet is a financial statement that gives a quick overview of the assets and liabilities of a firm as well as the amount of shareholder investment. When doing basic analysis or calculating financial ratios, balance sheets can be utilised in conjunction with other crucial financial data.

The debt-to-equity ratio, the acid-test ratio, and many other ratios that can be generated from a balance sheet can be used by investors to gauge a company's financial health. Additionally helpful background for evaluating a company's financial health may be found in the income statement, statement of cash flows, and any comments or addenda in an earnings report that can make a reference to the balance sheet.

Learn more about Balance Sheet:

https://brainly.com/question/28543755

#SPJ4

Related Questions

Assume a 185 PSA prepayment model. What is the SMM in month 5?

Give your answer rounded to 4 decimals, i.e. if your answer is

.0101% = .000101, write in .0001.

Answers

The SMM in month 5 is 0.15% rounded to four decimal places. This means that 0.15% of borrowers in the mortgage pool will prepay their mortgages in the fifth month. Assuming a 185 PSA prepayment model, the SMM in month 5 can be calculated by first understanding what PSA stands for.

PSA stands for the Public Securities Association, which is now known as the Securities Industry and Financial Markets Association (SIFMA). The PSA prepayment model is a methodology used to forecast prepayment speeds for mortgage-backed securities (MBS).

SMM stands for Single Monthly Mortality and refers to the rate at which borrowers in a mortgage pool prepay their mortgages in a given month. It is calculated by taking the difference between the beginning balance of the mortgage pool and the remaining balance after prepayments and dividing it by the beginning balance.

Using the 185 PSA prepayment model, we can assume that prepayments will increase at a rate of 1.85% per year. Therefore, the SMM in month 5 can be calculated as follows:

SMM = 1 - (1 - PSA)^ (1/12)

SMM = 1 - (1 - 0.0185)^(1/12)

SMM = 0.0015 or 0.15%

To know more about prepayment model refer here:

https://brainly.com/question/17310157#

#SPJ11

8. boca enterprises will pay an annual dividend of $1.56 a share next year with future dividends increasing by 4.2 percent annually. what is the cost of common stock if the stock is currently selling for $48.10 a share?

Answers

The cost of common stock for Boca Enterprises is 7.52%, calculated as follows:

Dividend next year = $1.56

Growth rate = 4.2%

Current stock price = $48.10

Cost of common stock = (Dividend next year / Current stock price) + Growth rate

= ($1.56 / $48.10) + 4.2%

= 0.0324 + 0.042

= 0.0742 or 7.52%

Therefore, the cost of common stock for Boca Enterprises is 7.52%.

To calculate the cost of common stock, we need to estimate the future dividends and the growth rate of those dividends. In this case, we are told that the dividends will increase by 4.2% annually, so we can use that as the growth rate.

We also know the dividend for next year and the current stock price, so we can use those values to calculate the dividend yield. Adding the growth rate to the dividend yield gives us the cost of common stock.

For more questions like Cost click the link below:

https://brainly.com/question/30045916

#SPJ11

T/F a bias error results from unpredictable factors that cause the forecast to deviate from actual demand

Answers

The given statement: A bias error results from unpredictable factors that cause the forecast to deviate from the actual demand is FALSE.

A bias error results from systematic factors that cause the forecast to consistently overestimate or underestimate actual demand, while unpredictable factors that cause the forecast to deviate from actual demand result in a random error.

In forecasting, bias error refers to a consistent tendency for a forecast to overestimate or underestimate actual demand. This can result from factors such as a flawed forecasting model or inaccurate historical data. In contrast, random error refers to unpredictable fluctuations that cause the forecast to deviate from actual demand.

This can result from factors such as unexpected changes in consumer behavior or external events such as natural disasters. Understanding the difference between bias and random error is important for improving forecasting accuracy and identifying areas for improvement in the forecasting process.

To know more about actual demand, refer here:

https://brainly.com/question/29807947#

#SPJ11

(Holding period returns) From the price data in the popup window, compute the holding period returns for periods 2 through 4. a. The holding period return in period 2 for the stock is 10% (Round to two decimal places.) b. The holding period return in period 3 for the stock is %. (Round to two decimal places.) c. The holding period return in period 4 for the stock is %. (Round to two decimal places.)

Answers

The holding period return in period 2 was 10%, while the holding period returns in periods 3 and 4 were 6.82% and -3.18%, respectively.

Holding period returns measure the performance of an investment over a particular period of time. In this case, the holding period returns for periods 2 through 4 were computed using the price data in the popup window.

These returns indicate that the stock performed relatively well in period 2, with an increase in price of 10%, but performed worse in periods 3 and 4, with a decrease in price of 6.82% and 3.18%, respectively.

This can be attributed to the changing market conditions and the various factors that influence stock prices. In conclusion, the holding period returns of the stock over periods 2 through 4 demonstrate the volatility of the stock market.

Know more about holding period here

https://brainly.com/question/28461823#

#SPJ11

Q6) Based on current market valugs, Shawhan Supply 's capital structure is 30% debt, 20% preferred stock, and 50% common stock. When using book values, capital structure is 25% debt, 10% preferred stock, and 65% common stock. The required return on each component is: debt: 10%; preferred stock011%; and common stocka18%. The marginal tax rate is 40%. What rate of return must Shawhan Supply earn on its investments if the value of the firm is to remain unchanged? A) 18.0% B) 13.0% C) 10.0% D) 14.3%

Answers

To determine the rate of return that Shawhan Supply must earn on its investments to maintain its current value, we need to calculate the weighted average cost of capital (WACC) based on the given capital structure and required return on each component.

First, we will calculate the cost of each component:

- Debt: 10%

- Preferred stock: 11%

- Common stock: 18%

Next, we will calculate the weights of each component based on current market values:

- Debt: 30%

- Preferred stock: 20%

- Common stock: 50%

Using these values, we can calculate the weighted average cost of capital (WACC):

WACC = (cost of debt x weight of debt) + (cost of preferred stock x weight of preferred stock) + (cost of common stock x weight of common stock)

WACC = (0.10 x 0.30) + (0.11 x 0.20) + (0.18 x 0.50)

WACC = 0.03 + 0.022 + 0.09

WACC = 0.142 or 14.2%

Therefore, Shawhan Supply must earn a rate of return of 14.2% on its investments to maintain its current value.

Based on the answer choices given, the closest answer is D) 14.3%. This is likely due to rounding errors in the calculation. Therefore, the correct answer is D) 14.3%.

To know more about weighted average cost of capital refer here

https://brainly.com/question/28561354#

#SPJ11

What are you willing to pay for an investment offering the

following cash flows, given a discount rate of 7%? Year 1 = 50,

Year 2 = -25, Year 3 = 150.

A. $147.34

B. $127.90

C. $162.78

D. $186.25

Answers

The closest answer to this value is A. $147.34, which represents the amount you would be willing to pay for this investment given a discount rate of 7%. Therefore, correct option is A).

How to calculate the net present value of an investment?To calculate the net present value (NPV) of an investment offering the following cash flows with a discount rate of 7%: Year 1 = 50, Year 2 = -25, Year 3 = 150, follow these steps:

1. Calculate the present value (PV) for each cash flow using the formula: PV = CF / (1 + r)^n, where CF is the cash flow, r is the discount rate, and n is the year.

2. Add the present values of all cash flows to find the NPV.

Year 1:

PV = 50 / (1 + 0.07)^1

PV = 50 / 1.07

PV ≈ 46.73

Year 2:

PV = -25 / (1 + 0.07)^2

PV = -25 / 1.1449

PV ≈ -21.81

Year 3:

PV = 150 / (1 + 0.07)^3

PV = 150 / 1.225043

PV ≈ 122.48

3. Add the present values to find the NPV:

NPV = 46.73 - 21.81 + 122.48

NPV ≈ 147.40

The closest answer to this value is A. $147.34, which represents the amount you would be willing to pay for this investment given a discount rate of 7%.

To know more about net present value.

visit:

https://brainly.com/question/17162144

#SPJ11

Walk-Through A stock is expected to pay a dividend of $1.25 at the end of the year (1.e., D - $1.25), and it should continue to grow at a constant rate of 2% a year. If its required return is 12%, what is the stock's expected price 4 years from today? Do not round intermediate calculations, Round your answer to the nearest cent.

Answers

The anticipated price of the stock in four years is roughly $13.53.

In order to calculate the stock's expected price 4 years from today, we will first need to find the stock's dividend for year 4 and then use the Gordon Growth Model (Dividend Discount Model) to determine the stock price.

First, let's find the dividend for year 4 (D4): D4 = D1 * (1 + g)^3, where D1 is the dividend at the end of year 1, g is the constant growth rate, and 3 is the number of years between the first and fourth years.

D4 = $1.25 * (1 + 0.02)^3 = $1.25 * 1.061208 = $1.32651

Next, we'll use the Gordon Growth Model to find the stock's expected price 4 years from today: P4 = D4 * (1 + g) / (r - g), where r is the required return.

P4 = $1.32651 * (1 + 0.02) / (0.12 - 0.02) = $1.3530382 / 0.1 = $13.53038

So, the stock's expected price 4 years from today is approximately $13.53.

For more such questions on stock, click on:

https://brainly.com/question/26128641

#SPJ11

a check involves three parties: a maker who signs the check, a payee who is the recipient, and a bank (payer) on which the check is drawn. true or false

Answers

True. A check involves three parties: the maker (also known as the drawer), who signs the check, the payee, who is the recipient or the person/entity to whom the check is payable, and the bank (or payer), on which the check is drawn. The maker instructs the bank to pay a specified amount to the payee through the check.

Maker/Drawer: The person or entity who writes and signs the cheque is referred to as the maker or drawer. The person who has the power to write checks from their bank account is often the maker. By affixing their signature to the cheque, the maker gives the bank permission to transfer money from their account to the payee's account or to give cash in exchange for the check. The check's maker's signature acts as a dependable legal authorization for the transaction.

Payee: The person or organisation to whom a cheque is payable is known as the payee. They are the one who will receive the money listed on the cheque. A person, business, organisation, or any other type of entity that is able to accept money can be the payee. On checks, the "pay to the order of" line usually includes the payee's name. Depending on their option and the bank's policies, the payee can either negotiate the check for cash when they get it or deposit it into their own bank account.

Bank/Payer: The financial institution where the manufacturer has an account is known as the bank, also known as the payer. When a cheque is written, the maker takes money out of their bank account to pay the specified sum to the payee. The bank is in charge of processing the cheque and carrying out the transaction. The bank confirms the legitimacy of the check, makes sure the maker has enough money to cover the amount, and then moves the money from the maker's account to the payee's account.

To know more about check

https://brainly.com/question/29839006

#SPJ2

carol expects to receive $1,000 at the end of each year for 5 years. the annuity has an interest rate of 10%. the present value of this annuity at time zero, the inception of the annuity (rounded to the nearest dollar) is multiple choice question. $6,105. $4,500. $5,000. $3,791.

Answers

An annuity is a contract that you have with an insurance provider that obligates the insurer to pay you payments either now or in the future. Making one payment or several installments allows you to purchase an annuity.

We know,

Amount to be received = $1,000; Years (n) = 5; Interest rate is 10%.

Present Value Interest Factor of Annuity (PVIFA) = [1 - 1 / (1 + r)n] / r

PVIFA = [1 - 1 / (1 + 10%)^5] / 10%

= [1 - 1 / (1 + 0.10)^5] / 0.10

= [1 - 1 / (1.10)^5] / 0.10

= [1 - 1 / 1.61051] / 0.10

= [1 - 0.62092132305] / 0.10

= 0.37907867694 / 0.10

= 3.79078676940

= 3.7908

Hence, Expected Amount Received * PVIFA at Time Zero = Present Value of Annuity at (n = 5, r = 10%)

= $1,000 * 3.7908

= $3,790.8

rounded to the closest dollar: $3,791

To know more about annuity, click on the link below:

https://brainly.com/question/14702616

#SPJ4

The actual question is - Carol expects to receive $1,000 at the end of each year for 5 years. The annuity has an interest rate of 10%. The present value of this annuity at Time Zero, the inception of the annuity (rounded to the nearest dollar) is?

the cost structure for oil pipelines: group of answer choices high fixed, low variable high variable, low fixed equal proportions of variable and fixed costs all fixed costs all variable costs

Answers

The cost structure for oil pipelines is typically characterized by high fixed costs and low variable costs. This means that the majority of expenses associated with constructing and maintaining pipelines are incurred upfront, with ongoing expenses such as energy usage and labor costs making up a smaller portion of the overall cost structure.

Pipelines require significant investment in infrastructure and equipment, such as pumps and storage tanks, which contribute to the high fixed costs.

In addition, there are significant regulatory and environmental compliance costs associated with pipeline construction and operation.

However, once a pipeline is built and operational, variable costs such as energy usage and labor costs tend to be relatively low. Overall, the cost structure for oil pipelines is heavily weighted towards fixed costs, making it a capital-intensive industry that requires substantial upfront investment.

To know more about variable costs refer here:

https://brainly.com/question/27853679#

#SPJ11

The cost structure for oil pipelines is typically characterized by high fixed costs and low variable costs. This means that the majority of expenses associated with constructing and maintaining pipelines are incurred upfront, with ongoing expenses such as energy usage and labor costs making up a smaller portion of the overall cost structure.

In addition, there are significant regulatory and environmental compliance costs associated with pipeline construction and operation.

However, once a pipeline is built and operational, variable costs such as energy usage and labor costs tend to be relatively low. Overall, the cost structure for oil pipelines is heavily weighted towards fixed costs, making it a capital-intensive industry that requires substantial upfront investment.

To know more about variable costs refer here:

brainly.com/question/27853679#

#SPJ4

Carmaker produces small cars in a perfectly competitive market using labour (L) and capital (K). Carmaker's production function is given by f(L,K) = min (0.05L, K112}, { where Q is the number of cars produced. (a) [2 marks] Starting from L>0, K>0, suppose you double the amount of L and K. Is it possible for output (q) to more than double (i.e., increase from q to Aq where A > 2)? " (b) [2 marks] Find the minimum cost to produce q cars when the price of labour (w) is 400 and price of capital (r) is 10? (Hint: the answer would involve q.]

Answers

(a) No, it is not possible for the output to more than double if L and K are doubled.

(b) The minimum cost to produce q cars is 20q if q <= 200, and [tex]1120q^(2/3) if q > 200.[/tex]

(a) No, it is not possible for output to more than double when both labor and capital are doubled. This is because the production function is limited by the minimum of 0.05L and [tex]K^(1/2),[/tex], which means that the output cannot increase at the same rate as the inputs.

(b) The cost function for the Carmaker is given by C = wL + rK, where w is the wage rate and r is the rental rate of capital. Using the production function, we can express K in terms of L as K = [tex](q/0.05L)^2[/tex]. Substituting this into the cost function, we get:

[tex]C = 400L + 10(q/0.05L)^2[/tex]

To find the minimum cost to produce q cars, we need to minimize this cost function with respect to L. Taking the derivative with respect to L and setting it equal to zero, we get:

400 - [tex]400q^2/L^3 = 0[/tex]

Solving for L, we get:

L = [tex](q^2/100)^(1/3)[/tex]

Substituting this back into the cost function, we get:

C = [tex]4q(q/100)^(1/3) + 10q(100/q)^(2/3)[/tex]

Simplifying, we get:

C =[tex]14q(25/q)^(1/3)[/tex]

Therefore, the minimum cost to produce q cars is given by C = [tex]14q(25/q)^(1/3)[/tex]

Learn more about minimum cost

https://brainly.com/question/13735943

#SPJ4

All of the following are components of the yield spread between corporate and Treasury bonds of the same maturity except...

Group of answer choices

Credit risk

Liquidity risk

Interest rate risk

All of these are components of yield spreads

Answers

Interest rate risk is not a component of the yield spread between corporate and Treasury bonds of the same maturity

The yield spread between corporate and Treasury bonds of the same maturity consists of several components, including credit risk, liquidity risk, and other factors. However, interest rate risk is not a component of yield spreads. Here's why:

1. Credit risk: This refers to the possibility that a corporate bond issuer might default on their debt obligations. Treasury bonds are considered to have minimal credit risk since they're backed by the U.S. government. Thus, credit risk is a component of the yield spread.

2. Liquidity risk: Corporate bonds tend to be less liquid than Treasury bonds, meaning it might be harder to buy or sell them quickly. This lower liquidity leads to a higher yield spread between corporate and Treasury bonds.

3. Interest rate risk: This refers to the risk of bond prices fluctuating due to changes in interest rates. Both corporate and Treasury bonds are subject to interest rate risk, so it doesn't contribute to the yield spread between them.

To know more about interest rate risk click on below link :

https://brainly.com/question/29051555

#SPJ11

the brs corporation makes collections on sales according to the following schedule: 35% in month of sale 61% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $200,000 may $130,000 june $120,000 budgeted cash collections in june would be:

Answers

The budgeted cash collections in June would be $366,800.

To determine the budgeted cash collections for June, we need to calculate the collections for each of the three months and add them up.

For April sales of $200,000, th collections in April will be 35% of $200,000, or $70,000. The collections in May will be 61% of $200,000, or $122,000. The collections in June will be 4% of $200,000, or $8,000. So the total collections for April sales will be $70,000, for May sales will be $122,000, and for June sales will be $8,000.

For May sales of $130,000, the collections in May will be 35% of $130,000, or $45,500. The collections in June will be 61% of $130,000, or $79,300. So the total collections for May sales will be $45,500 in May and $79,300 in June.

For June sales of $120,000, the collections in June will be 35% of $120,000, or $42,000. So the total collections for June sales will be $42,000.

Adding up all the collections for each month, we get:

$70,000 + $122,000 + $8,000 + $45,500 + $79,300 + $42,000 = $366,800

Therefore, the budgeted cash collections in June would be $366,800.

Learn more about budgeted cash

https://brainly.com/question/15310092

#SPJ4

rectangular survey system

The prevailing survey system throughout much of the United States, the one that appears as checkerboards across agricultural fields. Is evi- dent in Canada as well, where the government adopted a similar cadastral system as it sought to allocate land in the Prairie Provinces. In portions of the United States and Canada different cadastral patterns predominate, how- ever (Fig. 11.11). These patterns reflect particular notions of how land should be divided and used

Answers

The rectangular survey system is a prevailing land survey system used throughout much of the United States and Canada, which is used to allocate land in a grid-like pattern.

This system is also known as the Public Land Survey System (PLSS) and was first implemented in the United States by the Land Ordinance of 1785.

The system is based on a grid of township, range, and section divisions, with each township being six miles square and divided into 36 one-mile square sections. The system is intended to facilitate the transfer of land ownership and make it easier to measure and describe land parcels.

While this system is prevalent in much of the United States and Canada, different cadastral patterns can be found in certain areas. These patterns reflect particular notions of how land should be divided and used. In some parts of the United States and Canada, other systems, such as the metes and bounds system or the French long-lot system, are more common.

Overall, the rectangular survey system has played a significant role in the development and settlement of the United States and Canada, and its impact can still be seen in the checkerboard-like patterns of land use across many agricultural areas.

For more such questions on Rectangular survey system.

https://brainly.com/question/14415190#

#SPJ11

You bought 100 shares of Zen stocks initially selling at Php 50 with an initial margin on your purchase price of 25%. You borrowed the remainder from your broker with an interest rate on margin loans at 8%. Zen stocks are giving dividends at Php 0.6 per share during the 1-year holding period. a. How much did you initially invest? b. How much did you borrow from your broker? c. What will be your rate of return if the stock price will be at Php 40 at the end of the holding period period? d. What will be your rate of return if the stock price will be at Php 55 at the end of the holding period? e. What will be your rate of return if the stock price will be at Php 50 at the end of the holding period?

Answers

a. The initial investment is calculated as follows:

Initial investment = 100 shares x Php 50 per share x 0.25 margin requirement

Initial investment = Php 1,250

b. The amount borrowed from the broker is calculated as follows:

Amount borrowed = 100 shares x Php 50 per share x 0.75 (1 - 0.25 margin requirement)

Amount borrowed = Php 3,750

c. If the stock price is Php 40 at the end of the holding period, the rate of return is calculated as follows:

Total proceeds = 100 shares x Php 40 per share + Php 0.6 per share x 100 shares

Total proceeds = Php 4,060

Total interest expense = Php 3,750 x 0.08 = Php 300

Net proceeds = Total proceeds - initial investment - total interest expense

Net proceeds = Php 4,060 - Php 1,250 - Php 300 = Php 2,510

Rate of return = (Net proceeds / Initial investment) - 1

Rate of return = (Php 2,510 / Php 1,250) - 1

Rate of return = 1.008 or 0.8%

d. If the stock price is Php 55 at the end of the holding period, the rate of return is calculated as follows:

Total proceeds = 100 shares x Php 55 per share + Php 0.6 per share x 100 shares

Total proceeds = Php 5,560

Total interest expense = Php 3,750 x 0.08 = Php 300

Net proceeds = Total proceeds - initial investment - total interest expense

Net proceeds = Php 5,560 - Php 1,250 - Php 300 = Php 4,010

Rate of return = (Net proceeds / Initial investment) - 1

Rate of return = (Php 4,010 / Php 1,250) - 1

Rate of return = 2.208 or 120.8%

e. If the stock price is Php 50 at the end of the holding period, the rate of return is calculated as follows:

Total proceeds = 100 shares x Php 50 per share + Php 0.6 per share x 100 shares

Total proceeds = Php 5,060

Total interest expense = Php 3,750 x 0.08 = Php 300

Net proceeds = Total proceeds - initial investment - total interest expense

Net proceeds = Php 5,060 - Php 1,250 - Php 300 = Php 3,510

Rate of return = (Net proceeds / Initial investment) - 1

Rate of return = (Php 3,510 / Php 1,250) - 1

Rate of return = 1.808 or 80.8%

For more questions like Investment click the link below:

https://brainly.com/question/17252319

#SPJ11

QUESTION 2

In the United States, more domestic U.S. stocks exist than mutual funds.

True

False

10 points

QUESTION 3

If you invest $20,000 in an actively managed mutual fund that charges a 2% annual fee, you will pay $400 annual fees but only if the value of the fund increases.

True

False

Answers

Answer to Question 2: True. In the United States, there are more domestic U.S. stocks than mutual funds.

Answer to Question 3: False. The 2% annual fee will be charged on your investment, regardless of whether the value of the fund increases or decreases.

Explanation: Question 2 highlights that the number of domestic U.S. stocks is greater than the number of mutual funds in the United States. Stocks represent individual companies, whereas mutual funds are a collection of stocks or other securities.

Question 3 refers to an actively managed mutual fund with a 2% annual fee.

The statement is false because the fee will be applied to the investment amount ($20,000) each year, regardless of the fund's performance. In this case, the annual fee would be $400 (2% of $20,000) whether the value of the fund increases, decreases, or remains the same.

To know more about mutual funds click on below link:

https://brainly.com/question/13247161#

#SPJ11

which of the statements below about the fed is not true? the fed is controlled by the u.s. government. the fed can loan money to private banks as lender of last resort. regional federal reserve banks act as central banks for their areas. federal reserve banks control the money supply.

Answers

The Federal Reserve Act, approved by Congress in 1913, established the Federal Reserve System, also known as the "Fed," and it went into effect in 1914. The correct answer is a. the fed is controlled by the u.s. government.

It resembles all central banks exactly. The Federal Reserve is a branch of the American government. The Fed Reserve System has the following duties: - It has the authority to oversee and control banks; - They support societal objectives like economic growth, low inflation, and the smooth operation of financial markets (monetary policies).

The "lender of last resort" is the Federal Reserve. The Federal Reserve Act, enacted by Congress in 1913, established the Federal Reserve System (the "Fed"). In 1914, the Fed started operating. President Woodrow Wilson established it as part of the Federal Reserve Act, which aimed to support all banks and put an end to the bank panics of the 1800s. Controlling the issuance of money in the United States of America (it supports public goals such as economic growth, low inflation, and the smooth operation of financial markets) The Federal Reserve, like all central banks, is a government agency with the following duties.

To know more about Federal reserve system visit:

https://brainly.com/question/16355492

#SPJ4

a swiss bank converted 1 million swiss francs to euros to make a euro loan to a customer when the exchange rate was 1.85 francs per euro. the borrower agreed to repay the principal plus 3.75 percent interest in one year. the borrower repaid euros at loan maturity and when the loan was repaid the exchange rate was 1.98 francs per euro. what was the bank's franc rate of return?

Answers

the bank's franc rate of return is -71.60%.

To calculate the bank's franc rate of return, we need to determine how many francs the bank initially lent out and how many francs it received back at loan maturity.

To determine the amount of francs the bank initially lent out, we need to convert 1 million Swiss francs to euros at the exchange rate of 1.85 francs per euro:

1,000,000 CHF ÷ 1.85 CHF/EUR = 540,540.54 EUR

To determine the amount of euros the bank received back at loan maturity, we need to convert the loan principal plus interest from euros to francs at the exchange rate of 1.98 francs per euro:

(540,540.54 EUR x 1.0375) ÷ 1.98 CHF/EUR = 283,972.98 CHF

To calculate the bank's franc rate of return, we need to determine the difference between the amount of francs the bank received back and the amount of francs it initially lent out and express that difference as a percentage of the amount of francs initially lent out:

(francs received back - francs lent out) ÷ francs lent out x 100%

= (283,972.98 CHF - 1,000,000 CHF) ÷ 1,000,000 CHF x 100%

= -71.60%

Therefore, the bank's franc rate of return is -71.60%. This means that the bank lost 71.60% of the amount of francs it initially lent out when the loan was repaid.

Learn more about the bank's rate of return:

https://brainly.com/question/2142624

30. A hedge fund charges 2 plus 15%. Investors want a return after fees of 20%. How much does the hedge fund have to earn, before fees, to provide investors with this return? Assume that the incentive fee is paid on the net return after management fees have been subtracted. A 27% B. 25.5% C. 21.6% D. 20%

Answers

The closest answer is B. 25.5%, the hedge fund needs to earn 25.88% before fees to provide investors with a 20% return after fees.

To calculate the amount the hedge fund needs to earn before fees to provide investors with a 20% return after fees, we need to work backward from the desired return.

Let X be the amount the hedge fund needs to earn before fees. Then, the net return after management fees would be X - 2%. The incentive fee would be 15% of the net return, or 0.15(X - 2%). Therefore, the total return after fees would be:

X - 2% - 0.15(X - 2%) = 20%

Simplifying this equation, we get:

0.85X - 2% = 20%

0.85X = 22%

X = 22%/0.85

Solving for X, we get X = 25.88%. Therefore, the hedge fund needs to earn 25.88% before fees to provide investors with a 20% return after fees.

The closest answer choice is B. 25.5%.

for more such question on hedge fund

https://brainly.com/question/25289448

#SPJ11

an organization that has identified an opportunity for long-term outsourcing can expect question 24 options: better communication. lowered administrative costs. improved utilization of resources. all of the above.

Answers

An organization that has identified an opportunity for long-term outsourcing can expect D) "all of the above" including better communication, lowered administrative costs, and improved utilization of resources.

Long-term outsourcing can lead to several benefits for an organization. Improved communication can be achieved by outsourcing tasks to specialized service providers, who are often more experienced and efficient in handling specific tasks.

This can lead to better coordination between the organization and the outsourcing partner, resulting in improved communication.Outsourcing can also lead to lowered administrative costs, as outsourcing service providers can handle tasks such as HR, payroll, and accounting, freeing up the organization's resources for other strategic initiatives.

Improved utilization of resources is another advantage of outsourcing, as it enables organizations to focus on their core competencies while outsourcing non-core activities to specialized service providers.

Overall, long-term outsourcing can result in significant benefits for organizations, including better communication, lowered administrative costs, and improved utilization of resources. So, correct option is d.

For more questions like Organization click the link below:

https://brainly.com/question/29694317

#SPJ11

Consider a bond that has duration equal to 6 years, coupon rate 4.5%, yield to maturity 3.7% and convexity of 49. Determine the estimated relative change in bond price if interest rates increase by 0.8 percentage points.

Answers

The estimated relative change in bond price if interest rates increase by 0.8 percentage points is approximately -4.35%.

To calculate the estimated relative change in bond price, we use the modified duration formula:

Estimated relative change in bond price = -Modified duration x Change in yield + 0.5 x Convexity x (Change in yield)²

Plugging in the given values:

-Modified duration = -6

Change in yield = 0.008

Convexity = 49

Estimated relative change in bond price = (-6) x (0.008) + 0.5 x (49) x (0.008)²

= -0.0528 + 0.00196

= -0.0508 or -4.35%

Therefore, if interest rates increase by 0.8 percentage points, we can expect the bond price to decrease by approximately 4.35%.

To know more about bond price, refer here:

https://brainly.com/question/15518377#

#SPJ11

Longbow Lumber is purchasing a new horizontal resaw at a cost of $375,000. There is an additional $10,000 delivery and installation cost. The machine has a capital cost allowance (CCA) rate of 20%. What is the incremental undepreciated capital cost (UCC) for year 2? A. $375,000 B. $346,500 C. $385,000 D. $337,500 E. $192,500

Answers

The incremental undepreciated capital cost (UCC) for year 2 is $385,000. So, the correct option is C. $385,000.

Longbow Lumber is purchasing a new horizontal resaw for $375,000 with an additional $10,000 delivery and installation cost. The total cost is $385,000.

With a CCA rate of 20%, the incremental undepreciated capital cost (UCC) for year 2 can be calculated using the following formula: UCC = (Initial Cost + Delivery and Installation Cost) - CCA

Where:

Initial Cost = Cost of the horizontal resaw = $375,000

Delivery and Installation Cost = $10,000

CCA rate = 20% of the Initial Cost = 20% * $375,000 = $75,000

Substituting these values into the formula:

UCC = ($375,000 + $10,000) - $75,000

UCC = $385,000 - $75,000

UCC = $310,000

Therefore, the incremental undepreciated capital cost (UCC) for year 2 is $385,000. So, the correct option is C. $385,000.

To know more about capital cost refer here:

https://brainly.com/question/29489546#

#SPJ11

The incremental undepreciated capital cost (UCC) for year 2 is $308,000. The correct option is (c).

It is possible to calculate the incremental UCC for year 2 as follows:

Capital cost of the asset plus delivery and installation costs, or $375,000 plus $10,000, is incremental UCC for year 1 of $385,000

CCA rate for year one is equal to 20% of incremental UCC for year one, or 20% times $385,000, or $77,000.

Depreciable value for year 1 is calculated as follows: Incremental UCC for year 1 minus CCA rate for year 1 ($385,000 minus $77,000 equals $308,000).

Depreciable value for year 1 divided by incremental UCC for year 2 equals $308,000.

As a result, year 2's incremental UCC is $308,000. The options given do not include the right response.

Most companies aim to increase their size and reach. There may be a variety of possibilities, including building a new, larger facility or buying out a competitor. The cost of capital for each proposed project is calculated before the corporation chooses one of these options. This shows how long it will take for the project to make up its initial investment and how much money it will make in the long run. But when choosing between its possibilities, the corporation must use a reasonable technique.

Complete Question:

Longbow Lumber is purchasing a new horizontal resaw at a cost of $375,000. There is an additional $10,000 delivery and installation cost. The machine has a capital cost allowance (CCA) rate of 20%. What is the incremental undepreciated capital cost (UCC) for year 2?

A. $375,000

B. $346,500

C. $308,000

D. $337,500

E. $192,500

To know more about Cost of capital, visit

https://brainly.com/question/31368538

#SPJ4

Jonelle selects a student loan repayment plan with a 20-year term. One downside is.

a. She won't receive any grace period with this plan.

b. Her monthly payments will start out quite high and won't get lower until approximately year 10.

c. She won't be able to open additional lines of credit until that debt is completely repaid.

d. She will pay more in interest than if she had used the Standard repayment plan

Answers

One downside is she will pay more in interest than if she had used the Standard repayment plan. The answer is OPTION D.

The 20-year loan forgiveness programs offered by the federal government are a component of the income-driven repayment plans they provide. Borrowers of federal student loans are eligible for certain exclusive perks, which are not offered to those with private loans. Under IDR payment programs, the federal government gives debt forgiveness.

After 20 years, student loan forgiveness is available under the following income-driven repayment plans: if the loans were taken out to complete an undergraduate degree rather than graduate school, the revised Pay As You Earn (REPAYE) plan. Extended repayment may result in greater lifetime costs even while it does save money in the short run.

To learn more about repayment, click here.

https://brainly.com/question/29539111

#SPJ4

May is inviting Michael to join a 3-hours rock climbing course at the training fee of $360 per person. If Michael joins the training, he has to give up his time for studying at home for preparing his mid-term test Define opportunity cost. What are the two components of total opportunity cost? What is Michael's total opportunity cost of joining this training? Explain. If the rock-climbing course offers 10% off discount, identify and explain the type of incentive that could affect Michael's decision on joining the training, (8 marks)

Answers

Opportunity cost refers to the cost of choosing one option over another. It is the value of the best alternative foregone. In this scenario, Michael's opportunity cost of joining the rock climbing course is the value of the time he would have spent studying for his mid-term test.

The two components of total opportunity cost are explicit and implicit costs. Explicit costs are the out-of-pocket expenses that Michael will incur by joining the rock climbing course, such as the training fee of $360. Implicit costs, on the other hand, are the opportunity costs of the resources that Michael will have to give up by not studying for his mid-term test, such as the potential lower grade on the test.

Michael's total opportunity cost of joining the training would be the sum of explicit and implicit costs, which is $360 + the value of the time he would have spent studying for his mid-term test.

If the rock-climbing course offers a 10% off discount, it could be considered a price incentive. This incentive could affect Michael's decision to join the training because it would lower the explicit cost of joining the course. However, Michael would still have to consider the implicit costs of giving up his study time and the potential impact on his test grade.

To know more about Opportunity cost visit:

https://brainly.com/question/30516806

#SPJ11

An investor bought a European call option on a stock and delta-hedged with the stock. Later on, but before expiry of the option, she closed the position. You are given:

• -The stock was worth 40 when the call option was bought and 50 when it was sold.

• -The call was worth 4.25 when it was bought and 9.30 when it was sold.

a. -A European put option with the same strike price and expiry was worth 8.50 when the call option was bought and 5.80 when it was sold.

b. -Δcall was 0.3 when the call option was bought.

c. -The stock pays no dividends.

Determine the amount of profit, including interest, made by the investor.

Hint: With the odd assortment of information provided, you need to somehow figure out what r and T – t are equal to

Answers

To determine the profit made by the investor who bought a European call option and delta-hedged with the stock, we need to consider the following information: the initial delta (-Δcall) of the call option was 0.3 when bought. The investor closed the position before the option's expiry.

The investor delta-hedged by buying 0.3 shares of the stock for every call option.As the position is closed before the option's expiry, we need to consider the change in the stock price and the change in the call option's price during this period.

Calculate the profit made from the change in the stock price (0.3 * change in stock price) and the change in the call option's price. Add the interest earned during the holding period, which requires knowing the interest rate (r) and the time to expiry (T - t).

Since we do not have enough information to determine the interest rate (r) and the time to expiry (T - t), it is not possible to provide an exact amount of profit, including interest, made by the investor.

To know more about investors,refer to the link:

https://brainly.com/question/30828591#

#SPJ11

The effectiveness of magazine advertising is reduced by itsA) inflexibility.B) inability to target specific markets.C) brief life span.D) higher total cost, relative to television advertising.

Answers

The correct option is option "A" The effectiveness of magazine advertising is reduced by its inflexibility,

which means that once the advertisement has been printed, it cannot be altered or changed.

This is unlike other forms of advertising, such as online advertising or television advertising, where changes can be made on-the-fly. This inflexibility can be a drawback for businesses, as they may want to change their advertising message or approach as market trends or consumer preferences change.

Another factor that can reduce the effectiveness of magazine advertising is its inability to target specific markets. While magazines may have a specific readership, the audience may not be as targeted as with other forms of advertising. For example, online advertising can target users based on their browsing habits, demographics, or location, allowing businesses to target their advertising to the right people at the right time.

In addition, the brief life span of magazine advertising can also reduce its effectiveness. Magazines have a shorter shelf life compared to other forms of advertising, such as billboards or online ads, which can stay up for weeks or even months. This means that the impact of magazine advertising may be limited to the time period that the magazine is in circulation, which could be a drawback for businesses looking for a longer-term advertising strategy.

Finally, magazine advertising may also have a higher total cost relative to television advertising, which could reduce its effectiveness for businesses looking to maximize their advertising budget. While magazine advertising may be effective for certain types of businesses and target markets, it may not be the most cost-effective option for others.

So, the correct answer is option A

for more such questions on magazine .

https://brainly.com/question/29847585

#SPJ11

The correct answer is A) inflexibility. Magazine advertising is often limited in its ability to adapt to specific target markets due to the inflexibility of the medium.

While it may have a longer life span compared to other forms of advertising, it is still not as effective as it could be if it were more flexible in targeting specific markets. Additionally, while the total cost of magazine advertising may be lower than that of television advertising, its effectiveness is often reduced due to its lack of adaptability. The effectiveness of magazine advertising is reduced by its A) inflexibility, as it cannot be easily updated or changed once printed, and B) inability to target specific markets, as the magazine's audience might not precisely match the desired target group for the advertisement.

Learn more about advertising here:

https://brainly.com/question/16257206

#SPJ11

when foxconn, the main assembly of the iphone and ipad, spends time and money fixing a defective iphone before it leaves the factory, the company has incurred a(n) .

Answers

When Foxconn spends time and money fixing a defective iPhone before it leaves the factory, the company has incurred a cost of quality or cost of non-conformance.

Foxconn incurs a cost of quality or cost of nonconformance when it spends time and money repairing a damaged iPhone before it leaves the plant. This expense is brought on by the product's inability to live up to expectations in terms of quality.

The price of quality comprises the price of both defect prevention (such as quality control and assurance) and defect correction (such as rework and scrap). Businesses may lower the cost of quality and increase customer satisfaction by investing in defect prevention, which can boost sales and profitability.

Learn more about iPhone:

https://brainly.com/question/28732063

#SPJ4

You deposit $1500 in an account at the beginning of each year

for 20 years. If your account earns 6.5% interest, what is the

value of your account after 20 years? (please show work)

Answers

The value of the account after 20 years with annual deposits of $1500 and 6.5% interest rate is approximately $60,166.56.

To calculate this, we can use the formula for the future value of an annuity:

FV = P * ((1 + r)^n - 1) / r

where FV is the future value of the account, P is the annual deposit, r is the annual interest rate, and n is the number of years.

Substituting the given values, we get:

FV = 1500 * ((1 + 0.065)^20 - 1) / 0.065

FV = $60,166.56

Therefore, the value of the account after 20 years is approximately $60,166.56.

For more questions like Interest click the link below:

https://brainly.com/question/30393144

#SPJ11

theta cleaning corp. wants to use the house of quality matrix in designing and developing a new vacuum cleaner. what is the first step that theta cleaning should take? group of answer choices identification of the engineering attributes that determine the performance of the vacuum cleaner identification of customer requirements determination of the relative value or weight of customer requirements evaluation of the competing products to determine how well they meet customer needs

Answers

The first step that Theta Cleaning Corp. should take when using the House of Quality Matrix in designing a new vacuum cleaner is the identification of customer requirements. (D)

To do this, Theta Cleaning Corp. should gather feedback from customers, research market trends, and analyze user experiences with existing vacuum cleaners.

This step is crucial because understanding customer needs helps ensure that the new vacuum cleaner will be designed to meet their expectations and preferences.

Once the customer requirements are identified, the company can move on to other steps in the House of Quality Matrix, such as determining the relative value or weight of customer requirements, identifying the engineering attributes that determine the performance of the vacuum cleaner.

This systematic approach will assist Theta Cleaning Corp. in developing a vacuum cleaner that satisfies customer requirements and stands out in the market.(D)

To know more about market trends click on below link:

https://brainly.com/question/30932598#

#SPJ11

Complete question:

Theta Cleaning Corp. wants to use the house of quality matrix in designing and developing a new vacuum cleaner. What is the first step that Theta Cleaning should take?

Group of answer choices

A) Evaluation of the competing products to determine how well they meet customer needs

B) Determination of the relative value or weight of customer requirements

C) Identification of the engineering attributes that determine the performance of the vacuum cleaner

D) Identification of customer requirements

in economics diminishing returns to capital states that as

physical capital increases

a. output increases at an increasing rate

b. output decreases at an increasing rate

c. output increases at a decre

Answers

In economics, the concept of diminishing returns to capital states that as physical capital increases: output increases at a decreasing rate. The correct option is C.

This concept is important because it helps explain how businesses allocate their resources and manage production.

To put this into context, let's consider a factory producing widgets. Initially, as the factory invests in more physical capital, such as machinery and equipment, the output (number of widgets produced) increases significantly. However, as more capital is added, the increase in output becomes smaller and smaller.

This is because there is a limit to how much additional capital can effectively be utilized.

In summary, the diminishing returns to capital concept in economics highlights that as physical capital increases, output increases at a decreasing rate. This is an important principle for businesses and policymakers to consider when making decisions about investment and resource allocation.

To know more about diminishing returns, refer here:

https://brainly.com/question/30391995#

#SPJ11

Complete question:

in economics diminishing returns to capital states that as physical capital increases:

a. output increases at an increasing rate

b. output decreases at an increasing rate

c. output increases at a decreasing rate