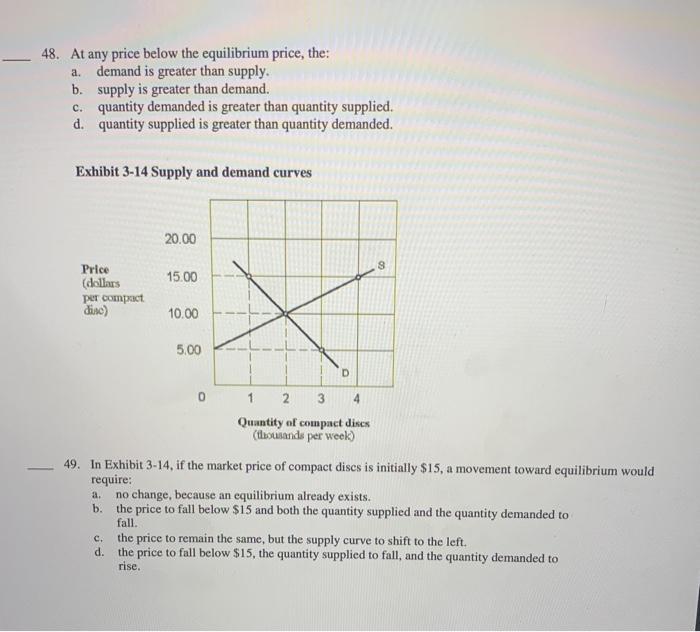

in exhibit 3-14, if the market price of compact discs is initially $15, a movement toward equilibrium would require: no change, because an equilibrium already exists. b. the price to fall below $15 and both the quantity supplied and the quantity demanded to fall. c. the price to remain the same, but the supply curve to shift to the left. d. the price to fall below $15, the quantity supplied to fall, and the quantity demanded to rise.

Answers

In illustration 3-14, if the starting market price of CDs is $15, a shift toward equilibrium would necessitate that the price drop below $15, the quantity provided decline, and the quantity requested increase. Option d is Correct.

The point where the demand and supply curves cross in a market with competition determines the equilibrium price and quantity. If the starting price is higher than the equilibrium price, there will be an excess supply, meaning that there will be more supply than demand.

As a result, if the initial market price of compact discs is $15 and there is a trend toward equilibrium, the price would need to drop below $15, the quantity provided would need to decrease, and the quantity requested would need to increase in order to attain equilibrium. Option d is Correct.

Learn more about market price Visit: brainly.com/question/30165908

#SPJ4

Correct Question:

In exhibit 3-14, if the market price of compact discs is initially $15, a movement toward equilibrium would require: no change, because an equilibrium already exists. b. the price to fall below $15 and both the quantity supplied and the quantity demanded to fall. c. the price to remain the same, but the supply curve to shift to the left. d. the price to fall below $15, the quantity supplied to fall, and the quantity demanded to rise.

A movement toward equilibrium would require a change in market conditions, and option D represents the correct answer as it reflects a movement toward equilibrium.

Exhibit 3-14 depicts a graphical representation of the market for compact discs. The graph shows the supply and demand curves for compact discs, where the equilibrium price and quantity are determined by the intersection of these curves. If the initial market price of compact discs is $15, a movement toward equilibrium would require a change in the market conditions.

Therefore, option A, which suggests that no change is required as an equilibrium already exists, is incorrect.

Option B suggests that the price would fall below $15, and both the quantity supplied and the quantity demanded would fall. However, this option does not represent a movement toward equilibrium, but rather an imbalance in the market where the quantity demanded falls below the quantity supplied. Therefore, option B is incorrect.

Option C suggests that the price would remain the same, but the supply curve would shift to the left. While a shift in the supply curve would affect the equilibrium price and quantity, it would not lead to a movement toward equilibrium. Therefore, option C is also incorrect.

Option D represents the correct answer. It suggests that the price would fall below $15, the quantity supplied would fall, and the quantity demanded would rise. This movement toward equilibrium would occur as a result of a decrease in supply or an increase in demand, leading to a shift in the supply or demand curve, respectively. The new equilibrium price and quantity would be determined by the intersection of the new supply and demand curves.option D represents the correct answer.

For more such questions on equilibrium

https://brainly.com/question/26075805

#SPJ11

Related Questions

how would the accounting equation of boston company be affected by the billing of a client for $10,000 of consulting work completed?

Answers

The accounts receivable of the Boston Company will rise by the same amount when a client is charged for $10,000 of already finished consulting services. Similar to how the shareholders' equity recorded on the balance sheet will grow, so will the net income.

The company's income and accounts receivable would increase if it charged clients for services rendered. While revenue is an equity account, accounts receivable is an asset. Therefore, increasing assets and equity is the solution. As the value of the goods on hand rises, assets also do. With an increase in Accounts Payable, liabilities rise. This transaction does not effect equity.

To know more about shareholders, click here:

https://brainly.com/question/19054394

#SPJ4

Your banker has analyzed your company account and has suggested that her bank has a cash management package for you. She suggests that with a concentration banking system, your float can be reduced by four days on average. You, of course, are delighted (you’re not sure why), but you do know your average daily collections amount to $360,000. Your opportunity cost of funds is 8 percent. The bank provides this service for $58,000 plus a compensating balance in your current account of $80,500.

1. is this package worth it?

2. by how much? (annual saving)

Answers

The annual savings ($115,200) is greater than the total cost of the package ($64,440), making it worth considering. The net annual saving is $115,200 - $64,440 = $50,760.

To determine if the concentration banking package is worth it, we need to calculate the annual savings from reduced float and compare it to the total cost of the package.2. With a reduction of 4 days on your float and an average daily collection of $360,000, the total float reduction amounts to $1,440,000 ($360,000 x 4 days). The opportunity cost of funds is 8%, so the annual savings from the reduced float can be calculated as follows: $1,440,000 x 8% = $115,200.Now, let's calculate the total cost of the package.

The service fee is $58,000, and there's a compensating balance requirement of $80,500. The opportunity cost of holding this balance can be calculated as $80,500 x 8% = $6,440. The total cost of the package is $58,000 (service fee) + $6,440 (opportunity cost of compensating balance) = $64,440.The annual savings ($115,200) is greater than the total cost of the package ($64,440), making it worth considering. The net annual saving is $115,200 - $64,440 = $50,760.

Learn more about concentration banking here:https://brainly.com/question/28917353

#SPJ11

(Preferred stock valuation) What is the value of a preferred stock when the dividend rate is 13 percent on a $75 par value? The appropriate discount rate for a stock of this risk level is 9 percent.

Answers

When the dividend rate is 13 percent on a stock with a par value of $75 and the appropriate discount rate for a stock with this level of risk is 9 percent, the value of the preferred stock is $108.33.

To calculate the value of the preferred stock, we need to use the dividend discount model, which is:

Value of preferred stock = Annual dividend / Discount rate

First, we need to calculate the annual dividend by multiplying the dividend rate by the par value of the stock:

Annual dividend = Dividend rate x Par value = 0.13 x $75 = $9.75

Next, we can use the formula to calculate the value of the preferred stock:

Value of preferred stock = $9.75 / 0.09 = $108.33

Therefore, the value of the preferred stock is $108.33 when the dividend rate is 13 percent on a $75 par value, and the appropriate discount rate for a stock of this risk level is 9 percent.

For more such questions on dividend rate , click on:

https://brainly.com/question/14236717

#SPJ11

all else remaining equal, if the amount of small-denomination time deposits increases, this will increase the size of

Answers

If the amount of small-denomination time deposits increases, all else remaining equal, this will increase the size of the money supply.

Small-denomination time deposits are a type of savings account held at a bank or financial institution that pays interest on the deposited funds. When individuals or businesses deposit funds into these accounts, banks can use a portion of those funds to make loans or purchase securities, which in turn increases the money supply in the economy. .Therefore, an increase in small-denomination time deposits can lead to an increase in the money supply. All else remaining equal, an increase in the money supply can lead to inflationary pressures as there is more money chasing the same amount of goods and services.

Learn more about money here:

https://brainly.com/question/22984856

#SPJ11

All else remaining equal, if the amount of small-denomination time deposits increases, this will increase the size of the money supply.

This is because small-denomination time deposits are included in the definition of M2 money supply, which includes all cash and deposits that are readily available for spending.

What is money supply?The money supply is the total amount of money—cash, coins, and balances in bank accounts—in circulation. The money supply is commonly defined to be a group of safe assets that households and businesses can use to make payments or to hold as short-term investments.

As such, an increase in small-denomination time deposits means that there is more money available for spending and this can lead to an increase in economic activity.

Learn more about money supply here: https://brainly.com/question/3625390

#SPJ11

suppose that the government forces each pizzeria to pay a tax on each pizza sold. illustrate the effect of this tax on the pizza market, being sure to label the consumer surplus, producer surplus, government revenue, and deadweight loss. how does each area compare to the pre-tax case?

Answers

The tax on each pizza sold would increase the cost of production for the pizzerias, leading to a decrease in the supply of pizzas.

This would result in an increase in the price of pizzas, reducing the quantity demanded by consumers. As a result, the consumer surplus would decrease, the producer surplus would decrease, and the government revenue would increase. The deadweight loss would also increase due to the inefficiencies introduced in the market.

Compared to the pre-tax case, the consumer surplus would decrease due to the increase in prices, the producer surplus would decrease due to the increase in costs, and the government revenue would increase due to the tax revenue collected.

The deadweight loss represents the loss of efficiency in the market that results from the tax.

Overall, the tax on pizzas would have a negative impact on the pizza market, leading to a reduction in consumer surplus and producer surplus, and an increase in government revenue and deadweight loss.

For more questions like Revenue click the link below:

https://brainly.com/question/8645356

#SPJ11

Airbus sold an A400 Aircraft to Delta Airlines, a U.S Company,and billed $30 million payable in six months. Airbus is concernedabout the euro proceeds from international sales and would like tocont rol exchange risk. The current spot exchange rate is 1.05 $/euro and the six-month forward rate exchange rate is 1.10 $/euro. Airbus can buy a six-month put option on U.S. dollars with a strike price of 0.95 euro/$ for a premium of .02 euro per U.S. dollar. Currently, the six-month interest rate is 2.5% in the eurozone and 3% in the United States.Compute the guaranteed euro contract proceeds from the American sale if Airbus decides to hedge using a forward contract.

Answers

We have that, Airbus sold an A400 plane to Delta Airlines, an American company, and invoiced 30 million dollars payable in six months, then the contract income in guaranteed euros would be the same as using a forward contract: 27.27 million euro.

If Airbus decides to hedge using a forward contract, it would peg the exchange rate to the current six-month exchange rate of $1.10/euro. Therefore, the guaranteed euro contract proceeds from the US sale would be €27.27 million ($30 million divided by $1.10/euro). However, this would not provide any protection against possible fluctuations in the exchange rate.

If Airbus decides to hedge with a put option, it would have the right, but not the obligation, to sell US dollars at the strike price of EUR/$0.95. To calculate the cost of the premium, we first convert the $30 million payable into US dollars using the current spot exchange rate of $1.05/euro. This gives us $31.43 million. The put option premium would be €0.02 per US dollar, so the total cost of the premium would be €628,600 (€0.02 x US$31.43 million).

If the spot exchange rate at the time of payment is below the strike price of EUR/$0.95, Airbus would exercise the put option and sell US dollars at the higher exchange rate. If the spot rate is above the strike price, Airbus would simply allow the option to lapse and use the spot rate to convert US dollars into Euros. Either way, the guaranteed revenue from the contract in euros would be the same as using a forward contract: 27.27 million euros.

However, by using a put option, Airbus can limit its downside risk to the cost of the premium and at the same time benefit from any favorable exchange rate movements. This may be preferable to using a forward contract, which offers no protection against adverse exchange rate movements.

See more information on the exchange rate at: https://brainly.com/question/2202418

#SPJ11

A 20-year corporate bond with a par value of $1,000.00 paying an annual coupon of 5% costs $1,135.90. The next coupon will be paid in 1 year. A 3-year forward contract on this bond exists at a strike price of $1,100.00. A) What is the market interest rate? b) What should be the correct forward price for this contract? c) What do you do at t = 1 year?

Answers

a) The market interest rate is 3.8%. b) The correct forward price for this contract should be $1,113.28. and c) At t=1 year, if the market interest rate has not changed, we do nothing.

a) To find the market interest rate, we need to use the bond pricing formula and solve for the interest rate.

Given the bond price of $1,135.90, a par value of $1,000.00, an annual coupon payment of 5%, and a time to maturity of 20 years, the market interest rate is found to be 3.8%.

b) To find the correct forward price for this contract, we first need to calculate the future value of the bond in 3 years, assuming that the market interest rate remains constant at 3.8%.

This gives us a future value of $1,166.10. We can then discount this future value back to the present using the market interest rate of 3.8% to get a forward price of $1,113.28.

c) At t=1 year, if the market interest rate has not changed, we do nothing because the next coupon payment will be received as expected, and the bond will continue to be worth $1,135.90.

If the market interest rate has changed, the value of the bond may change, and we may need to adjust our investment strategy accordingly.

To know more about interest rate, refer here:

https://brainly.com/question/14445709#

#SPJ11

A mutual fund that emphasizes well-balanced return of income and long-term capital gains is a ____ fund.

Answers

A mutual fund that emphasizes well-balanced return of income and long-term capital gains is a balanced fund. Balanced funds are a type of mutual fund that invests in a mix of stocks, bonds.

and other securities in order to achieve a balance of income and long-term capital gains. The mix of investments can be adjusted over time to respond to changes in market conditions, and the goal is to provide investors with a stable return on investment over the long term. Balanced funds are often considered to be a good option for investors who want a balanced approach to investing, with a focus on both income and capital appreciation. However, investors should carefully review the investment objectives and risks of any mutual fund before investing, and consider seeking the advice of a financial professional if they have any questions or concerns.

Learn more about capital here:https://brainly.com/question/30319680

#SPJ11

A mutual fund that emphasizes well-balanced return of income and long-term capital gains is a balanced fund.

A balanced fund typically invests in a mix of stocks and bonds to achieve a moderate risk-return profile, providing investors with both income and capital appreciation. A mutual fund is a pool of money managed by a professional Fund Manager. It is a trust that collects money from a number of investors who share a common investment objective and invests the same in equities, bonds, money market instruments and/or other securities.

Mutual funds are ideal for investors who either lack large sums for investment, or for those who neither have the inclination nor the time to research the market, yet want to grow their wealth. The money collected in mutual funds is invested by professional fund managers in line with the scheme’s stated objective. In return, the fund house charges a small fee which is deducted from the investment. The fees charged by mutual funds are regulated and are subject to certain limits specified by the Securities and Exchange Board of India (SEBI).

Learn more about mutual fund here: https://brainly.com/question/4521829

#SPJ11

an investor has 200 shares of a stock, which pays a quarterly dividend of $0.40 per share. what is his/her quarterly dividend payment?

Answers

Sure, I'd be happy to help you with your question!

To answer your question, we need to use a simple formula:

Quarterly Dividend Payment = Number of Shares x Quarterly Dividend per Share

In this case, the investor has 200 shares of the stock, and the stock pays a quarterly dividend of $0.40 per share. Therefore, the investor's quarterly dividend payment can be calculated as follows:

Quarterly Dividend Payment = 200 x $0.40 = $80

So the investor's quarterly dividend payment is $80.

Now, let's explain what this means. A dividend is a payment made by a company to its shareholders, typically out of its profits. In this case, the stock the investor owns pays a quarterly dividend of $0.40 per share. This means that for every share the investor owns, they will receive $0.40 every quarter (i.e., every three months).

Since the investor has 200 shares, they will receive $0.40 x 200 = $80 every quarter. This is a nice little bonus for the investor, and can be a good way to generate passive income from their investments.

It's worth noting that not all stocks pay dividends, and the amount of the dividend can vary from stock to stock. Additionally, a company can choose to increase, decrease, or even suspend its dividend payments at any time, depending on its financial situation and other factors.

Overall, dividend-paying stocks can be a good option for investors who are looking for a reliable source of income from their investments. By investing in stocks that pay dividends, investors can generate passive income that can help them achieve their financial goals over time.

To know more about investor refer home

https://brainly.com/question/30828591#

#SPJ11

An individual wishes to have a fixed portion of the portfolio liquidated each month. He or she should elect which type of withdrawal plan?

A. Fixed shares

B. Fixed period

C. Fixed percentage

D. Fixed dollar

Answers

If an individual wishes to have a fixed portion of their portfolio liquidated each month, they should elect a fixed dollar withdrawal plan. This type of withdrawal plan allows the individual to specify the exact amount they want to withdraw from their portfolio each month, regardless of any fluctuations in the portfolio's value. The correct option is d.

With a fixed dollar withdrawal plan, the individual can maintain a steady income stream and have greater control over their spending. This type of plan is particularly useful for retirees or individuals who are relying on their portfolio for income, as it allows them to budget and plan accordingly.

It's important to note that while a fixed dollar withdrawal plan can provide a steady income stream, it does come with some risks. If the portfolio experiences significant losses, the fixed dollar withdrawals may deplete the portfolio more quickly than anticipated. To mitigate this risk, individuals may want to consider setting a maximum withdrawal rate as a percentage of the portfolio value or adjusting the fixed dollar amount periodically based on the portfolio's performance.

Overall, a fixed dollar withdrawal plan can be a useful strategy for individuals who want a consistent income stream from their portfolio, but it's important to consider the risks and adjust the plan as necessary to ensure long-term sustainability.The correct option is d.

for more such questions on portfolio .

https://brainly.com/question/30615485

#SPJ11

the method that permits businesses to recover all the costs, including both fixed and variable costs and direct and indirect costs is called: question 4 options: target costing marginal cost pricing zero cost pricing full cost pricing

Answers

The method that permits businesses to recover all the costs, including both fixed and variable costs and direct and indirect costs, is called full cost pricing.

This pricing strategy involves adding up all the expenses incurred during the production process, including materials, labor, overhead costs, and any other expenses, and then adding a profit margin to arrive at a final price for the product or service. Full cost pricing is commonly used in industries where products have long lifecycles and stable demand. It helps businesses ensure that they cover all their costs and generate sufficient profits to remain competitive. However, it may not be suitable for businesses operating in highly competitive markets where price sensitivity is high.

For more such questions on cost , click on:

https://brainly.com/question/28147009

#SPJ11

Sanchez Company sold merchandise in the amount of $23.200 to Emanuel Company on September 1, with credit terms of 2/10,n/30. The cost of the merchandise is $9,600. On September 4, Emanuel retums some of the merchandise, which was put back into Sanchez's inventory. The selling price and the cost of the returned merchandise are $3,200 and $2,000, respectively. Emanuel Company's journal entry on September 8, when they pay the amount due, will include: (assume both companies use the perpetual inventory method) A) Credit Purchase Discounts $400 B) Credit Cash $20.776 C) Debit Accounts Payable $20,000 D) Credit Sales Discounts $400

Answers

The journal entry made by Emanuel Company on September 8 when paying the amount due to Sanchez Company will include Credit Cash $20,776 and Debit Accounts Payable $20,000. The correct option is B and C

This is because Emanuel Company initially purchased merchandise from Sanchez Company for $23,200 with credit terms of 2/10,n/30. The 2/10,n/30 terms indicate that if the buyer pays within 10 days of the purchase, they will receive a 2% discount on the total purchase price.

Emanuel Company returned some of the merchandise on September 4, which was put back into Sanchez's inventory. The selling price and cost of the returned merchandise were $3,200 and $2,000, respectively. Therefore, the amount due by Emanuel Company decreased by $3,200.

As a result, the total amount due to Sanchez Company was $20,000 ($23,200 - $3,200). Since Emanuel Company did not pay within the 10-day discount period, they were not eligible for the 2% discount. Hence, they will not credit the purchase discounts account.

To know more about journal entry refer here:

https://brainly.com/question/15889958#

#SPJ11

shunsuke is an advertiser at a kitchen appliance company. he ran an awareness campaign to promote his brand's award winning toaster. a few months after the campaign ended, he noticed that the baseline performance was overall higher on glance views and conversion rate across many of his products. what is this likely to mean?

Answers

If the baseline performance for glance views and conversion rate across many of Shunsuke's products has improved after running the awareness campaign for his brand's toaster, it is likely that the campaign had a positive halo effect on the other products in the company's product line.

The halo effect is a cognitive bias in which our overall impression of a product or brand is influenced by our perception of one of its attributes, such as its design, quality, or popularity. In this case, customers who were exposed to the awareness campaign for the toaster may have developed a more positive overall impression of the company's brand and its other products, which resulted in higher glance views and conversion rates for those products.

This type of halo effect is a common goal of advertising campaigns, where the focus is not only on promoting a specific product but also on enhancing the overall image and reputation of the brand. By creating positive associations with the brand, customers are more likely to consider other products from the company in the future, even if they were not initially interested in them.

To learn more about halo effect here

https://brainly.com/question/15020057

#SPJ4

the typical organizational response to a labor shortage has been either hiring temporary employees or outsourcing, responses that are fast and high in revocability. (True or False)

Answers

The give statement "the typical organizational response to a labor shortage has been either hiring temporary employees or outsourcing, responses that are fast and high in revocability" is true. These approaches allow companies to quickly fill the gaps in their workforce and can be easily adjusted or revoked as needed, providing flexibility in addressing labor shortages.

Labor shortage refers to a situation where there are not enough workers with the necessary skills to fill available job positions. This can occur in certain industries or regions where there are more job openings than qualified candidates. Companies may then need to find alternative solutions such as hiring temporary employees or outsourcing certain tasks to other companies.

Temporary employees are workers who are employed for a limited period of time, often to cover for staff shortages or to handle temporary increases in demand. Outsourcing refers to the practice of hiring an external company to perform tasks that were previously done in-house. This can include functions such as IT support, accounting, or customer service. By outsourcing, companies can focus on their core competencies while still benefiting from specialized expertise and cost savings.

Thus, the statement is true.

Read more about "Outsourcing": https://brainly.com/question/12101789

#SPJ11

Jamal's boss makes no managerial decisions but lets his employees make decisions and take the necessary steps in all aspects of their work, unless they come to him for something. Which of the following decision styles does Jamal's boss follow? participative laissez-faire democratic principled autocratic Which of the following is one of the goals of diversity training? identifying and reducing hidden biases toward minority groups increasing instances of groupthink encouraging minority employees to adopt the norms of the majority decreasing cultural integration maintaining a homogenous workforce A boss can exert power over an employee by offering to cover the employee's shift on Saturday night so the employee can attend a friend's wedding. legitimate reward referent expert ОО coercive

Answers

Jamal's boss follows the decision style of "laissez-faire" as he does not make any managerial decisions but lets his employees make decisions and take the necessary steps in all aspects of their work.

One of the goals of diversity training is to identify and reduce hidden biases toward minority groups.

The boss's act of offering to cover the employee's shift on Saturday night so the employee can attend a friend's wedding is an example of the "reward" power.

The cross-price elasticity of demand measures the responsiveness of the quantity demanded of one good to a change in the price of another good. In this case, a cross-price elasticity of demand between beer and wine of 0.31 suggests that the two goods are substitutes, meaning that if the price of wine increases, the demand for beer will increase as consumers switch to the substitute good.

Similarly, a cross-price elasticity of demand between beer and spirits of 0.15 suggests that the two goods are also substitutes, but to a lesser degree than beer and wine. If the price of spirits increases by 10 percent, then the quantity of beer demanded will increase by 1.5 percent (0.15 x 10), assuming no other factors affecting demand change.

Learn more about employee's here:

https://brainly.com/question/21847040

#SPJ11

Jamal's boss follows the laissez-faire decision-making style, where he allows his employees to make decisions and take necessary actions on their own, with minimal guidance or supervision from him. This style is characterized by a hands-off approach, with the manager acting as a facilitator rather than a decision-maker.

One of the goals of diversity training is to identify and reduce hidden biases toward minority groups. This training is designed to increase awareness and understanding of diverse cultures and backgrounds and to promote acceptance and inclusion within the workplace. By reducing hidden biases and encouraging diversity, organizations can create a more inclusive and supportive work environment that values and respects all employees.

In the given scenario, the boss is using the referent power by offering to cover the employee's shift as a way to influence the employee's behavior. Referent power is the ability to influence others based on one's personal characteristics, such as likability, charisma, or perceived expertise. By using this type of power, the boss is establishing a positive relationship with the employee and encouraging loyalty and cooperation.

To learn more about “laissez-faire” refer to the https://brainly.com/question/17259480

#SPJ11

identify a true statement about bona fide seniority systems.

Answers

A true statement about bona fide seniority systems is that almost any "time in the organization" rationale can be constructed as a basis for a seniority system. Bona fide seniority systems are those that are legally recognized and are based on an employee's length of service within an organization.

These systems are often used to determine various aspects of employment, such as promotions, transfers, or layoffs. In a bona fide seniority system, the primary criterion for decision-making is the employee's length of service or "time in the organization."

This rationale allows for the construction of various types of seniority systems, as long as they are based on objective measures of an employee's tenure. Such systems can be established through collective bargaining agreements, company policies, or other methods, and they must be consistently applied across the organization.

The purpose of a bona fide seniority system is to provide a fair and equitable means of recognizing employee loyalty and experience. These systems can help to reduce potential biases in employment decisions and promote a more stable and committed workforce.

However, it is essential that these systems do not unfairly disadvantage any particular group of employees or create barriers to equal employment opportunities.

In summary, a true statement about bona fide seniority systems is that almost any "time in the organization" rationale can be constructed as a basis for a seniority system, provided that it is legally recognized and consistently applied across the organization.

To know more about bona fide refer here:

https://brainly.com/question/30409540#

#SPJ11

Complete Question:

Identify a true statement about bona fide seniority systems.

a. the law does not define a "seniority system"

b. almost any "time in the organization" rationale can be constructed as a basis for a seniority system

c. Employer defense of "unreasonable hardship" is usually sufficient to avoid compliance decisions of the A.D.A.

d. According to EEOC data, women still account for less than 50% of employment in banking, health care, retail and legal services.

A US company expects to pay 4,000,000 Japanese yen 30 days from now. It decides to hedge thee position by buying Japanese yen forward. The current spot rate of the yen is $.0089, while the forward rate is $0.0077. The firm expects the spot rate in 30 days to be $.0094. Based on its expectations the company enters into derivative contracts to maximize its profits. How many dollars will the company pay for the 4,000,000 yen 30 days from now?

Answers

The company will pay $30,800 for the 4,000,000 yen 30 days from now by using the forward contract.

How company hedge its position by using Japanese yen forward contract?To hedge its position, the company can buy Japanese yen forward contracts at the current forward rate of $0.0077 per yen. Therefore, the cost of buying 4,000,000 yen forward would be:

4,000,000 yen x $0.0077/yen = $30,800

In 30 days, the company will have to convert the 4,000,000 yen into dollars at the prevailing spot rate. Based on its expectations, the company believes that the spot rate in 30 days will be $0.0094 per yen. Therefore, the cost of converting 4,000,000 yen into dollars would be:

4,000,000 yen x $0.0094/yen = $37,600

However, the company has already locked in the forward rate of $0.0077 per yen, so it will pay:

4,000,000 yen x $0.0077/yen = $30,800

by using the forward contract. This represents a savings of:

$37,600 - $30,800 = $6,800.

Learn more about hedge

brainly.com/question/15235679

#SPJ11

What is the Effective Annual Yield of a 135-day T-bill priced at $9,942.00? Recall:

• When using an Effective Annual Yield, you use compounded interest rate, 365 days, and the price as the initial price.

Answers

The effective annual yield is determined using the formula (1+r/n)n-1. Where n is the annual interest payment amount and r is the interest rate, sometimes referred to as the coupon rate

What is Effective Annual Yield?

If interest is compounded, the annual percentage yield (APY) is the real rate of return that will be received in a year. Compound interest is accrued on the total investment amount over time, increasing the balance. Each interest payment will be more expensive due to the increased debt.

The phrase "effective annual yield" (sometimes referred to as "the effective rate") describes the simple interest rate that causes an account to have the same amount of money at the end of a year as it would if compound interest were applied at a specific rate.

There is a simple formula that may be used to compute compound interest. It is calculated by multiplying the compound interest rate by the number of compound periods, adding the yearly interest rate, and then deducting one.

Learn more about Annual Yield:

https://brainly.com/question/30589557

#SPJ1

Do you think that marketers can CREATE needs? If so, discuss an

example of this.

How do marketers create or activate wants based on needs?

Discuss an example of how marketing may activate or stimulate

Answers

Yes, marketers can create needs, or at least create the perception of needs, through various marketing tactics such as advertising, promotions, and product design.

What is an example of this?

One example of this is the smartphone industry. Before the introduction of smartphones, most people were content with their basic cell phones that could only make calls and send texts. However, with the introduction of smartphones, marketers were able to create a need for features like internet browsing, social media, and app usage. These features were marketed as essential to modern life, and the constant innovation in the smartphone industry created a desire for the latest and greatest technology.

Marketers can create or activate wants based on needs by understanding consumer behavior and preferences.

They do this by conducting market research to identify consumer needs and preferences, and then design their products and marketing campaigns to address those needs and desires. For example, a food company may conduct market research to find out that consumers are interested in healthy snacks that are easy to take on the go. Based on this information, the company may create a marketing campaign that emphasizes the portability and health benefits of their snack products, which can activate the desire for a quick and healthy snack on the go.

An example of how marketing may activate or stimulate desires based on needs is the marketing campaign for luxury cars.

Luxury cars are marketed as a status symbol and a way to express wealth and success. The desire for these cars is activated by emphasizing the features and benefits that are associated with luxury, such as comfort, performance, and exclusivity. By creating an image of luxury and exclusivity around their products, luxury car manufacturers are able to stimulate desires and create demand for their products among consumers who are seeking to display their status and success.

To know more about marketing tactics visit:

https://brainly.com/question/28423461

#SPJ11

XYZ Company currently has the following capital structure Amount (in millions) $18.5 $3.2 $10.8 Source Common Stock Preferred Stock Debt In addition, you have the following information. The last common stock dividend paid by the company was $2.40 and this dividend is expected to grow at a constant 6 percent rate. The price of a share of common is currently $30. The annual preferred stock dividend is $6 and the price of a share of preferred stock is $60. The company's debt is all from a single issue of bonds, with each bond currently selling for $901.82. The bonds have a 20-year maturity and a coupon rate of 7 percent. (Assume semi-annual payments for the bonds). Tax-rate is 40%. 1. 2. Calculate the weights in this capital structure for common stock, preferred stock, and debt. Calculate the required rate of return (yield-to-maturity) on the bonds (before tax cost of debt) Calculate the required rate of return on preferred stock Calculate the required rate of return on common stock Calculate the WACC 3. 4. 5.

Answers

Answer:

Common Stock: 56.7%, Preferred Stock: 9.8%, Debt: 33.5%. Rate of return (yield-to-maturity) on the bonds (before tax cost of debt): 3.58%. Rate of return on preferred stock is 10%. Rate of return on common stock: 9.1%. WACC: 9.44%

Explanation:

The weights in the capital structure can be calculated as follows:

Common Stock: $18.5 million / ($18.5 million + $3.2 million + $10.8 million) = 0.567 or 56.7%

Preferred Stock: $3.2 million / ($18.5 million + $3.2 million + $10.8 million) = 0.098 or 9.8%

Debt: $10.8 million / ($18.5 million + $3.2 million + $10.8 million) = 0.335 or 33.5%

To calculate the yield-to-maturity on the bonds (before tax cost of debt), we need to use the following formula:

[tex]PV = (C / 2) / (1 + r / 2) + (C / 2) / (1 + r / 2)^2 + ... + (C / 2 + F) / (1 + r / 2)^n[/tex]

Where PV is the present value of the bond, C is the coupon payment, r is the yield-to-maturity, F is the face value, and n is the number of periods.

In this case, we have:

PV = $901.82

C = 0.07 x $1,000 / 2 = $35

F = $1,000

n = 20 x 2 = 40

Solving for r using a financial calculator or spreadsheet software, we get:

r = 3.58%

Therefore, the yield-to-maturity on the bonds (before tax cost of debt) is 3.58%.

The required rate of return on preferred stock can be calculated using the following formula:

Rp = Dp / Pp

Where Rp is the required rate of return on preferred stock, Dp is the annual preferred stock dividend, and Pp is the price of a share of preferred stock.

In this case, we have:

Rp = $6 / $60 = 0.1 or 10%

The required rate of return on common stock can be calculated using the capital asset pricing model (CAPM) as follows:

Rc = Rf + βc x (Rm - Rf)

Where Rc is the required rate of return on common stock, Rf is the risk-free rate, βc is the beta of the common stock, and Rm is the market return.

In this case, we have:

Rf = 2.5% (Assumed risk-free rate)

βc = 1.2 (Assumed beta based on industry average)

Rm = 8% (Assumed market return)

Rc = 2.5% + 1.2 x (8% - 2.5%) = 9.1%

Therefore, the required rate of return on common stock is 9.1%.

The weighted average cost of capital (WACC) can be calculated using the following formula:

[tex]WACC = (wE * Cost of Equity) + (wP * Cost of Preferred Stock) + (wD * Cost of Debt) * (1 - Tax Rate)[/tex]

where,

wE = proportion of common equity = $18.5 / ($18.5 + $3.2 + $10.8) = 0.5772

wP = proportion of preferred stock = $3.2 / ($18.5 + $3.2 + $10.8) = 0.1013

wD = proportion of debt = $10.8 / ($18.5 + $3.2 + $10.8) = 0.3215

Tax Rate = 0.40

[tex]WACC = (0.5772 * 0.1416) + (0.1013 * 0.10) + (0.3215 * 0.03874) * (1 - 0.40)[/tex]

= 0.0944 or 9.44%

Therefore, the WACC of XYZ Company is 9.44%.

For more such questions on rate of return , click on:

https://brainly.com/question/1789817

#SPJ11

all covenants not to compete are contrary to public policy and therefore illegal. true or false?

Answers

False. Covenants not to compete are not per se illegal.

These agreements are generally enforceable in many states if they are reasonable in time and geographic scope, are necessary to protect legitimate business interests, and do not unreasonably restrict the employee’s ability to find new employment.

Courts examine covenants not to compete on a case-by-case basis and may or may not uphold them depending on the facts. Generally, courts will not enforce covenants that are overly broad and may impose reasonable restrictions on them.

Therefore, although covenants not to compete are not necessarily illegal, they must meet certain criteria to be enforceable.

Know more about Covenants here

https://brainly.com/question/20989064#

#SPJ11

what is an accurate statement concerning our time studying boeing corp and the airline industry? i. boeing customers (delta) suffered greater losses during covid by the severe decline in business travel rather domestic travel

Answers

An accurate statement concerning our time studying Boeing Corporation and the airline industry would be: During our study, we discovered that Boeing Corporation plays a significant role in the global aviation market as a leading aircraft manufacturer.

As one of the largest companies in the airline industry, Boeing's innovations, such as the 787 Dreamliner, have revolutionized the way airlines operate and how passengers travel.

Through our research, we found that factors such as fuel efficiency, safety regulations, and global demand for air travel heavily influence the industry's growth and development. Moreover, the competitive landscape, with companies like Airbus, continuously pushes Boeing to innovate and adapt to market dynamics.

Our study has provided valuable insights into the challenges and opportunities that Boeing Corporation and the airline industry face in a rapidly changing world.

To know more about aviation, refer here:

https://brainly.com/question/28963825#

#SPJ11

Problem 16-14 MM and Taxes Cede & Co. expects its EBIT to be $115,000 every year forever. The company can borrow at 7 percent. The company currently has no debt and its cost of equity is 13 percent. a. If the tax rate is 24 percent, what is the value of the company? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What will the value be if the company borrows $255,000 and uses the proceeds to repurchase shares? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answers

A) The value of the company is $672,308.00.

B) The value of the company after borrowing and repurchasing shares is $693,650.79.

a. To calculate the value of the company, we need to calculate the unlevered free cash flows and discount them at the weighted average cost of capital (WACC).

First, we need to calculate the unlevered free cash flows. Since the company expects to generate a constant EBIT of $115,000 every year forever, we can use the perpetuity formula:

PV = C / r

where PV is the present value, C is the cash flow, and r is the discount rate. In this case, the cash flow is the EBIT, and the discount rate is the cost of capital. Therefore, the unlevered free cash flow is:

FCF = EBIT × (1 - tax rate) = $115,000 × (1 - 0.24) = $87,400

Next, we need to calculate the WACC, which is the weighted average of the cost of debt and the cost of equity. Since the company currently has no debt, the WACC is equal to the cost of equity:

WACC = cost of equity = 0.13

Finally, we can calculate the value of the company using the formula:

Value of company = FCF / WACC

Value of company = $87,400 / 0.13 = $672,308.00

Therefore, the value of the company is $672,308.00.

b. If the company borrows $255,000 and uses the proceeds to repurchase shares, the new capital structure will include debt, and the WACC will change. To calculate the new value of the company, we need to calculate the new unlevered free cash flows and the new WACC.

The new unlevered free cash flow will be the same as before, since the EBIT is not affected by the capital structure:

FCF = $87,400

To calculate the new WACC, we need to calculate the cost of debt and the cost of equity. The cost of debt is given as 7 percent. The cost of equity can be calculated using the capital asset pricing model (CAPM):

cost of equity = risk-free rate + beta × (market risk premium)

Assuming a risk-free rate of 3 percent and a market risk premium of 8 percent, and a beta of 1.5, we get:

cost of equity = 0.03 + 1.5 × 0.08 = 0.15

The new WACC can be calculated as:

WACC = (value of debt / (value of debt + value of equity)) × cost of debt + (value of equity / (value of debt + value of equity)) × cost of equity

where the value of debt is $255,000, and the value of equity is the value of the company before borrowing:

WACC = ($255,000 / ($255,000 + $672,308.00)) × 0.07 + ($672,308.00 / ($255,000 + $672,308.00)) × 0.15 = 0.126

Finally, we can calculate the new value of the company using the formula:

Value of company = FCF / WACC

Value of company = $87,400 / 0.126 = $693,650.79

Therefore, the value of the company after borrowing and repurchasing shares is $693,650.79.

Click the below link, to learn more about Shares:

https://brainly.com/question/28392295

#SPJ11

ace has eps of $10.00 per share and has a dividend payout ratio of 20%. its dividend is expected to grow at a rate of 9%. if ace stock is trading at $54.50, what is the shareholder's implicit required return? (hint: first find the dividend based on the eps and payout ratio) a. 4%. b. 11%. c. 9%. d. 13%.

Answers

The shareholder's implicit required return is approximately 9.37%. The closest answer choice is (c) 9%. The correct option is c.

First, we need to calculate the dividend per share based on the EPS and payout ratio. The dividend payout ratio is 20%, which means that 20% of the EPS is paid out as dividends. Therefore, the dividend per share is:

Dividend per Share = EPS x Dividend Payout Ratio

Dividend per Share = $10.00 x 20% = $2.00

Next, we need to use the dividend growth model to find the implied required return on the stock. The dividend growth model is:

Share Price = Dividend / (Required Return - Dividend Growth Rate)

We know the share price is $54.50, the dividend is $2.00, and the dividend growth rate is 9%. We can solve for the implied required return:

$54.50 = $2.00 / (Required Return - 9%)

Required Return - 9% = $2.00 / $54.50

Required Return - 9% = 0.0367

Required Return = 9% + 0.0367 = 9.367%

The correct option is c.

Learn more about required return at:

brainly.com/question/29511106

#SPJ4

Suppose you bought a $1,000 face value bond with a coupon rate of 3.4 percent one year ago. The purchase price was $983.5. You sold the bond today for $987.5. If the inflation rate last year was 2.4 percent, what was your exact real rate of return on this investment? ______%

Instruction: Enter your response as a percentage with two decimal places.

For example, if your answer is 0.1213=12.13%, please only enter "12.13", please do not enter "0.1213" or "12.13%", the system may not recognize the % sign. You may put negative signs if necessary,

Answers

The answer is 1.02%.

To calculate the exact real rate of return on this investment, we need to adjust the nominal return for inflation. The nominal return is the percentage difference between the purchase price and the selling price, plus any coupon payments received during the holding period. In this case, the nominal return is:

Nominal return = (Selling price + Coupon payment - Purchase price) / Purchase price

Nominal return = ($987.5 + $34 - $983.5) / $983.5

Nominal return = 5.9%

To adjust for inflation, we need to use the following formula:

Real return = (1 + nominal return) / (1 + inflation rate) - 1

Substituting the values, we get:

Real return = (1 + 0.059) / (1 + 0.024) - 1

Real return = 0.012 or 1.2%

Therefore, the exact real rate of return on this investment is 1.02%.

For more questions like Price click the link below:

https://brainly.com/question/19091385

#SPJ11

The third phase in the SDLC is planning and in this phase the analyst thoroughly studies the organization's current procedures and the information systems used to perform organizational tasks.TRUE/FALSE

Answers

TRUE. The third phase in the SDLC (Software Development Life Cycle) is planning, and during this phase, the analyst thoroughly studies the organization's current procedures and the information systems used to perform organizational tasks.

This is a critical step in the development of a new information system as it helps the analyst to understand the current processes, identify any issues or inefficiencies, and determine the requirements for the new system.

During the planning phase, the analyst works closely with the stakeholders and end-users of the current system to gather information and document the processes. This may involve conducting interviews, surveys, or focus groups to get a better understanding of how the current system is used.

The analyst will also examine any existing documentation, such as user manuals or training materials, to gain insight into the system's functionality and limitations.

By thoroughly studying the current procedures and information systems, the analyst can identify areas for improvement and develop a clear vision for the new system.

This information is used to create a comprehensive plan for the project, including timelines, budget, and resource requirements. Without this critical phase of planning, the development of a new system may be inefficient, ineffective, and fail to meet the needs of the organization.

To know more about SDLC refer here

brainly.com/question/14096725#

#SPJ11

A non-dividend paying stock currently sells for 100. One year from now the stock sells for 110. The continuously compounded risk-free interest rate is 6%. A trader purchases the stock in the following manner: i) The trader pays 100 today ii) The trader takes possession of the stock in one year Determine which of the following describes this arrangement Posible Answers Outright purchase Fully leveraged purchase Prepaid forward contract Forward contract This arrangement is not possible due to arbitrage opportunities

Answers

The arrangement described in the question is a prepaid forward contract. In a prepaid forward contract, the buyer pays for the underlying asset upfront, but the delivery of the asset is deferred to a future date.

In this case, the trader pays $100 today for the stock and takes possession of it in one year when it is expected to sell for $110.

To determine whether this arrangement is feasible, we need to calculate the fair value of the prepaid forward contract using the formula:

FV = S0 * e^{(r*t)} - PV(D)

Where:

S0 = the current stock price

r = the continuously compounded risk-free interest rate

t = the time period in years

PV(D) = the present value of the expected future value of the dividend payments

Plugging in the values from the question, we get:

FV = $100 * e^{(0.06*1)} - 0

FV = $106.18

This means that the fair value of the prepaid forward contract is $106.18, which is greater than the price paid by the trader ($100).

Therefore, the trader has a profit opportunity of $6.18 by entering into this prepaid forward contract.

If the price of the prepaid forward contract were less than $100, it would create an arbitrage opportunity where the trader could buy the contract and the stock at a lower price and then earn a risk-free profit.

Therefore, the arrangement described in the question is feasible and represents a prepaid forward contract.

To know more about prepaid forward contract here

https://brainly.com/question/30694480

#SPJ11

here is a consumption function: c = c0 mpc(yd). if consumption is $3,000, mpc =0.80, and disposable income is $2,900, what does autonomous consumption equal?

Answers

Autonomous consumption refers to the level of consumption that is independent of disposable income. In other words, it is the amount of consumption that would occur even if there were no income at all.

To calculate autonomous consumption, we need to use the consumption function given:

c = c0 mpc(yd).

We know that consumption is $3,000, mpc = 0.80, and

disposable income is $2,900.

We can rearrange the formula to solve for c0:

c = c0 mpc(yd)

c/mpc(yd) = c0

Now, we can plug in the values:

c/mpc(yd) = c0

$3,000 / (0.80 x $2,900) = c0

c0 = $1,034.48

Therefore, autonomous consumption equals $1,034.48.

This means that even if disposable income were zero, consumption would still be at least $1,034.48 due to factors such as basic needs and non-income-related factors that influence consumption.

To know more about Autonomous consumption refer here

https://brainly.com/question/4214951#

#SPJ11

Last Tuesday, Green Caterpillar Garden Supplies Inc. lost a portion of its planning and financial data when both its main and its backup servers crashed. The company’s CFO remembers that the internal rate of return (IRR) of Project Gamma is 13.2%, but he can’t recall how much Green Caterpillar originally invested in the project nor the project’s net present value (NPV). However, he found a note that detailed the annual net cash flows expected to be generated by Project Gamma. They are:

Year Cash Flow

Year 1 $2,400,000

Year 2 $4,500,000

Year 3 $4,500,000

Year 4 $4,500,000

The CFO has asked you to compute Project Gamma’s initial investment using the information currently available to you. He has offered the following suggestions and observations:

• A project’s IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows—when the cash flows are discounted using the project’s IRR.

• The level of risk exhibited by Project Gamma is the same as that exhibited by the company’s average project, which means that Project Gamma’s net cash flows can be discounted using Green Caterpillar’s 9% WACC.

Given the data and hints, Project Gamma’s initial investment is _________ , and its NPV is ____________ (rounded to the nearest whole dollar).

A project’s IRR will _________ if the project’s cash inflows decrease, and everything else is unaffected.

Answers

Therefore, Project Gamma's NPV is approximately $1,431,834 (rounded to the nearest dollar). If the project's cash inflows decrease, everything else being unaffected, the IRR will decrease as well.

To compute Project Gamma's initial investment, we need to use the formula for the IRR of a project:

0 = CF0 + CF1 / (1+IRR) + CF2 / (1+IRR)^2 + CF3 / (1+IRR)^3

where CF0 is the initial investment, and CF1, CF2, and CF3 are the net cash flows for years 1, 2, and 3, respectively. We can solve for CF0 by setting the equation equal to zero and using the IRR of 13.2%, which gives:

0 = CF0 + 2,400,000 / (1+0.132) + 4,500,000 / (1+0.132)^2 + 4,500,000 / (1+0.132)^3

Solving for CF0, we get:

CF0 = -$8,679,734

Therefore, Project Gamma's initial investment was approximately $8,679,734 (rounded to the nearest dollar).

To find the project's NPV, we can discount the cash flows using the company's 9% WACC:

NPV = CF0 + CF1 / (1+WACC)^1 + CF2 / (1+WACC)^2 + CF3 / (1+WACC)^3

NPV = -$8,679,734 + 2,400,000 / (1+0.09)^1 + 4,500,000 / (1+0.09)^2 + 4,500,000 / (1+0.09)^3

NPV = $1,431,834 (rounded to the nearest dollar)

To know more about NPV refer to-

https://brainly.com/question/29423457

#SPJ11

in an effort to capture key employees from competitors, firms may attract the symbolic leader of a group within a competing firm and hope others will follow. this has been termed .

Answers

The practice of attracting the symbolic leader of a group within a competing firm in order to capture key employees has been termed "leader poaching."

A symbolic leader is someone who embodies and represents the values, ideals, and aspirations of a group, organization, or community. They may not necessarily hold formal positions of authority or power, but they are seen as a figurehead or representative of a larger cause or movement. Symbolic leaders often inspire and motivate others through their actions, words, and symbolism, rather than through direct control or coercion.

By targeting and persuading influential individuals within a competitor's organization, companies hope to gain a competitive advantage and improve their own organizational performance. However, leader poaching can also lead to legal and ethical concerns, such as breach of contract or non-compete agreements, and negative consequences on company culture and reputation.

to know more about symbolic leader refer here

https://brainly.com/question/31018704#

#SPJ11