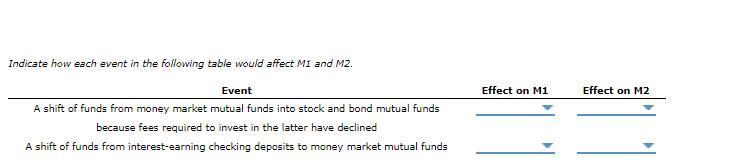

Indicate how each event in the following table would affect M1 and M2. Event Effect on M1 Effect on M2 A shift of funds from interest-earning checking deposits to money market mutual funds ___ (decrease/increase/no change) ___ (increase/decrease/no change)A shift of funds from money market mutual funds ___ (decrease/increase/no change) ___ (no change/increase/decrease)because fees required to invest in the latter have declined

Answers

Impact of Event on M1 Impact on M2 a transfer of money from money market mutual funds to interest-bearing checking accounts with a loss in value. All the blanks are explained below.

Please indicate the impact of each event on M1 and M2 in the accompanying table.

At M1: Money market mutual funds are losing money at an increasing rate since there are decrease expenses associated with investing in them.

At M2: Money market accounts provide variable interest rates have no change, thus the return on investment for customers may change over time with increase. These accounts frequently offer tier rates, which means that bigger balances are rewarded with a higher annual percentage interest (APY). When compared to other mutual funds and the majority of other investments, money market funds are a form of mutual fund that have comparatively minimal risks.

Learn more about mutual funds Visit: brainly.com/question/4521829

#SPJ4

Correct Question:

Indicate how each event in the following table would affect M1 and M2. Event Effect on M1 Effect on M2 A shift of funds from interest-earning checking deposits to money market mutual funds ___ (decrease/increase/no change) ___ (increase/decrease/no change)A shift of funds from money market mutual funds ___ (decrease/increase/no change) ___ (no change/increase/decrease)because fees required to invest in the latter have declined.

A shift of funds from interest-earning checking deposits to money market mutual funds would result in a decrease in M1 as interest-earning checking deposits are included in M1, but money market mutual funds are not. On the other hand, this event would result in an increase in M2 as money market mutual funds are included in M2 but interest-earning checking deposits are not.

Event B: A shift of funds from money market mutual funds because fees required to invest in the latter have declined would result in no change in M1 as money market mutual funds are not included in M1. However, this event would result in an increase in M2 as money market mutual funds are included in M2.Overall, changes in M1 and M2 are influenced by shifts in funds between different types of accounts.

When funds are shifted from one type of account to another, the impact on M1 and M2 depends on whether the account type is included in each monetary aggregate. Therefore, it is essential to understand the components of M1 and M2 to predict the effect of changes in financial behavior on these aggregates.

For more such questions on mutual funds

https://brainly.com/question/29837697

#SPJ11

Related Questions

Which of the following describes the loss settlement basis for a fire damage claim to a dwelling insured under a DP-3 policy?

A. Actual cash value of the dwelling up to the Coverage A limit

B. Replacement cost up to the Coverage B limit

C. Actual cash value of the dwelling up to the Coverage B limit

D. Replacement cost up to the Coverage A limit

Answers

According to DP-3 policy the loss settlement basis for a fire damage claim to a dwelling insured describe by (B)Replacement cost up to the Coverage B limit.

The DP-3 policy is a special form policy for dwelling fire insurance, which provides open perils coverage on the dwelling and other structures on the insured property, as well as named perils coverage on personal property. The loss settlement basis for a fire damage claim to a dwelling insured under a DP-3 policy is typically based on replacement cost up to the Coverage B limit, which is the limit of insurance for other structures on the insured property. This means that the insurer will pay the cost to repair or replace the damaged property with materials of like kind and quality, up to the Coverage B limit, without deduction for depreciation.

Learn more about DP-3 policy-

https://brainly.com/question/31457176

#SPJ11

The loss settlement basis for a fire damage claim to a dwelling insured under a DP-3 policy is typically "replacement cost up to the Coverage A limit." Therefore, the correct answer is D.

Under a DP-3 policy, Coverage A provides coverage for the dwelling, while Coverage B provides coverage for other structures on the property. In the event of a covered loss, the insurance company will typically pay the cost to repair or replace the damaged property up to the applicable policy limit. In this case, the loss settlement basis for a fire damage claim to a dwelling insured under a DP-3 policy is replacement cost up to the Coverage A limit, which means the insurance company will pay the cost to repair or replace the damaged dwelling up to the limit specified in Coverage A, without taking depreciation into account.

Learn more about policy here

https://brainly.com/question/28024313

#SPJ11

victoria's vineyard is considering hiring more sommeliers. the market wage for a sommelier is $120 per day. the average sommelier approves 40 bottles of wine per day, but victoria expects the next sommelier to produce only 20 bottles per day. assuming the market for wine is perfectly competitive, victoria's vineyard will hire another sommelier if: group of answer choices a bottle of wine sells for $3. the new sommelier can produce 40 bottles. a bottle of wine sells for $2. a bottle of wine sells for $6 or more.

Answers

Victoria's Vineyard will hire another sommelier if a bottle of wine sells for $6 or more. Thus, Option D is correct.

This is because the market wage for a sommelier is $120 per day, which means that the cost of hiring a sommelier is $120 per day regardless of how many bottles they approve. However, if a bottle of wine sells for $6 or more, and the sommelier is able to produce 20 bottles per day, then the revenue generated from those 20 bottles will be at least:

= 20 x $6

= $120

Therefore, hiring another sommelier would result in a positive return on investment for Victoria's Vineyard. On the other hand, if a bottle of wine sells for $3 or $2, and the sommelier is only able to produce 20 bottles per day, then the revenue generated would not be enough to cover the cost of hiring another sommelier.

Option D holds true.

Learn more about sommelier: https://brainly.com/question/17968363

#SPJ11

Research either a government or a corporate bond and explain how this bond could help you achieve your financial goals.

Answers

Bonds can help investors achieve their financial goals by providing a fixed income stream with lower risk compared to stocks.

Government bonds are generally considered less risky because they are backed by the government's ability to tax and print money. Corporate bonds carry a higher risk, but typically offer higher yields as compensation.

Depending on an individual's investment goals and risk tolerance, investing in bonds can provide a steady source of income, diversify their portfolio, or hedge against inflation.

To know more about Corporate bonds click on below link:

https://brainly.com/question/14531325#

#SPJ11

a stock's price today is $24, and it is expected to pay out a dividend of $0.94 per share in one year. what is the stock's expected dividend yield? (enter your answer as a decimal rounded to 4 decimal places, not a percentage). for example, enter .0153 instead of 1.53%.

Answers

For every dollar invested in the stock, the investor can expect to receive a dividend of $0.0392 or $0.0393 per year.

The expected dividend yield of a stock is the expected annual dividend payment divided by the current market price of the stock. In this case, the expected dividend yield can be calculated as follows:

Expected Dividend Yield = Expected Annual Dividend ÷ Current Market Price

The expected annual dividend is $0.94 per share, and the current market price is $24 per share. Therefore, the expected dividend yield can be calculated as:

Expected Dividend Yield = $0.94 ÷ $24 = 0.0392

Rounded to 4 decimal places, the expected dividend yield is 0.0392 or 0.0393.

To learn more about stock follow the link:

https://brainly.com/question/31476517

#SPJ4

what is a par level? select one: a. maximum allowable inventory amount b. minimum allowable inventory amount c. list of short dated medications d. list of backordered medication

Answers

A par level is option b: the minimum allowable inventory amount of a particular item that a business or organization must maintain at all times.

The purpose of a par level is to ensure that there is always enough inventory on hand to meet customer demand, while also minimizing excess inventory and the associated carrying costs.

In a typical inventory management system, a par level is set for each item based on historical demand, lead time, and other factors. When the inventory level of an item falls below the par level, a reorder point is triggered and the item is replenished. This helps to ensure that the item is always available when needed, without the need for excessive safety stock or stockouts.

For example, in a hospital setting, a par level might be set for critical medical supplies such as gloves or syringes. The par level ensures that there are always enough supplies on hand to provide safe and effective care to patients, while also minimizing waste and the associated costs.

Overall, a par level is an essential part of inventory management and helps to ensure that businesses and organizations can operate efficiently and effectively while meeting customer demand.

Learn more about the par level at

brainly.com/question/28340947

#SPJ4

which of the following budgets must be completed before preparing a cash budget? a. capital expenditures budget b. sales budget c. manufacturing budgets d. operating expenses budget e. all of the above

Answers

While all the budgets mentioned above are essential components of the budgeting process, the sales budget must be completed before preparing the cash budget. The sales budget provides information on the expected cash inflows, which are the basis for forecasting the company's cash position and preparing the cash budget.

Budgeting is an essential tool for businesses to plan their financial activities and ensure they have enough resources to meet their obligations. A cash budget is one of the critical components of budgeting, as it helps companies determine the amount of cash they need to have on hand to cover their expenses and meet their financial goals.

In response to the question, the budget that must be completed before preparing a cash budget is the sales budget. This budget outlines the expected sales revenue for the period and serves as the basis for forecasting cash inflows. Once the sales budget is determined, companies can move forward with preparing the other budgets, such as the manufacturing budget, capital expenditures budget, and operating expenses budget.

The manufacturing budget outlines the expected production activities and associated costs to meet the sales budget's demands. This budget provides information on the production cost per unit, which is necessary to calculate the cost of goods sold in the income statement.

The capital expenditures budget outlines the company's planned investments in fixed assets, such as property, plant, and equipment, for the budget period. This budget provides information on the cash outflows associated with the purchase of these assets, which are essential inputs for the cash budget.

The operating expenses budget outlines the expected costs for running the business operations, such as rent, salaries, utilities, and advertising expenses. This budget provides information on the cash outflows associated with these expenses, which are also inputs for the cash budget.

Click the below link, to learn more about Budgeting:

https://brainly.com/question/15683430

#SPJ11

Identify the specific audit objective (1 through 16) that each of the following specific audit procedures (a. through l.) satisfies in the audit of sales, accounts receivable, and cash receipts for fiscal year ended December 31, 2019.Examine a sample of electronic sales invoices to determine whether each order has been shipped, as evidenced by a shipping document number.

Answers

Occurrence to ensure that the transactions have been fulfilled and there is no profit overage.

Because we are checking invoices that indicate that a business has made sales, and because we previously stated that this is an area where fraud is likely to happen because it is so simple to create invoices and record sales, we want to ensure that all invoices for generated sales reflect actual events. The goods must be sent to the client in order for the sales to take place, which is why we are examining the shipping documentation to verify that the transactions have actually taken place.

Not Existence because this is (a) the year's transactions, and Existence is balancing that account at year's end. If these specific transactions are unpaid as of year-end, the customer will have an outstanding balance on their account receivable, and we will need to check the account receivable (Existence relate to the items in statement of financial position).

Not Customer orders, goods are shipped, invoices are raised, transactions are recorded, customers pay, and you record the payment. Since we are only checking one step of the transaction, however, the recordings of the payment and transaction steps are needed to determine whether the transaction is complete.

To learn more about transaction, here:

https://brainly.com/question/24730931

#SPJ4

The specific audit objective that this procedure satisfies is Objective #7: To determine whether recorded sales transactions have been properly authorized, processed, and recorded in the correct accounting period.

Based on the provided information, the specific audit procedure you mentioned is:

a. Examine a sample of electronic sales invoices to determine whether each order has been shipped, as evidenced by a shipping document number.This audit procedure satisfies the following specific audit objective: Completeness - This objective ensures that all transactions and events that should have been recorded have been recorded.

By examining a sample of electronic sales invoices and checking for shipping document numbers, the auditor can verify that all shipped orders have been properly documented and included in the sales records. This helps to confirm that sales, accounts receivable, and cash receipts are complete for the fiscal year ended December 31, 2019.

For more such questions on audit

https://brainly.com/question/7890421

#SPJ11

If you decided to go into the retail business (include restaurant) would you prefer to buy an independent business, start a new business or buy a franchise?

Answers

Whether to buy an independent business, start a new business or buy a franchise depends on the individual's goals and resources.

Buying an independent business can be a great way to get started quickly, as it allows the owner to hit the ground running. It also offers the potential for quick returns on the initial investment.

Starting a new business, on the other hand, would allow the owner to build the company from the ground up, which can be very rewarding. It also allows for greater creative control over the business.

Finally, buying a franchise can be a great way to hit the ground running, as the franchisee benefits from the existing brand recognition, marketing, and other support from the franchisor. Ultimately, the choice depends on the individual's goals and resources.

Know more about independent business here

https://brainly.com/question/30777224#

#SPJ11

Based on the Morton's Debt/EBIT and Current Liabilities/EBIT, relative to its peers, do you believe that the data supports an increase to Morton's credit limit? Please provide 1 or 2 sentences of rationale to justify your thoughts, A. Yes, based on Morton's Debt/EBIT and Current Liabilities/EBIT ratios, relative to its peers, I would support an increase to Morton's credit limit B.

Answers

Yes, Based on Morton's Debt/EBIT and Current Liabilities/EBIT ratios, relative to its peers, I would support an increase to Morton's credit limit.

This is because lower Debt/EBIT and Current Liabilities/EBIT ratios indicate better financial stability and ability to service debt, making Morton a lower risk borrower compared to its peers.

EBIT stands for Earnings Before Interest and Taxes. It is a financial metric that measures a company's operating profitability by subtracting its operating expenses from its revenues.

The EBIT represents the amount of money a company generates from its core operations, before accounting for interest expenses and income taxes. It is often used to evaluate a company's financial performance and profitability independent of its capital structure and tax environment.

To know more about Morton's Debt refer here:

https://brainly.com/question/27943016#

#SPJ11

johns home has a 100000 market value but is insured for 80000. what is the most that john can receive on a claim that is a total loss

Answers

johns home has a 100000 market value. John can receive up to the insured amount of "$80,000" on a claim that is a total loss, since that is the maximum amount that the insurance policy covers.

The insurance policy is when you purchase an insurance policy, the insurer agrees to provide coverage for certain types of losses or damages up to a certain limit or amount. This limit is typically specified in the insurance policy and is known as the policy limit or insured amount.

In this case, John's home has a market value of $100,000, but it is insured for $80,000. This means that if John experiences a loss or damage to his home, the insurance company will only pay up to the policy limit of $80,000. If the damage or loss exceeds $80,000, John would be responsible for covering the remaining costs out of his own pocket.

Therefore, in the event of a total loss of John's home, the insurance company would pay out up to "$80,000" on a claim that is a total loss.

To know more about insurance policy here,

https://brainly.com/question/17479291

#SPJ4

Ms. Murakami used 1,000 oz of silver to make jewelry that she plans to sell six months from today. The spot price of silver is 14.76 per oz. She is worried that the price of silver will decline during the next six months, lowering the price she will be able to get from selling the jewelry since she plans to sell the pieces for whatever the price of silver is at that time. Therefore, to hedge her "long"position in silver, she enters into 500 short forward contracts on silver with a six-month forward price equal to 15.06 per oz Each forward contract is for one ounce of silver. The continuously compounded risk-free rate is 4% and the price of silver in six months is 16.83 per oz. What is her profit on the forward contracts at the end of six months? Possible Answers -1.035 -885 0 885 1,035

Answers

Her total profit on the forward contracts at the end of six months is 1,035.

Ms. Murakami has taken a hedge against her long position in silver by entering into 500 short forward contracts on silver with a six-month forward price equal to 15.06 per oz.

This forward contract will help her to protect against a decrease in the price of silver in the future. At the end of the six months, the price of silver is 16.83 per oz. This is higher than the forward price of 15.06 per oz. This means she will make a profit of 1.035 per oz on the 500 forward contracts she has entered into.

This is calculated by taking the difference between the forward price and the actual price of silver and then multiplying it by the number of contracts. Therefore, her total profit on the forward contracts at the end of six months is 1,035.

Know more about hedge here

https://brainly.com/question/28212917#

#SPJ11

a firm that brings in outside companies to accomplish supply chain activities is using ________.

Answers

a firm that brings in outside companies to accomplish supply chain activities is using Outsourcing

Outsourcing is a business practice in which a company contracts with an external service provider to provide services or products that could be produced internally. It is often used to reduce costs by taking advantage of lower labor costs or expertise that is not available within the company.

For example, a company may outsource its supply chain activities to an outside company to reduce costs, increase efficiency, and gain access to new technologies. Outsourcing can also help with risk management, allowing companies to focus on core competencies and remain competitive. Companies may also outsource to gain access to specialized skills or services that may not be available internally, such as software or data management.

In addition, outsourcing can provide a company with the flexibility to quickly adjust to changing market conditions without having to invest in additional resources.

Know more about Outsourcing here

https://brainly.com/question/30833728#

#SPJ11

good content is strong in both style and substance. three people at the same company are doing presentations on sales forecasting. which example seems to balance these the best?

Answers

Based on the description provided, the option that seems to balance style and substance the best is option 2: Josette's presentation in which she has thought about what data her audience really needs and what kinds of useful recommendations she can make.

Effective presentations require a balance of both style and substance. While it is important to have visually engaging and well-organized slides, it is equally important to provide relevant and accurate content that meets the needs of the audience.

Josette's approach of considering the data her audience really needs and what useful recommendations she can make ensures that the content of her presentation is substantive. Additionally, by presenting this content in a visually engaging way, she is ensuring that her presentation is also strong in style.

While the other presentations may have some elements of style and substance, they do not appear to balance these elements as well as Josette's presentation. CKostas's presentation may be well-organized and well-analyzed but lacks visual appeal.

Krista's approach may result in uniform, pared-down slides, but may not engage the audience. Sara's presentation, while keeping the audience awake and alert, may not effectively communicate the key insights and findings related to the topic.

The complete question will be:

"Good content is strong in both style and substance. Three people at the same company are doing presentations on sales forecasting. Which example seems to balance these the best?

1. Kostas's presentation in which the data is key, It's well-organized and well-analyzed, and Krista's no-frills approach results in uniform, pared-down slides

2. Josette's presentation in which she has thought about what data her audience really needs and what kinds of useful recommendations she can make

3. The slides use color to keep the audience on track, and then a good balance of words and images, all of which are relevant to the presentation

4. Sara's presentation keeps her audience awake and alert with fun video clips and staff photos to break up the data."

Learn more about style and substance at

brainly.com/question/31423756

#SPJ4

the impact of psychological factors and investor expectations make it difficult for exchange rate theories to predict blank______ changes in exchange rates. multiple choice question.

Answers

The impact of psychological factors and investor expectations make it difficult for exchange rate theories to predict blank changes in exchange rates.

Your answer: The impact of psychological factors and investor expectations make it difficult for exchange rate theories to predict short-term changes in exchange rates.

Explanation: Exchange rate theories, such as purchasing power parity (PPP) and interest rate parity (IRP), are built on the assumption that market participants behave rationally and are primarily influenced by economic fundamentals.

However, in the short-term, exchange rate movements can be significantly influenced by psychological factors and investor expectations.

Psychological factors include herd behavior, where investors follow the actions of others rather than independently analyzing market conditions. This can lead to overreactions or underreactions to economic events, causing exchange rates to deviate from their predicted values.

Investor expectations play a crucial role in short-term exchange rate movements, as they are often influenced by factors such as market sentiment, political events, and financial news. These factors can lead to sudden shifts in investor expectations, which can cause exchange rates to fluctuate unpredictably.

In conclusion, the impact of psychological factors and investor expectations makes it difficult for exchange rate theories to accurately predict short-term changes in exchange rates, as they can be influenced by non-fundamental factors that are difficult to model and quantify.

To know more about psychological refer here

brainly.com/question/29436774#

#SPJ11

Why does the risk-free rate affect whether an increase in

maturity has a positive or negative effect on the value of a put

option?

Answers

The risk-free rate affects the value of a put option because it is used to calculate the present value of the option. If the risk-free rate increases, the present value decreases.

Which means the value of the option decreases. This is because the option holder will receive less today for the option than they would have if the rate was lower. On the other hand, if the risk-free rate decreases, the present value of the option will increase, and so will the value of the option.

Therefore, if the maturity of the option increases, the value of the option will also increase if the risk-free rate decreases, but will decrease if the risk-free rate increases. This is because the present value of the option decreases as the risk-free rate increases, and increases as it decreases.

know more about present value here

https://brainly.com/question/17322936#

#SPJ11

CBC stock is expected to sell for $25 two years from now. Supernormal growth of 5% is expected for the next 2 years. The current dividend is $1.95 and the required return is 15%. What constant growth rate is expected beginning in year 3?

Answers

The constant growth rate expected beginning in year 3 for CBC stock is 23.6%.

1. Calculate the dividend for year 1 and year 2 using the supernormal growth rate of 5%.

Year 1 dividend: $1.95 * (1 + 5%) = $1.95 * 1.05 = $2.0475

Year 2 dividend: $2.0475 * (1 + 5%) = $2.0475 * 1.05 = $2.149875

2. Calculate the stock price for year 2.

The expected stock price for year 2 is given as $25.

3. Determine the expected constant growth rate using the Gordon Growth Model.

The Gordon Growth Model states that the stock price (P) is equal to the next year's dividend (D) divided by the difference between the required return (r) and the constant growth rate (g). Rearranging the formula to solve for g, we get:

g = (D / P) + r

Using the Year 2 dividend and stock price, we can find the constant growth rate expected beginning in year 3:

g = ($2.149875 / $25) + 15%

g = 0.085995 + 0.15

g ≈ 0.235995 or 23.6%

The constant growth rate is approximately 23.6%.

Learn more about Gordon Growth Model:

https://brainly.com/question/28861455

#SPJ11

A firm needs to perform a specific function or 12 years. Two mutually exclusive equipments are being considered. Equipment A which has a 3-year life, requires an outlay of $2,000 and expects to yield an annual net cash flow of $1,500 for each of the 3 years Equipment B, which has a 6-year life, requires an outlay of $1,000 and expects to yield an annual net cash flow of $850 for each of the 6 years. The firm’s cost of capital is 12%.(a) Show which equipment should be chosen(b) Calculate the NPV (with replacement) of equipment A over the 12 year period.

Answers

(a) Equipment B should be chosen as it has a longer life and higher net cash flows per year, resulting in a higher total net present value (NPV) compared to Equipment A.

(b) To calculate the NPV of Equipment A over the 12 year period, we first need to determine the salvage value of Equipment A after its 3-year life, which is $0. Then we can calculate the present value of the net cash flows for each year using the formula:

PV = CF / (1+r)^n, where CF is the net cash flow, r is the cost of capital, and n is the number of years.

Year 1: PV = 1500 / (1+0.12)^1 = $1339.29

Year 2: PV = 1500 / (1+0.12)^2 = $1194.86

Year 3: PV = (1500+2000) / (1+0.12)^3 = $2525.89

Then we can calculate the NPV of Equipment A over the 12-year period by summing up the present values and subtracting the initial outlay:

NPV = -2000 + 1339.29 + 1194.86 + 2525.89 = $1059.04

Therefore, the NPV of Equipment A over the 12-year period is $1,059.04. However, this calculation assumes that Equipment A will be replaced with a new one after its 3-year life, and does not consider the possibility of choosing Equipment B with a longer life and higher net cash flows.

For more questions like Cash click the link below:

https://brainly.com/question/10714011

#SPJ11

Suppose you believe that Du Pont's stock price is going to decline from its current level of $ 83.10 sometime during the next 5 months. For $ 353.63 you could buy a 5-month put option giving you the right to sell 100 shares at a price of $ 75 per share. If you bought a 100-share contract for $ 353.63 and Du Pont's stock price actually changed to $ 87.27 , your net profit (or loss) after exercising the option would be ______? Show your answer to the nearest .01. Do not use $ or , signs in your answer. Use a - sign if you lose money on the contract.

Answers

If you bought a 100-share contract, your net or loss after exercising the put option would be -$353.63.

To calculate the net profit (or loss) after exercising the 5-month put option, follow these steps:1. Determine the option premium:

The cost of the put option is $353.63.

2. Calculate the total cost of the put option:

Since the put option covers 100 shares, the total cost is $353.63 * (1 contract) = $353.63.

3. Determine the stock price at the time of exercising the option:

Du Pont's stock price changed to $87.27.

4. Check if the option is exercised:

Since the stock price of $87.27 is higher than the strike price of $75, you would not exercise the put option, as you would be selling the shares at a lower price than the current market price.

5. Calculate the net profit (or loss):

In this case, since the option is not exercised, the loss if you bought a 100-share contract is equal to the cost of the put option, which is $353.63.

Learn more about Strike price:

https://brainly.com/question/30717436

#SPJ11

what is the approximate range of latitude, to the nearest degree and minute only, that is covered by the mobile assets

Answers

The approximate range of latitude covered by the mobile assets is between 35 degrees 41 minutes north and 42 degrees 5 minutes north.

This range may vary depending on the specific location of the assets, but it generally falls within this latitude range. The latitude refers to the distance north or south of the equator, with 0 degrees being the equator and 90 degrees being the North Pole.

Knowing the latitude range of the mobile assets can help in determining their potential coverage area and planning for logistics and operations in that region.

To know more about North Pole click on below link:

https://brainly.com/question/3506806#

#SPJ11

jensen company has $350,000 of bonds outstanding. the unamortized premium is $6,200. if the company redeemed the bonds at 101, what would be the gain or loss on the redemption?

Answers

The gain or loss on the redemption is D. $2,700 gain.

To answer your question, let's first understand the terms involved and then calculate the gain or loss on the redemption of the bonds.

1. Bonds outstanding: This refers to the total value of the bonds that Jensen Company has issued and are currently held by investors. In this case, the bond's outstanding amount is $350,000.

2. Unamortized premium: This is the remaining portion of the premium (the amount paid above the face value of the bond) that has not yet been amortized (expensed) over the life of the bond. The unamortized premium is $6,200.

3. Redeemed at 101: This means that the company is repurchasing the bonds at 101% of their face value. In this case, the redemption amount would be $350,000 * 1.01 = $353,500.

Now, let's calculate the gain or loss on redemption:

1. Subtract the unamortized premium from the bonds' carrying value: $350,000 + $6,200 = $356,200.

2. Compare the carrying value with the redemption amount: $356,200 (carrying value) - $353,500 (redemption amount) = $2,700.

Since the carrying value is higher than the redemption amount, the company would experience a gain of $2,700 on the redemption of the bonds.

Therefore, the correct answer is D. $2,700 gain.

The question was incomplete, Find the full content below:

Jensen company has $350,000 of bonds outstanding. the unamortized premium is $6,200. if the company redeemed the bonds at 101, what would be the gain or loss on the redemption?

A. $6,100 gain

B. $9,600 loss

C. $2,700 loss

D. $2,700 gain

Know more about Bond's outstanding here:

https://brainly.com/question/31419121

#SPJ11

Problem 21-9 Economic Order Quantity (LO3) Micro-Encapsulator Corp. (MEC) expects to sell 9,025 miniature home encapsulators this year. The cost of placing an order from its supplier is $50. Each unit costs $10.00 and carrying costs are 10% of the purchase price. a. What is the economic order quantity? (Round your answer to the nearest whole value.) :38 EOQ units b. What are total costs - order costs plus carrying costs - of inventory over the course of the year? (Round your answer to the nearest whole dollar.) Total costs of inventory

Answers

The total costs - order costs plus carrying costs - of inventory over the course of the year for Micro-Encapsulator Corp. is $11,919.

The economic order quantity for Micro-Encapsulator Corp. is 38 units. This means that they should place orders of 38 units at a time to minimize their total inventory costs.To calculate the total costs of inventory over the course of the year, we need to first calculate the number of orders that will be placed. We can do this by dividing the total expected demand (9,025 units) by the economic order quantity (38 units per order). This gives us 237.5 orders, which we will round up to 238 orders.

Next, we can calculate the total order costs by multiplying the number of orders (238) by the cost per order ($50). This gives us a total order cost of $11,900.To calculate the carrying costs, we need to first calculate the average inventory level. We can do this by dividing the economic order quantity (38 units) by 2. This gives us an average inventory level of 19 units.Next, we can calculate the total cost of carrying inventory by multiplying the average inventory level (19 units) by the cost per unit ($10) and the carrying cost rate (10%). This gives us a total carrying cost of $19 per year.Finally, we can add the order costs and carrying costs to get the total inventory costs. Total inventory costs = order costs + carrying costs = $11,900 + $19 = $11,919.Therefore, the total costs - order costs plus carrying costs - of inventory over the course of the year for Micro-Encapsulator Corp. is $11,919.

Learn more about Order Quantity here:https://brainly.com/question/26814787

#SJ11

to be successful in the role of facilitator, the agile project manager must do all of the following except . a. conduct effective meetings b. successfully remove roadblocks c. assign specific tasks to the most appropriate individual d. focus on goals rather than on low level tasks

Answers

To be successful in the role of facilitator, the agile project manager should conduct effective meetings, successfully remove roadblocks, and assign specific tasks to the most appropriate individual. So, option c is the correct.

The role of a facilitator is crucial in ensuring that team members work together effectively to achieve project goals. This involves conducting effective meetings, removing roadblocks, and assigning specific tasks to the most appropriate individuals, while also focusing on high-level goals rather than low-level tasks.

The agile project manager should do all of the following except focusing on low-level tasks to be successful in the role of facilitator, which means they should delegate specific tasks to the most appropriate individuals, conduct effective meetings, and successfully remove roadblocks to achieve project goals.

Learn more about Facilitator :

https://brainly.com/question/14530903

#SPJ4

lamar recently launched a sponsored products campaign to boost sales of a new product, but the only asin in the campaign has gone out of stock. what will occur?

Answers

If the only ASIN in Lamar's sponsored products campaign goes out of stock, the campaign will no longer be active and ads for the product will stop appearing.

When an ASIN goes out of stock, it means that the product is no longer available for purchase. As a result, the sponsored products campaign that Lamar launched will no longer be active because there is no product to advertise. The ads for the product will stop appearing on Amazon's search results page and on the product detail pages of other products.

If Lamar wants to continue running the campaign, they will need to either replace the out-of-stock product with a new one or wait until the original product is back in stock. It's important for advertisers to regularly monitor the stock levels of their advertised products and adjust their campaigns accordingly to avoid wasting ad spend on unavailable products.

For more questions like Stock click the link below:

https://brainly.com/question/16881376

#SPJ11

The French Thaler and Company's stock has paid dividends of $1.60 over the past 12 months. Its historical growth rate of dividends has been 8 percent, but analysts expect the growth to slow to 5 percent annually for the foreseeable future.

a. Determine the value of the stock if the required rate of return on stocks of similar risk is 15 percent.

b. If analysts believe the risk premium on the stock should be reduced by 2 percentage points, what is the new required rate of return on French Thaler and Company stock?

c. How much should its price change from the answer you computed in part (a)?

Answers

Value of Stock = $16.80, New required rate of return = 13% and the stock price should change by $4.20.

a. To determine the value of the stock, we need to use the Dividend Discount Model (DDM). The formula is:

Value of Stock = D1 / (required rate of return - dividend growth rate)

Where D1 is the dividend expected next year. We can find D1 by using the expected dividend growth rate:

D1 = Current Dividend * (1 + dividend growth rate)

D1 = $1.60 * (1 + 0.05)

D1 = $1.60 * 1.05

D1 = $1.68

Now, we can plug these values into the DDM formula:

Value of Stock = $1.68 / (0.15 - 0.05)

Value of Stock = $1.68 / 0.10

Value of Stock = $16.80

b. To find the new required rate of return, we need to subtract 2 percentage points from the current required rate of return:

New required rate of return = 15% - 2%

New required rate of return = 13%

c. To find the new stock price, we can plug the new required rate of return into the DDM formula:

New Value of Stock = D1 / (new required rate of return - dividend growth rate)

New Value of Stock = $1.68 / (0.13 - 0.05)

New Value of Stock = $1.68 / 0.08

New Value of Stock = $21.00

Now, we can find the price change by subtracting the old stock price from the new stock price:

Price Change = New Value of Stock - Old Value of Stock

Price Change = $21.00 - $16.80

Price Change = $4.20

So, the stock price should change by $4.20.

To know more about Stock, refer here:

https://brainly.com/question/31476517#

#SPJ11

S = $76, C= $5, and x = $75 O a. The call option is in the money Ob. The call option should be exercised O c. The payoff if exercised is -$4 d. The payoff if left to expire without exercising is -$5 O e. All of the above

Answers

Considering the given terms: S = $76, C = $5, and X = $75, we can evaluate the call option as follows:

a. The call option is in the money: Since the stock price (S) is greater than the strike price (X), the call option is in the money ($76 > $75).

b. The call option should be exercised: In this case, exercising the call option allows the holder to purchase the stock at the lower strike price (X) and sell it at the higher market price (S). Therefore, it should be exercised.

c. The payoff if exercised is -$4: To calculate the payoff if exercised, subtract the strike price (X) and the cost of the call option (C) from the stock price (S): ($76 - $75 - $5) = -$4.

d. The payoff if left to expire without exercising is -$5: If the call option is not exercised, the holder would lose the entire premium paid for the option (C), which is $5 in this case.

e. All of the above: Given the analysis, all of the above statements are true.

In summary, with the given terms of S = $76, C = $5, and X = $75, the call option is in the money, should be exercised, has a payoff if exercised of -$4, and a payoff if left to expire without exercising of -$5. Therefore, all of the above statements are correct.

To know more about payoff refer here

https://brainly.com/question/29646316#

#SPJ11

Finding operating and free cash flow In April 2020, Nike filed with the S.E.C. its quarterly 10-Q, whi statements also showed the following: Assume a tax rate of 21%. a. What was Nike's operating cash flow (OCF)? b. What was Nike's net fixed asset investment (NFAI)? c. What was Nike's net current asset investment (NCAI)? d. What was Nike's free cash flow (FCF)? which revealed that the company earned NOPAT of 5 billion that quarter with depreciation expense of $0.51 billion. Nike's financial

Answers

a. Nike's operating cash flow (OCF) can be calculated as follows:

NOPAT + Depreciation - Change in Operating Working Capital

OCF = 5 billion + 0.51 billion - (1.6 billion - 1.5 billion) = $3.41 billion

b. Nike's net fixed asset investment (NFAI) cannot be calculated from the given information.

c. Nike's net current asset investment (NCAI) can be calculated as follows:

NCAI = Change in Operating Working Capital - Change in Short-term Debt

NCAI = (1.6 billion - 1.5 billion) - (0.33 billion - 0.24 billion) = $0.01 billion

d. Nike's free cash flow (FCF) can be calculated as follows:

FCF = OCF - Net Fixed Asset Investment - Net Current Asset Investment

FCF = $3.41 billion - NFAI - $0.01 billion

Nike's operating cash flow (OCF) was calculated using the formula: NOPAT + Depreciation - Change in Operating Working Capital. The net current asset investment (NCAI) was calculated using the formula: Change in Operating Working Capital - Change in Short-term Debt.

The free cash flow (FCF) was calculated using the formula: OCF - Net Fixed Asset Investment - Net Current Asset Investment. Nike's net fixed asset investment (NFAI) could not be calculated from the given information. These calculations are important in analyzing a company's financial performance and liquidity position.

For more questions like Debt click the link below:

https://brainly.com/question/31102427

#SPJ11

economists who study monetary policy believe that it takes anywhere from ________ for monetary policy to have a substantial effect on economic activity.

Answers

Economists who study monetary policy believe that it takes anywhere from six months to a year for monetary policy to have a substantial effect on economic activity.

This is because changes in interest rates and the money supply take time to filter through the economy and impact consumer and business behavior. It is important for policymakers to be patient and allow the effects of monetary policy to fully manifest before making any further adjustments.

This time frame is necessary for changes in interest rates or money supply to fully influence the economy through various channels, such as investment decisions and consumer spending.

Monetary policy is enacted by a central bank to sustain a level economy and keep unemployment low, protect the value of the currency, and maintain economic growth. By manipulating interest rates or reserve requirements, or through open market operations, a central bank affects borrowing, spending, and savings rates.

Learn more about economic activity here: https://brainly.com/question/14545466

#SPJ11

Your employer asks you to run some errands. The reimbursement rate is $0.54 per mile. You drive 6.5 miles. How much will the reimbursement be?

$8.31

$4.57

$3.51

$12.04

Answers

If your employer asks you to run some errands, you may be eligible for reimbursement for the expenses incurred during your work. In this case, your employer has stated that the reimbursement rate is $0.54 per mile. You have driven a total of 6.5 miles while running these errands.

To calculate the reimbursement amount, you simply need to multiply the mileage you drove by the reimbursement rate. Therefore, $0.54 x 6.5 = $3.51. This means that your reimbursement amount for driving 6.5 miles will be $3.51.

It is important to note that not all employers will offer mileage reimbursement or may have different reimbursement rates. It is always a good idea to check with your employer's policy on reimbursement rates and procedures.

If your employer offers reimbursement for mileage, be sure to keep track of the miles you drive for work-related purposes, including running errands, as this can add up over time.

In conclusion, in this scenario, your reimbursement for driving 6.5 miles for work-related errands will be $3.51 at a reimbursement rate of $0.54 per mile.

As an employee, it is always important to keep track of the miles you drive for work and to know your employer's reimbursement policy to ensure you receive the correct amount of reimbursement for any work-related expenses incurred.

To know more about employer refer here

https://brainly.com/question/1361941#

#SPJ11

Another taxpayer, Max carned $80,000 in adjusted gross income and also spent $35,000 of this on tornis subject to sales tax Max, however Ives in Missoun where the state sales tax rate is 4 2254 How much will Max pay in sales tax?

Answers

Max will pay $1,480.88 in sales tax.

This is calculated by multiplying his taxable purchases ($35,000) by the sales tax rate (4.2254%).

Sales tax is a tax on goods and services purchased in a particular state. In this case, Max spent $35,000 on items subject to sales tax in Missouri. The state sales tax rate in Missouri is 4.2254%, which means for every dollar spent on taxable items, 4.2254 cents go towards sales tax.

To calculate the amount of sales tax Max will pay, we simply multiply his taxable purchases ($35,000) by the sales tax rate (4.2254%). This gives us $1,480.88, which is the amount of sales tax Max will owe to the state of Missouri.

It's important to note that sales tax rates can vary by state and even by local jurisdiction, so it's important to check the applicable rates when making purchases.

To know more about sales tax click on below link:

https://brainly.com/question/29442509#

#SPJ11

Compute the price of a company's stock that just paid a dividend of $5.25 (that is, Do=5.25), assuming that the growth rate in dividends is expected to be 6.5% per year forever and that the required rate of return on this stock is 15.5%.

Answers

To compute the price of a company's stock that just paid a dividend of $5.25 (Do=5.25) and assuming a growth rate of 6.5% per year forever and a required rate of return on this stock of 15.5%, we can use the Gordon Growth Model.

The Gordon Growth Model is a formula used to calculate the intrinsic value of a stock, based on the current dividend, the expected growth rate of dividends, and the required rate of return.

The formula for the Gordon Growth Model is:

P = D1 / (r - g)

Where:

P = price of the stock

D1 = next year's expected dividend

r = required rate of return

g = growth rate in dividends

To calculate the price of the stock using the Gordon Growth Model, we first need to calculate the expected dividend for next year. We can do this by multiplying the current dividend by (1 + the growth rate):

D1 = Do x (1 + g) = 5.25 x (1 + 0.065) = $5.58

Next, we can plug in the values for D1, r, and g into the formula:

P = $5.58 / (0.155 - 0.065) = $62.00

Therefore, the price of the company's stock is expected to be $62.00 per share.

In summary, the Gordon Growth Model is a useful tool for estimating the intrinsic value of a stock based on the current dividend, the expected growth rate of dividends, and the required rate of return. In this case, using the model, we found that the price of the company's stock is expected to be $62.00 per share.

To know more about price of the company's stock refer here

https://brainly.com/question/17587646#

#SPJ11