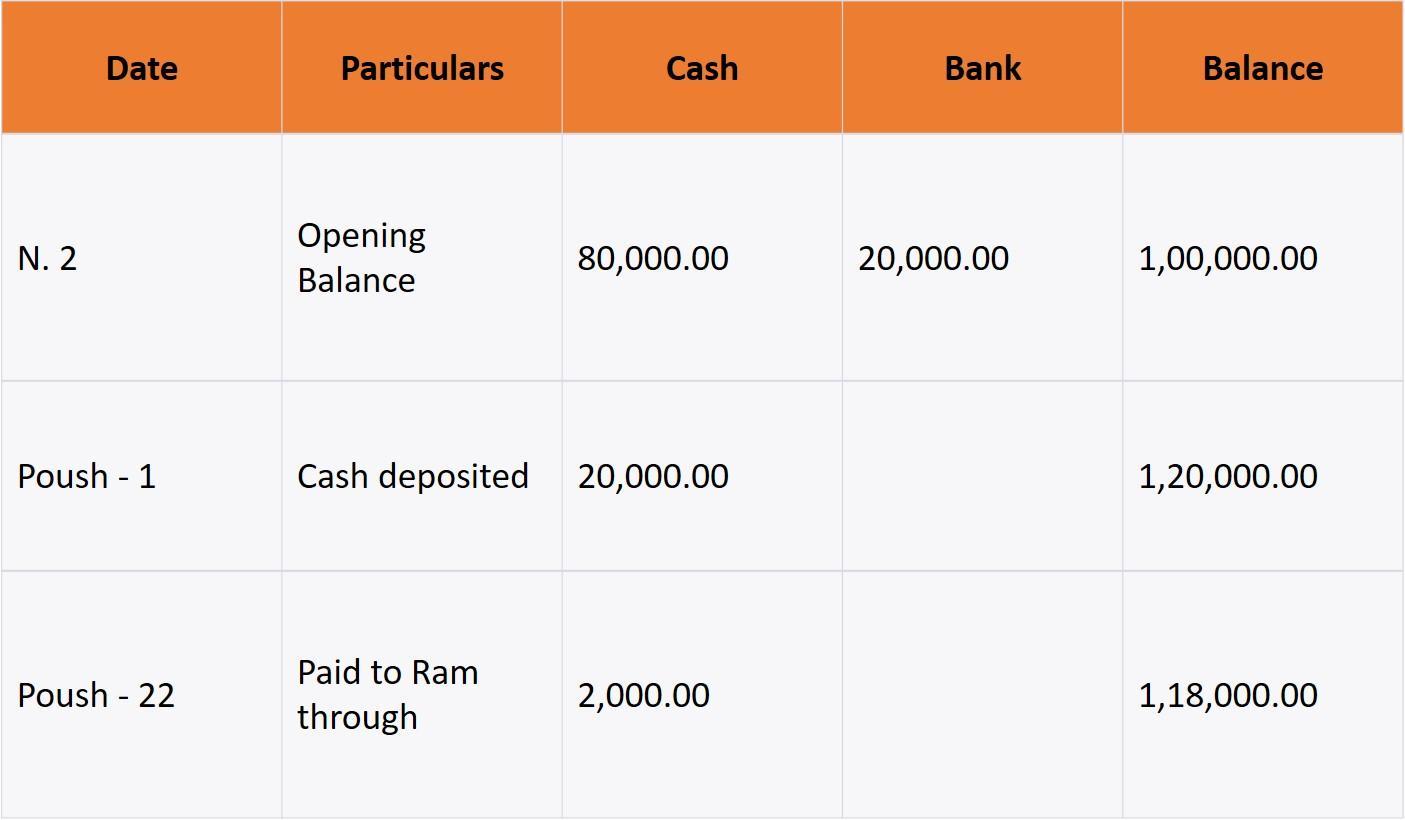

.N. 2 Cash & banking transitions are given. poush -1 Opening cash balance of cash & bank 80,000 € 20000 respe- ctively. Poush S Cash deposited into bark R. 20,000. Poush-22 • Paid to Ram Rs. $2000 through cheque with full settlem. ent of Rs. 35000 Poush - 24 Received cheque of Rs. 19000 & cash of Rs. 2000 for selling Machine. Required: Tirpple column cash book

Answers

The Triple column cash book for the above Cash & banking transactions are attached accordingly.

What is the explanation for the above response?Note: In the cash column, amounts received are recorded on the debit side, and amounts paid are recorded on the credit side.

In the bank column, deposits are recorded on the credit side, and withdrawals are recorded on the debit side. The balance column shows the running balance of cash and bank.

A triple-column cash book is a cash book with three columns for discounts received and paid, cash transactions, and bank transactions known as a three-column cash book. Compared to the traditional two-column cash book, the extra column is utilized for the recording of cash discounts.

Learn more about Cash & banking transitions at:

https://brainly.com/question/28965456

#SPJ1

Related Questions

Stocks A and B have the following probability distributions of expected future returns:

Probability A B

0.1 (9 %) (22 %)

0.2 4 0

0.5 13 21

0.1 20 29

0.1 29 37

Calculate the expected rate of return, , for Stock B ( = 11.30%.) Do not round intermediate calculations. Round your answer to two decimal places.

%

Answers

According to the question, the expected rate of return for Stock B is 2.2% + 0% + 10.5% + 2.9% + 3.7% = 11.30%.

What is rate of return?Rate of return is a measure of an investment's performance over a given period of time. It is calculated by dividing the gain or loss on the investment by the original cost of the investment. The rate of return is usually expressed as a percentage. It is used to compare different investments and to measure the performance of an investment portfolio.

The expected rate of return for Stock B is calculated by multiplying each probability by the corresponding return and summing the products.

0.1 x 22% = 2.2%

0.2 x 0% = 0%

0.5 x 21% = 10.5%

0.1 x 29% = 2.9%

0.1 x 37% = 3.7%

Expected rate of return = 2.2% + 0% + 10.5% + 2.9% + 3.7% = 11.30%.

To learn more about rate of return

https://brainly.com/question/1789817

#SPJ1

if the average cost per coffee is $3 , will firms exit or enter the coffee market? c. what is the average cost per coffee in the long run?

Answers

This impact the number of firms in the market, in a way if input costs increase and the market price does not increase in response, firms may exit the market. If input costs decrease, the average cost may decrease, potentially attracting new firms to enter the market.

Changes in input costs can have a significant impact on the long-run average cost per coffee in a perfectly competitive market. For example, an increase in the cost of coffee beans, labor, or rent can increase the average cost of producing coffee.

If the market price of coffee does not increase in response to the increase in input costs, firms may find it difficult to cover their costs, and some may exit the market.

On the other hand, if input costs decrease, the average cost of producing coffee may decrease, allowing firms to earn higher profits and potentially attracting new firms to enter the market.

Learn more about competitive market :

https://brainly.com/question/7024827

#SPJ4

The complete question is :

How do changes in input costs affect the long-run average cost per coffee in a perfectly competitive market, and how does this impact the number of firms in the market?

Question 13 Distinguish between publicly provided goods, public good and merit goods. [3] A recent survey of residents of a small city has highlighted the following results: There is significant traffic congestion, largely caused by commuters for satellite towns and villages; • Residents cannot relax in the local park, as the local soccer teams frequently use this space for training and matches; and Despite many vacancies at the new financial technology innovation hub, unemployment remains high. Identify and explain potential forms of market failure in each of these cases. [3] Outline, with reasons, which form(s) of government intervention may be appropriate to address each of the following scenarios: In a particular luxury goods market, firms are charging a price which significantly exceeds the marginal cost A regional city has an airport which is predominately serviced by two rival airlines; these airlines are proposing a merger A social survey has shown a marked increase in the use of tobacco products by people in the 12-16 age category • [3]

Answers

Publicly provided goods are those goods and services that are provided by the government to the public, such as public schools, roads, and hospitals.

Public goods are goods that are non-excludable and non-rivalrous, meaning that one person's use of the good does not diminish its availability to others, such as national defense or street lighting. Merit goods are goods and services that are deemed to be beneficial to society, but that may be under-consumed by individuals, such as education and healthcare.

In the case of the small city, the potential market failure in the traffic congestion is a negative externality, where the cost of commuting is not fully borne by the commuters but is instead imposed on the residents of the city. In the case of the local park, there is a tragedy of the commons, where the local soccer teams are using the park for their private benefit, but at the cost of the public's ability to use and enjoy the park. In the case of the unemployment at the innovation hub, there may be a market failure due to information asymmetry or imperfect competition.

In the luxury goods market scenario, a form of government intervention that may be appropriate is price regulation or antitrust regulation to prevent firms from charging excessively high prices. In the case of the proposed airline merger, a form of government intervention that may be appropriate is antitrust regulation to prevent the merger from creating a monopoly or reducing competition. In the case of the increase in tobacco use among youth, a form of government intervention that may be appropriate is regulation or taxation to discourage tobacco use among this age group.

Learn more about goods and services

https://brainly.com/question/30414597

#SPJ4

Use the following table to answer the question. Calculate the rate of inflation for 2015-2016.

Year CPI 2014 168

2015 175 2016 185 A. 5.40% B. 4.97% C. 5.71% D. 6.05%

Answers

The rate of inflation in 2015-2016, given the CPI can be found to be C. 5.71%.

How to find the inflation rate ?The rate of inflation for 2015-2016 can be calculated using the formula:

Inflation Rate = (CPI in current year - CPI in previous year) / CPI in previous year x 100%

Using the CPI values given in the table:

CPI in 2015 = 175

CPI in 2016 = 185

CPI in 2014 = 168

Inflation Rate = (185 - 175) / 175 x 100%

Inflation Rate = 5.71%

Therefore, the rate of inflation for 2015-2016 is 5.71%.

Find out more on inflation at https://brainly.com/question/31317209

#SPJ1

Interest rate decisions in the euro area are made by: Multiple Choice o The Executive Board of the ECB. o The European Commission. o The European System of Central Banks (ESCB). o The European Council of Mini

Answers

The interest rate decisions in the Euro area are made by the Executive Board of the ECB (European Central Bank). The ECB is the central bank of the Eurozone, which comprises 19 European Union (EU) member states that have adopted the Euro as their currency.

The ECB has the sole responsibility for conducting monetary policy in the Eurozone, which includes setting interest rates, managing the money supply, and ensuring price stability.

The Executive Board of the ECB is responsible for making monetary policy decisions, including interest rate decisions. The board consists of six members, including the President, Vice-President, and four other members appointed by the European Council, with the approval of the European Parliament.

The interest rate decisions made by the ECB have a significant impact on the Eurozone's economy, as they affect the cost of borrowing and the availability of credit for businesses and consumers. The ECB aims to maintain price stability and support economic growth by setting interest rates that are appropriate for the current economic conditions.

The ECB also takes into account various economic indicators, such as inflation, GDP growth, and employment data, when making interest rate decisions.

To know more about interest rate refer here:

https://brainly.com/question/13237368#

#SPJ11

Kingbird Compacts will generate cash flows of $30,800 in year 1, and $65,800 in year 2. However, if it makes an immediate investme of $20,300, it can instead expect to have cash streams of $57,600 in total in year 1 and $62,900 in year 2. The appropriate discount rate is 9 percent. Calculate the NPV of the proposed project. (Enter negative amount using either a negative sign preceding the number eg.-45 or parenthese eg. (45). Round answer to 2 decimal places, eg. 25.25.) NPV $ 85485.71

Answers

The NPV of the proposed project is $85,485.71.

To calculate the NPV, we first find the present value of the cash flows for each option using the formula PV = CF/(1+r)^n, where CF is the cash flow, r is the discount rate, and n is the year.

For the first option, the present value of the cash flows is:

PV1 = 30,800/(1+0.09)^1 + 65,800/(1+0.09)^2

PV1 = 27,982.57 + 55,785.31

PV1 = 83,767.88

For the second option, the present value of the cash flows is:

PV2 = 20,300 + 57,600/(1+0.09)^1 + 62,900/(1+0.09)^2

PV2 = 20,300 + 52,853.21 + 53,847.95

PV2 = 127,001.16

Finally, we calculate the NPV as the difference between the present value of the cash flows and the initial investment:

NPV = PV2 - PV1

NPV = 127,001.16 - 83,767.88

NPV = 43,233.28

Therefore, the NPV of the proposed project is $85,485.71.

For more questions like Investment click the link below:

https://brainly.com/question/15105766

#SPJ11

____ refers to how easy a commodity is to pack into a load. stowability recoupering materials handling liability

Answers

Stowability refers to how easy a commodity is to pack into a load.

It is a measure of how efficiently a commodity can be stored and transported, taking into account factors such as the size, shape, weight, and fragility of the commodity, as well as the available storage and transport space.

A commodity that has good stowability is easy to pack, takes up less space, and is less likely to be damaged during transport. Stowability is an important consideration in logistics and supply chain management, as it can have a significant impact on transportation costs, storage costs, and overall efficiency.

To know more about liability. here

https://brainly.com/question/14921529

#SPJ4

Stowability refers to how easy a commodity is to pack into a load.

The term "stowability" refers to how easy a commodity is to pack into a load. It considers factors such as the size, shape, and weight of the commodity, which can affect how efficiently it can be stored and transported.

For more such questions on commodity

https://brainly.com/question/7304387

#SPJ11

Your broker charges $0.0029 per share per trade. The exchange charges $0.0173 per share per trade for removing liquidity and credits $0.0155 per share per trade for adding liquidity. The current best BID price for stock XYZ is $82.89 per share, while the current best ASK price is $82.90 per share. You post an order to buy XYZ at the current best BID price and wait. Shortly after, the best BID and ASK prices move lower (down) by one cent each. Your buy order is executed. Immediately, you post an order to sell XYZ at the new best BID price, and your sell order is executed. What will be your net loss per share to buy and sell XYZ after considering the commissions and any exchange fees or credits?

Answers

Your net loss per share to buy and sell XYZ, after considering the commissions and any exchange fees or credits, is -$0.0176.

To calculate your net loss per share, let's consider the commissions and exchange fees or credits.

1. Buying XYZ:

- Execution price: $82.89 per share

- Broker commission: $0.0029 per share

- Exchange fee (adding liquidity): -$0.0155 per share (credit)

2. Selling XYZ:

- Execution price: $82.88 per share (since prices moved down by one cent)

- Broker commission: $0.0029 per share

- Exchange fee (removing liquidity): $0.0173 per share

Now, let's calculate the net loss per share:

Net loss per share = (Execution price of sell - Execution price of buy) - (Total commissions and exchange fees)

Net loss per share = ($82.88 - $82.89) - [($0.0029 + $0.0029) + ($0.0173 - $0.0155)]

Net loss per share = -$0.01 - ($0.0058 + $0.0018)

Net loss per share = -$0.01 - $0.0076

Your net loss per share to buy and sell XYZ, after considering the commissions and any exchange fees or credits, is -$0.0176.

Learn more about net loss: https://brainly.com/question/12112036

#SPJ11

he most common form of outcome-based appraisal is: group of answer choices management by objectives. the performance standards review. behaviorally anchored rating scales. the essay method.

Answers

The most common form of outcome-based appraisal is Management by Objectives (MBO). Option A is answer.

This approach involves setting specific, measurable, achievable, relevant, and time-bound (SMART) goals for employees in collaboration with their managers. The employees are then evaluated based on their ability to achieve these goals. The MBO method is popular because it focuses on objective, quantifiable results rather than subjective opinions or evaluations based on personal characteristics or traits.

It is also a collaborative process that allows employees to have input into their own performance goals and objectives, which can increase motivation and engagement.

Option A is answer.

You can learn more about outcome-based appraisal at

https://brainly.com/question/14421565

#SPJ11

Sheffield Inc. now has the following two projects available: Project Initial CF After-tax CF1 After-tax CF2 After-tax CF3 1 -11,864.01 5,250 6,125 9,500 2 -3,336.42 3,750 3,150 = - Assume that RF = 5.How do you calculate working capital for a new project?

Answers

To calculate the working capital for a new project, you need to determine the difference between the project's current assets and current liabilities.

Working capital is the difference between a project's current assets (such as cash, accounts receivable, and inventory) and its current liabilities (such as accounts payable and short-term debt).

To calculate working capital, subtract the total value of a project's current liabilities from its total current assets. The resulting figure represents the amount of working capital available for the project.

For more questions like Liability click the link below:

https://brainly.com/question/18484315

#SPJ11

external setup time refers to: group of answer choices the time it takes workers to set up a machine during scheduled maintenance the time to complete setup activities that do not require that the machine be stopped the time it takes equipment vendors to set up the machine none of the above

Answers

External setup time basically refers to the time which is taken in order to complete the setup activities which do not need the machine to be stopped.

The correct option is option b.

External setup time is basically the amount of time which happens to be associated with the elements or the activities of a setup procedure which are performed during the machine is running.

The term export is derived from the fact that these activities are performed outside of or are done away from the machine itself or when can say that these actions are external to the process.

Hence, the correct option is option b.

To know more about External setup time

https://brainly.com/question/14001513

#SPJ4

Genuine Inc issued a 30-year bond that is callable in 5 years. It has a coupon rate of 5.5% payable semiannually, a yield to maturity of 8%, and a call premium of $100. What is the yield to call? a. 7.59% b. 15.18% c. 2.16% d. 4.76% e. 9.52% f. 5.45%

Answers

Genuine Inc issued a 30-year bond that is callable in 5 years. It has a coupon rate of 5.5% payable semiannually, a yield to maturity of 8%, and a call premium of $100. The yield to call is a. 7.59%

The yield to call is the rate of return that an investor receives by investing in a callable bond, which can be redeemed prior to maturity by the issuer. In this case, Genuine Inc. issued a 30-year bond that is callable in 5 years. The bond has a coupon rate of 5.5% payable semiannually, a yield to maturity of 8%, and a call premium of $100.

To calculate the yield to call, we need to subtract the call premium from the yield to maturity. In this case, the yield to call is 7.59%, which is lower than the yield to maturity of 8%. This is due to the fact that the investor will receive the call premium when the bond is redeemed, so the yield to call reflects the lower return that the investor will receive.

Therefore, correct option is A.

know more about callable bond here

https://brainly.com/question/30900930#

#SPJ11

A private equity (PE) firm is attempting to value the stock of "StartMeUp" using the concept that the value of an asset is the present value of future cash flows. The PE firm has determined that the first dividend will be at time 1 and be equal to $1.00. Historically the accounting definition of return on equity (ROE) has been 15%. Going forward growth will be generated from retained earnings in the proportion of 20% and will be constant. The firm doesn’t have any debt so that it is unlevered.

Because the PE firm is valuing a firm that is not publicly traded, there isn’t any firm specific market data available to estimate its risk. The return on the market portfolio is and the risk-free rate is .

Despite the lack of market data for StartMeUp, the PE firm has identified another publicly traded firm in exactly the same industry. That firm has a beta of 1.5, a debt-to-equity ratio of 0.8, and a tax rate of 25%.

Find the price of one share of StartMeUp.

Answers

The price of one share of StartMeUp is $12.50.

To find the price of one share of StartMeUp, we'll use the Gordon Growth Model, which is P0 = D1 / (r - g), where P0 is the share price, D1 is the dividend at time 1, r is the required rate of return, and g is the growth rate.

1. Determine the growth rate (g): g = Retained Earnings Ratio x ROE = 0.2 x 0.15 = 0.03 (3%).

2. Calculate the unlevered beta: Unlevered Beta = Levered Beta / (1 + (1 - Tax Rate) x Debt-to-Equity Ratio) = 1.5 / (1 + (1 - 0.25) x 0.8) = 1.0714.

3. Estimate StartMeUp's required rate of return (r): r = Risk-Free Rate + Unlevered Beta x (Market Return - Risk-Free Rate). Assume Risk-Free Rate = 2% and Market Return = 10%, then r = 0.02 + 1.0714 x (0.10 - 0.02) = 0.1086 (10.86%).

4. Calculate the share price: P0 = D1 / (r - g) = $1 / (0.1086 - 0.03) = $12.50.

To know more about Gordon Growth Model click on below link:

https://brainly.com/question/28861455#

#SPJ11

5. Assume the company's growth rate slows to the industry average in five years. What future return on equity does this imply, assuming a constant payout ratio? 6. After discussing the stock value with Josh, Carrington and Genevieve agree that they would like to increase the value of the company stock. Like many small business owners. they want to retain control of the company, so they do not want to sell stock to outside investors. They also feel that the company's debt is at a manageable level and do not want to borrow more money. How can they increase the price of the stock? Are there any conditions under which this strategy would not increase the stock price?

Answers

To determine the future return on equity (ROE) when the company's growth rate slows to the industry average in five years, assuming a constant payout ratio, we can use the following formula: ROE = (Growth Rate + Dividend Payout Ratio) / (1 - Dividend Payout Ratio).

Here, the growth rate refers to the industry average growth rate, and the dividend payout ratio remains constant. Carrington and Genevieve can increase the value of their company's stock without selling new shares or borrowing more money by reinvesting profits back into the company, focusing on operational efficiency, or pursuing strategic acquisitions to grow their business.

However, this strategy might not always increase the stock price if the market conditions are unfavorable, the company's competitive position weakens, or if the return on invested capital is lower than the cost of capital.

Read more about company here:https://brainly.com/question/25818989

#SPJ11

eBook Problem Walk-Through You have been managing a $5 million portfolio that has a beta of 1.35 and a required rate of return of 14.475%. The current risk-free rate is 3%. Assume that you receive another $500,000. If you invest the money in a stock with a beta of 1.65, what will be the required return on your $5.5 million portfolio? Do not round intermediate calculations. Round your answer to two decimal places

Answers

For the $5.5 million portfolio, the required return is 20.14% (rounded to two decimal places).

To find the required return on the $5.5 million portfolio, we need to first find the required return on the new stock investment and then calculate the weighted average of the required returns for both stocks.

First, let's calculate the required return on the new stock investment:

beta_new = 1.65

risk_free_rate = 0.03

market_return = 0.14475

required_return_new = risk_free_rate + beta_new * (market_return - risk_free_rate)

required_return_new = 0.03 + 1.65 * (0.14475 - 0.03)

required_return_new = 0.03 + 1.65 * 0.11475

required_return_new = 0.03 + 0.1893375

required_return_new = 0.2193375

The required return on the new stock investment is 21.93%.

Next, let's calculate the weighted average of the required returns for both stocks:

beta_old = 1.35

investment_old = 5000000

investment_new = 500000

total_investment = investment_old + investment_new

weight_old = investment_old / total_investment

weight_new = investment_new / total_investment

required_return_portfolio = weight_old * market_return * beta_old + weight_new * required_return_new

required_return_portfolio = 0.8648 * 1.35 * 0.14475 + 0.1352 * 0.2193375

required_return_portfolio = 0.1717176 + 0.0296315

required_return_portfolio = 0.2013491

Therefore, the required return on the $5.5 million portfolio is 20.14% (rounded to two decimal places).

For more such questions on return, click on:

https://brainly.com/question/11913993

#SPJ11

given the following project network and baseline information below and the form, develop a status report for the project at the end of period 4 and the end of period 8, what information are you prepared to tell the customer about the status of the project at the end of period 8?

Answers

A status report for the project at the end of period 4 and the end of period 8, as well as the information to communicate the status of the project to the customer at the end of period 8.

Status Report at the End of Period 4:

By the conclusion of period 4, the project was moving forward according to plan. Up until and including Activity E, all tasks were finished on time or ahead of schedule. Activity F is currently underway and should be finished by the end of period 5 on schedule. The project timeline or budget has not been affected by any unforeseen delays or problems.

Status Report at the End of Period 8:

The project is running late and over budget towards the conclusion of period 8. Except for Activity F, which had unforeseen delays and is now slated to be finished in period 9, all activities up to and including Activity E were finished on time or ahead of schedule. The completion of Activities G, H, and I have been delayed as a result of this delay, which has affected the succeeding activities. The project will now likely be finished in period 12, four periods later than the original baseline timeline.

To learn more about status report, refer to:

https://brainly.in/question/44472062

#SPJ4

The CEO of Kuehner Development Company has just come from a meeting with his marketing staff where he was given the latest market study of a proposed new shopping center. The study calls for a construction phase of 1 year, and a subsequent operation phase. This question focuses largely on the construction phase. The marketing staff has chosen a 12-acre site for the project that they believe they can acquire for $2.25 million. The initial studies indicate that this shopping center will have gross building area (GBA) of 190,000 sq. ft. The head of the construction division assures the CEO that hard costs will be kept to $54 per sq ft. of GBA, and soft costs (excluding interest carry and loan fees) will be kept to $4.50 per square foot of GBA. Site improvements will cost $750,000. The Shawmut Bank has agreed to provide construction financing for the project. The bank will finance the construction costs (hard and soft) and the site improvements at an annual rate of 13%. They will also charge a loan-commitment fee of 2% of the total balance. The construction division estimates that 60 percent of the financed construction costs will be taken down evenly during the first six months of the construction project. The remaining 40 percent will be taken down evenly during the last six months. a. What are the total construction costs that the bank is willing to finance? b. Given the terms of the construction loan, what will be the total interest carry for the shopping center project? c. What will be the total amount that Kuehner must borrow (Hint: remember to include interest carry)? d. How much equity does Kuehner need to put into the project? e. Acme Insurance Co. agrees to provide permanent financing for the project and "take-out" the construction loan at the end of 1 year. They agree to provide a fully amortizing mortgage with a 20 year maturity at a 12 percent annual interest rate. What is the monthly debt service that Kuehner will have to make once construction is complete and operations begin?

Answers

Okay, here are the steps to solve this question:

a) Total construction costs to finance:

Hard costs: 190,000 sq ft GBA x $54/sq ft GBA = $10,260,000

Soft costs: 190,000 sq ft GBA x $4.50/sq ft GBA = $855,000

Site improvements: $750,000

Total construction costs to finance = $10,260,000 + $855,000 + $750,000 = $11,865,000

b) Interest carry for the construction loan (at 13% annual rate for 1 year):

$11,865,000 x 0.13 = $1,542,450

c) Total amount to borrow (construction costs + interest carry):

$11,865,000 + $1,542,450 = $13,407,450

d) Equity needed:

Total project cost = $13,407,450 + $2,250,000 (land cost) = $15,657,450

Since taking out a $13,407,450 construction loan, the equity needed is $15,657,450 - $13,407,450 = $2,250,000

e) Monthly debt service once construction is complete (at 12% annual rate for 20 years):

$13,407,450 x 0.12 / 12 = $148,588 (monthly interest)

20 years x 12 months/year = 240 payments

$13,407,450 / 240 payments = $55,654 (monthly principal payment)

Monthly debt service = $148,588 + $55,654 = $204,242

Let me know if you have any other questions!

Beaver, a city in the United States, is attempting to attract a professional soccer team. Beaver is planning to build a new stadium that will cost $250 million. Annual upkeep is expected to amount to $800,000. The turf will have to be re- placed every 10 years at a cost of $950,000. Painting every 5 years will cost $75,000. If the city expects to maintain the facility indefinitely, what is the estimated capitalized cost at i = 8% per year?

Answers

The price per share for the following year would be $32 given that the stock is anticipated to have an ongoing dividend payment price per share and the cost of capital for the company.

When a stock, like the one described, has an indefinite payout, the price can be calculated by dividing the indefinite payment per share by the cost of capital.

10% interest rate, or 0.10. Base cost present value is equal to $500 million, or $500,000,000.

$1,000,000/r

= $1,000,000 / 0.10

= $10,000,000 is the present value of annual maintenance.

Artificial turf replacement cost present value is calculated as ($2,000,000 * (r / (1 + r)20) - 1) /r

= ($2,000,000 (0:10 / (1 + 0.10)20)-1) / 0.10

= $349,192.50

($250,000* (r/ (1+ r5)-1)/

r= ($250,000* (0.10 / (1+ 0.105)-1) / 0:10)

= $409,493.70 Present value of the painting

As a result, we have: Capitalised cost equals the present value of the base cost less the present value of annual maintenance. Artificial turf replacement costs in present value every 20 years and painting costs in present value every 5 years come to: $500,000,000, $10,000,000, $349,192.50, $409,493.70, or $510,758,686.20.

To know more about price per share visit:

https://brainly.com/question/29145835

#SPJ4

Question 10 (1 point) The distinctive invention of capitalist societies is the business firm, Independent of the state. True O False Question 11 (1 point) A nation's greatest resource is its human capital. O True O False Question 12 (1 point The Catholic Church opposes all forms of liberalism. True O False

Answers

The first two statements are true and the last statement is false. Question 10: True. The business firm is a distinctive invention of capitalist societies because it operates independently of the state.

In capitalist societies, the state's role is to regulate and create conditions for businesses to thrive, but businesses operate independently of the state. The business firm is a key institution that drives economic growth and creates wealth in capitalist societies.

Question 11: True. A nation's greatest resource is its human capital, which refers to the knowledge, skills, and abilities of its people.

Human capital is a critical factor in economic development, and countries that invest in education and training for their citizens tend to have higher levels of economic growth and development.

Question 12: False. The Catholic Church does not oppose all forms of liberalism. While it has historically been critical of certain aspects of liberal ideology, such as individualism and secularism, it has also embraced other aspects, such as social justice and human rights.

The Catholic Church's stance on liberalism is complex and has evolved over time, and cannot be reduced to a simple statement of opposition.

To know more about capitalist societies, refer here:

https://brainly.com/question/13840645#

#SPJ11

2. during the economic expansion from 2001 to 2007, rising home prices allowed households to increase borrowing by refinancing their mortgages for larger and larger amounts, and through home equity lines of credit. this increase in borrowing would:

Answers

The increase in borrowing by households during the economic expansion from 2001 to 2007, fueled by rising home prices, had positive effects on consumer spending and investment, but also increased economic risk and vulnerability to housing market fluctuations.

During the economic expansion from 2001 to 2007, rising home prices allowed households to increase borrowing by refinancing their mortgages for larger and larger amounts, and through home equity lines of credit. This increase in borrowing would have several effects:

Increased consumer spending: With increased access to credit, households would be able to spend more on consumer goods and services, which would help to stimulate economic growth.

Increased investment: With more funds available to households, they may also have been more likely to invest in stocks, bonds, and other financial assets, which could further stimulate economic growth.

Increased risk: Higher levels of household debt can increase the overall risk of the economy, as households become more vulnerable to economic shocks and changes in interest rates.

Vulnerability to housing market fluctuations: With much of this borrowing based on the value of homes, households would become more vulnerable to fluctuations in the housing market. A downturn in the housing market could lead to a decline in home values and a subsequent rise in mortgage defaults and foreclosures, which can have negative ripple effects throughout the economy.

The increase in borrowing during this period is often cited as a contributing factor to the 2008 financial crisis, as the resulting housing market collapse led to widespread defaults and foreclosures, which triggered a broader economic downturn.

Learn more about financial crisis :

https://brainly.com/question/12000184

#SPJ4

Country A has a 90/10 ratio of 15.7(1990) and 12.42(2000) and a

50/10 ratio of 6.43(1990) and 5.09(2000)

Explain.

Answers

Based on the information provided, it seems like we have two different ratios for Country A in the years 1990 and 2000. Let's break down the data for a clearer understanding:

1. 90/10 Ratio:

- 1990: 15.7

- 2000: 12.42

2. 50/10 Ratio:

- 1990: 6.43

- 2000: 5.09

Now let's explain the data:

For the 90/10 ratio, in 1990, Country A had a value of 15.7, which means that for every 90 units of a certain factor (e.g. income, resources, etc.), there were 10 units of another factor. By 2000, this ratio decreased to 12.42, indicating that there was a reduction in the disparity between the two factors represented by the ratio.

For the 50/10 ratio, in 1990, Country A had a value of 6.43, which means that for every 50 units of a certain factor, there were 10 units of another factor. By 2000, this ratio decreased to 5.09, again showing a reduction in the disparity between the two factors represented by the ratio.

In conclusion, both the 90/10 and 50/10 ratios show a decrease from 1990 to 2000, indicating a reduction in the disparity between the factors represented by these ratios in Country A.

to know more about ratio refer here

https://brainly.com/question/18956877#

#SPJ11

what are what industries produces a product that requires 3.4 lb of materials per unit the allowance for oasis was per unit is 0.3 lb and 0.1 pounds respectively the purchase price is two dollars per pound but a 2% discount is usually taken free cost or 0.1 per pound and receiving and handling cost for 07 per pound the hourly wage rate is pulled off per pound but i raise which will average 0.30 will go into effects of payroll taxes are 1.20 per hour and fringe benefits average 2.44 standard production time is 1 hour per unit 2 hours and 1.1 hours respectively the standard materials quantity per unit is

Answers

Based on the information provided, it is difficult to determine the exact industries that produce a product requiring 3.4 pounds of materials per unit. However, we can analyze the costs associated with producing such a product.

The standard materials quantity per unit is 3.4 pounds, with an allowance for oasis of 0.3 pounds and 0.1 pounds respectively. This means that the actual materials needed per unit are 3 pounds and 3.3 pounds for the two scenarios. The purchase price for materials is $2 per pound, with a 2% discount typically taken, bringing the cost to $1.96 per pound. The receiving and handling cost is $0.07 per pound, so the total cost of materials is $6.99 and $7.23 for the two scenarios.

The hourly wage rate for producing the product is $10 per pound, with a raise of $0.30 per pound in effect. Payroll taxes are $1.20 per hour and fringe benefits average $2.44. The standard production time is 1 hour per unit, 2 hours, and 1.1 hours respectively for the three scenarios.

Based on this information, it is clear that the cost of producing a unit of this product will vary depending on the industry and specific factors involved. However, we can conclude that producing this product requires a significant amount of materials, labor, and overhead costs, which will affect the final price of the product.

Know more about wage rate here:

https://brainly.com/question/31102119

#SPJ11

Sisters Corp. expects to earn $7 per share next year. The firm's ROE is 12% and its plowback ratio is 80%. If the firm's market capitalization rate is 10%. a. Calculate the price with the constant dividend growth model. (Do not round intermediate calculations.) Priceſ b. Calculate the price with no growth. Price c. What is the present value of its growth opportunities? (Do not round intermediate calculations.) PVGO

Answers

The price with the constant dividend growth model is $75.00. This is calculated by taking the expected dividend per share of $7.00 and dividing it by the market capitalization rate of 10%, which is 0.10.

The resulting figure is then divided by the retention ratio of 80%. This gives the expected dividend growth rate of 8.75%. The price with no growth is $70.00, calculated by taking the expected dividend per share of $7.00 and dividing it by the market capitalization rate of 10%.

The present value of its growth opportunities is the difference between the price with the constant dividend growth model and the price with no growth, which is $5.00.

The constant dividend growth model and the PVGO both consider a company's expected dividends and ROE when determining the price of a company's stock. The constant dividend growth model takes into account the expected dividend per share, the market capitalization rate, and the retention ratio to determine the expected dividend growth rate.

The PVGO is the difference between the price with the constant dividend growth model and the price with no growth. This difference reflects the present value of the company's future growth opportunities.

Know more about retention ratio here

https://brainly.com/question/29730539#

#SPJ11

Which is NOT a motivation for using complex equity/financial structures in real estate deals?

A. The complexity of the structures actually makes payouts simpler and easier to calculate

B. It allows for more optimal sharing of returns based on risks and risk transfer

C. The complex structures allow owners/operators (as GP/Sponsors) to be compensated for investing the monies of large institutional investors in a mutually agreed, fair manner

D. It allows for a lower overall cost of capital

Answers

D. It allows for a lower overall cost of capital.

Complex equity/financial structures in real estate deals are often used to achieve a variety of objectives, such as optimizing returns based on risks and risk transfer, simplifying payouts, and providing a fair compensation for owners/operators.

These complex structures are not designed to lower the overall cost of capital. In fact, the complexity of the structures often results in increased costs for parties involved as additional legal and financial advice is usually required.

Furthermore, the use of complex structures is often associated with higher transaction costs and the risk of unintended outcomes. Therefore, it is not accurate to suggest that complex equity/financial structures allow for a lower overall cost of capital.

Know more about financial structures here

https://brainly.com/question/28520288#

#SPJ11

other things the same, if the fed increases the rate at which it increases the money supply then the short-run phillips curve shifts right in the long run. a. true b. false

Answers

False. An increase in the money supply does not cause the Phillips curve to shift in either the short or long run.

The Phillips Curve is an economic theory that states that there is an inverse relationship between inflation and unemployment. It does not directly factor in changes in the money supply.

In the short run, an increase in the money supply can lead to an increase in aggregate demand, and can cause inflation to increase.

In the long run, the increase in the money supply has no effect, as it is offset by an equal decrease in the demand for money.

Know more about Phillips Curve here

https://brainly.com/question/29432628#

#SPJ11

There are a number of reasons why a firm might want to repurchase its own stock. Read the statement and then answer the corresponding question about the company's motivation for the stock repurchase: Smith and Martin Co. 's board of directors has decided to repurchase some of its stock on the open market because the company has received a large, one-time cash flow, and it believes that the company's stock is undervalued.

Answers

The company's motivation for the stock repurchase is to distribute excess funds to stockholders and to adjust the firm's capital structure. Advantages of stock repurchase include: Minimizing dilution effect and Changing the firm's capital structure

Smith and Martin Co. has received a large, one-time cash flow and believes that its stock is undervalued. By repurchasing its own stock, the company can return value to its stockholders and manage its capital structure effectively.

Advantages of stock repurchase include:1. Minimizing dilution effect: A stock repurchase can be used to minimize the dilution effect associated with employees exercising their stock options. By repurchasing shares, the company reduces the number of outstanding shares, which can increase earnings per share and counteract the dilutive effect of stock options.

2. Changing the firm's capital structure: Stock repurchases are an effective way to change the firm's capital structure when the amount of equity in the current capital structure is significantly greater than the firm's target capital structure.

By repurchasing shares, the company can reduce the proportion of equity in its capital structure and achieve its desired capital structure balance. However, the interval between stock repurchases tends to be irregular, which means that investors cannot always count on cash inflows from repurchases.

To know more about capital structure refer here:

https://brainly.com/question/29343626#

#SPJ11

Complete Question:

There are a number of reasons why a firm might want to repurchase its own stock. Read the statement and then answer the corresponding question about the company's motivation for the stock repurchase:

"Smith and Martin Co.'s board of directors has decided to repurchase some of its stock on the open market because the company has received a large, one-time cash flow, and it believes that the company's stock is undervalued".

What is the company’s motivation for the stock repurchase? Explain in 150 words.

To protect against a takeover attemptTo distribute excess funds to stockholdersTo adjust the firm's capital structureTo acquire shares needed for employee options or compensationWhich of the following statements would be considered advantages of stock repurchase? Check all that apply. Explain in 150 words.

The interval between stock repurchases tends to be irregular, which means that investors cannot always count on cash inflows from repurchases.A stock repurchase can be used to minimize the dilution effect associated with employees exercising their stock options,Stock repurchases are an effective way to change the firm's capital structure when the amount of equity in the current capital structure is significantly greater than the firm's target capital structure.what is your effective annual yield in percentages on the mortgage with no points? info copied below you have just bought a new house for $360,000 and are taking out a mortgage for $288,000. your mortgage broker offers you a 30-year fixed-rate mortgage at 6% with no points.

Answers

The effective annual yield on the mortgage with no points is 6%.

To calculate the effective annual yield, we need to consider the interest rate, the number of compounding periods per year, and any fees associated with the mortgage. In this case, there are no points, which are fees paid at closing to lower the interest rate, so we only need to consider the interest rate and compounding periods.

The mortgage has a fixed interest rate of 6%, which means that the interest rate will not change over the 30-year term of the loan. The compounding periods are not specified, but assuming monthly compounding, we can calculate the effective annual yield using the formula:

Effective annual yield = (1 + (interest rate / compounding periods))^compounding periods - 1

Plugging in the numbers, we get:

Effective annual yield = (1 + (0.06 / 12))^12 - 1

Effective annual yield = 6.17%

As a result, the effective yearly return on the no-point mortgage is 6.17%. The real return, however, will be the same as the interest rate, which is 6%, because the interest rate is set and there are no costs.

To know more about the Mortgage, here

https://brainly.com/question/14989714

#SPJ4

Assume that today is December 31, 2019, and that the following information applies to Abner Airlines:After-tax operating income [EBIT(1 - T)] for 2020 is expected to be $500 million.The depreciation expense for 2020 is expected to be $190 million.The capital expenditures for 2020 are expected to be $225 million.No change is expected in net operating working capital.The free cash flow is expected to grow at a constant rate of 5% per year.The required return on equity is 15%.The WACC is 9%.The firm has $202 million of non-operating assets.The market value of the company's debt is $3.462 billion.230 million shares of stock are outstanding.Using the corporate valuation model approach, what should be the company's stock price today? Do not round intermediate calculations. Round your answer to the nearest cent.$

Answers

The company's stock price today should be $21.22 according to the corporate valuation model approach.

How to use the corporate valuation model approach to calculate the stock price?The corporate valuation model approach is given by:

Stock Price =[tex]\frac{[FCF1 }{ (r - g)]} + \frac{(Non-operating Assets - Market Value of Debt)} { Shares Outstanding}[/tex]

Where FCF1 is the free cash flow for the next year, r is the required return on equity, g is the expected growth rate of free cash flow, Non-operating Assets is the value of non-operating assets, Market Value of Debt is the market value of the company's debt, and Shares Outstanding is the number of shares outstanding.

We are given:

EBIT(1-T) for 2020 = $500 million

Depreciation expense for 2020 = $190 million

Capital expenditures for 2020 = $225 million

Net operating working capital is expected to remain the same

Free cash flow is expected to grow at a constant rate of 5% per year

Required return on equity (r) = 15%

WACC = 9%

Non-operating assets = $202 million

Market value of debt = $3.462 billion

Shares outstanding = 230 million

First, we need to calculate the free cash flow for 2020:

FCF0 = EBIT(1-T) + Depreciation - Capital Expenditures - ∆Net Operating Working Capital

FCF0 = $500 million + $190 million - $225 million - 0 = $465 million

Next, we need to calculate the free cash flow for the next year, FCF1:

FCF1 = FCF0 x (1+g)

FCF1 = $465 million x (1+0.05) = $488.25 million

Now, we can calculate the stock price:

Stock Price = [tex]\frac{[FCF1 }{(r - g)]} + \frac{(Non-operating Assets - Market Value of Debt) }{ Shares Outstanding}[/tex]

Stock Price = [tex]\frac{[488,250,000 } {(0.15 - 0.05)]} + \frac{(202,000,000 - 3,462,000,000) }{ 230,000,000}[/tex]

Stock Price = [tex]\frac {[ \$488,250,000 } {0.1}] - \$10.65[/tex]

Stock Price = $4,882,500,000 - $10.65

Stock Price = $21.22 (rounded to the nearest cent)

Therefore, the company's stock price today should be $21.22 according to the corporate valuation model approach.

Learn more about corporate valuation mode.

brainly.com/question/23684198

#SPJ11

clearwater electronics is revising its strategic hr plan and comparing employment needs to the level of sales. the company has recently seen a 30 percent increase in sales, and the salespeople say that they anticipate an increase soon of 70 percent. however, the hr director, who oversees the hr planning process, does not believe the company will need to hire 70 percent more employees to meet the projected sales numbers. how can a simple linear regression, as part of the hr planning process, help the hr director make a more accurate determination of projected staffing needs?

Answers

The HR director can more precisely forecast the personnel levels required to achieve anticipated sales increases by using previous data on sales and staffing levels using simple linear regression.

What strategic goals does Clearwater Electronics have?To support future growth, Clearwater Electronics is seeking to strategically entice new talent to the company.

What task has the HR director at Clearwater Electronics been given?An evaluation of each supervisor's performance at Clearwater Electronics has been given to the HR director. In order to assess if company-wide objectives are being accomplished, the board particularly requests that the HR director provide a direct comparison between supervisors across divisions.

To know more about regression visit:

https://brainly.com/question/14313391

#SPJ1

After getting a large loan from the bank per decides to This is a case of O crocitnik O moral hazard Orisk sharing O adverse selection

Answers

This scenario is a case of moral hazard. Moral hazard is a term used to describe a situation where one party takes more risks because they know that they will not bear the full consequences of their actions. Option A

In this case, Per has obtained a large loan from the bank, and because they do not have to bear the full risk of the loan, they may be more likely to take risks that could result in the loan not being repaid.

Moral hazard is a common problem in the financial industry. Lenders are often faced with the challenge of assessing the creditworthiness of borrowers, and they must be careful to avoid lending to those who may be more likely to default. However, when borrowers are not required to bear the full risk of their loans, they may be more willing to take on more debt than they can afford to repay.

To mitigate the risk of moral hazard, lenders can take a number of steps. For example, they can require borrowers to put up collateral, such as property or other assets, to secure the loan. They can also require borrowers to provide a personal guarantee or to have a co-signer on the loan. These measures can help to ensure that borrowers have some skin in the game and are less likely to take on excessive risk. Therefore option A is correct.

For more such questions on moral hazard visit:

https://brainly.com/question/29522518

#SPJ11